|

>> See Past News Editions >> Click to Print >2016-2017 TAF Approved USPAP Online

|

Incorrect Reporting of Sales & Listing Data

in Appraisal Reports

By Dave Towne

The impetus for this article comes from my observations (not formal reviews) of actual reports submitted to underwriting and written by appraisers unknown to each other, in different states and at different times. Despite all these differences, from a data standpoint, what is reported in the various case studies cited below is nearly identical. The information, however, while similar, is unfortunately not accurate for reporting purposes in my opinion. My goal is to encourage appraisers to reconsider their property analysis and report-writing process.

Too many properties are reported as “comparables” even though they probably are not. The case studies below show why.

To understand why I believe these reports are inaccurate, we need to examine the Market Conditions Addendum Form (the 1004MC), coupled with the primary report form. This 1004MC form (from the GSEs) did not exist prior to March 2009. It was mandated then as a reaction to the financial meltdown across the globe, beginning in 2007-2008, allegedly caused by “faulty” residential appraisals in the U.S.- even though the real root cause was lax underwriting and poor regulating of mortgage loans. Be that as it may, we appraisers are now compelled to utilize this “new” form in virtually all “federally-related” appraisals (i.e., sold to the GSE’s), even though the form is poorly designed, in terms of statistical reporting, and has instructions that are somewhat confusing.

The intent of the 1004MC is to augment the market statistics of the subject property and its competitive properties– something not easily done with the 1004 Form without additional addendum information (the same applies for the 2055, 1073/1075 and 1025 Forms). Market statistics are not something most residential appraisers were reporting prior to 2009.

With the mandated use of the 1004MC, the primary appraisal form is linked to the 1004MC. But the instructions on the MC form, and the entry fields on the main appraisal form (top of page 2), appear to be misunderstood by many appraisers. This may be leading to incorrect data being reported.

(story continues below)

(story continues)

We

The key requirement on the 1004MC form is the second to last sentence in the Instructions section at the top of the page. It reads: “Sales and listings must be properties that compete with the subject property, determined by applying the criteria that would be used by a prospective buyer of the subject property.” The operative words are “compete with.”

From what I have observed in several appraisals completed by different appraisers, it appears that there is a misunderstanding and therefore a misapplication of reported properties, which can lead to improper comparables selected for use in the report. Let’s examine two case studies.

Case Study #1 is for a home appraised for $835,000. It’s in an urban subdivision of similar upscale homes, but also has other lower-priced subdivisions and other developments of higher value luxury homes in close proximity, which is common in that high-density metro area.

Figure 3

![]()

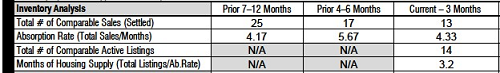

Figure 4

This is another situation where, in this appraiser’s opinion, the appraiser has overstated the number of “comparable” properties. According to the report, in the past year there were 55 sales of “comparable” properties. Really? Thirteen of these are within the past three months. But note the range of sales or listed prices: $65,000 on the low end to $203,000 on the high end. Or $73,000 lower to $65,000 higher than the appraised value. Is this excessive? Yes it is.

In this report, there is no Addendum with additional information. The only information is on the pre-printed form pages. Nothing on those describes why there is a very wide value range of sales and listings reported. (There are missing required USPAP reporting items also, which should be of concern to all appraisers. But that’s a topic for another day.)

(story continues below)

My final case study demonstrates the principles and suggestions in this article. This home is in a small urban city of approximately 28,000 people about 40 miles from a major metropolitan area. Appraised value was $361,500. See figures 5 and 6.

Figure 5

![]()

Figure 6

This appraiser reports only four sales considered to “compete” with the subject. Three of those are on the grid page in the report, along with the single listing.

This appraiser has been doing this in all reports since this form became a requirement. Doing so corrects the improper six-month data report the form stipulates (when compared to the two three-month columns), enabling the trend checkboxes to be more accurate. In all these years no one has commented about that modification. Unfortunately, this must be done manually; the pseudo MC form generating Excel spreadsheets are not designed to correct the actual 1004MC.

There seems to be a mentality among appraisers to believe that more is better. As two of these case studies show, that’s not correct. If you’re reporting properties that actually are not comparable or competitive, it can be said that your report is not credible.

Appraisers are not supposed to pick “comps” on price alone. However, when there is a wide range of sale prices in the neighborhood, it should trigger further examination to determine what part of the range is most appropriate for the appraised property. Amenities, design, overall condition and quality elements also should be considered. But price is still important, as noted in the first case study, a “comp” selling for $1.1 million probably is not comparable or competitive to the $835,000 subject. Likewise, a “comp” selling for only $65,000 – shown in the second case study, has significant differences to a property valued at $138,000.

In summary, it’s my view that many appraisers are combining all properties within a neighborhood (as the GSE report form page 1 implies) on the MC form and report page 2, regardless of their comparability, rather than isolating the reported sales and listings to those properties that would actually “compete” with the appraised property, as is required on the MC form.

Don’t be afraid to report reality. Often, there are very few properties that are actually similar to the subject. Be proactive and report real market evidence of the competitive/comparable properties.

Available Now!

Part 1: On–Demand

Part 2: On-Demand

Appraiser Adjustments: Solving Common Problems

By: Richard Hagar, SRA

Failure to provide proof and analysis to support your adjustments means a rough road from now on out. In this upcoming two-part webinar, Richard Hagar, SRA shares the most common methods that can be used for determining adjustments and shows examples of how it applies to numerous components throughout an appraisal. Hagar will work through many examples, explaining how to calculate adjustments in the “real world.” Learn to apply regression analysis within different neighborhoods as well as how to use the right adjustment method on duplexes, multifamily, condos, and waterfront property. Sign Up Now!

Current Webinars

• Appraisal Adjustments: Solving Common Problems – Richard Hagar, SRA (November Series)

On Demand- Available Now

• How to Create a Proper Reconciliation – Tim Andersen, MAI (two part webinar)

• Claims, Complaints, and E&O Insurance – David Brauner

• Fannie Mae and Q&C Ratings – Richard Hagar, SRA (two-part webinar)

Season Ticket: $129 (Save 35% on all five recorded webinars above)

Save $78: Get the Season Ticket– good through Thanksgiving!

About the Author

Dave Towne is a Certified Residential Appraiser with 14.5 years’ experience in small urban, suburban and rural areas. Dave is a noted writer, blogger, and educator on appraisal topics since 2005. He can be reached at dtowne@fidalgo.net.

>Click to Print

>New: Collateral Underwriter Blog: Find answers, offer solutions.

>Opt-In to Working RE Newsletters

Send your story submission/idea to the Editor: isaac@orep.org

by Jessica Aguirre

The 1004MC is insufficient to provide a complete market analysis. I don’t completely agree with everything in this article though. Particularly with the second case study. The amount of comparable or competing sales would not be strange in a suburban market area with plenty of sales (300-500 total sales within a 1 mile radius in some cases). The number of comparable sales reported on page 2 of the report should include the sales after implementing a search criteria within MLS to eliminate truly non-competitive sales to the total sales within the neighborhood. Condition, if reported by the Realtor, is subjective and may not be accurate in the eye of the Appraiser. Therefore, condition would be difficult to eliminate in the search criteria.

-The author indicated that he works in a rural area. I can understand why 55 comparable sales might be considered high for a rural neighborhood and that the case study may apply to his geographical area. Not all markets are the same.

by Tony Witt

The author has a point that very few people can properly fill the form out but what he doesn’t realize is there are many limitations to how you can direct the MLS to sort the data. And since one can not hand-pick the data it would be impossible not to include resulting sales that would not be competitive. The one character that I am sure carries across the nation is condition. There is no way to direct the MLS to sort for condition. And if you search by price point you eliminate the possibility to analyze changing price trends. In my area there isn’t even a safe way to search for room count and especially not GLA. Making the whole form pretty much a joke and not possible to have it agree with the top of page 2 where “comps” can be hand picked.

-by Mark Anderson

I use the form more for info on market turnover and state data is limited and significant conclusions cannot be made. Do not support the form, but it is my understanding that underwriting does not understand it either, thus have never had a comment on it. The only value is that at least appraisers started looking at additional data, misusing the form is understandable due to lack of overall clarity.

-by Pat Bange

Mary Jo Gray is completely correct. In a small community, the subjects market and the neighborhood are not the same descriptions. I hate trying to explain this to reviewers so that it meets with their computers approval. When did we give up logical appraising for this purpose?

-by Joyce J. Potts, SRA, AI-RRS

First, there has to be uniformity of the understanding of the definitions between MARKET AREA, NEIGHBORHODD, DEVELOPMENT and SUBDIVISION. Secondly, there has to be uniformity in the understanding between the MICRO vs. MACRO market. These definitions have too many ‘Shades of Grey’ within the appraisal community. As such, it’s really up to the appraiser to define them within their report with specificity. Example: See Mid-Florida (Orlando) Regional Market Pulse for residential macro trends by county. The One-Unit Housing Trend information & Present Land Use % above (Page 1) is based on the micro market as defined by the Appraiser’s Delineated Boundaries and Market Area Map attached. The Inventory/Absorption at the top of the Sales Comparison Approach has additional filters to reflect homes having similar physical characteristics within the micro area and deemed to be competitive, alternative substitutes to the subject property. See Inventory and Absorption Analysis on Page 3, above the Cost Approach:

Inventory Levels and Absorption Rate are based on the following search criteria: (State search criteria):

Absorption Rate: XX Solds / 12 Months = XX.X sales per month.

Inventory Level: XX Listings / XX sales per month = X.XX months of inventory.

Do what you say and say what you do.

Everyone demonizes the 1004MC, however few like myself, see some benefit. If my value is $100,000 via the SCA, and the median price for the last two quarters of the 1004MC are $230K and $220K respectively, it commands an explanation as to why my subject property’s value is so far below the median price. That is ONE example of what I think the 1004MC was designed to flag. The other main purpose, its trends based on the prior year. The 1004MC certainly is NOT optimal, but I think if serves a purpose, especially for larger markets. Rural and/or semi-rural markets, i would agree, it’s usually not useful due to that lack of data to make it statistically significant. I use it to support trends, market condition adjustments in many cases and use it to MY ADVANTAGE in writing a better, compelling report.

-by Cathy

As all can see, Appraisers have differing ideas of how to fill out this form. When I took a class explaining how to fill out this form, I was taught to use expired, off market etc to gain enough data to make the form reliable, BS. I provide all sales within 1 mile of subject, or expand up to 5 miles. I don’t use the MLS Neighborhood Codes for this information. Area 130 for example includes many cities with a huge range of values and are not relevant to the subject. I run a CMA of sales and listings including all within the subject’s market. Although area 120 includes homes on the water, some with great views and sell much higher due to the name of the city, I exclude Normandy Park if I am appraising a home in DesMoines, NP is not comparable. On the MC, I include only homes that are truly comparable and state that on the form. 300sf difference, within 10 years, one mile etc. If the market is stable I do not include REO properties. I also state and note that. I often include the MLS sheets of my results. The form sucks, just explain what you did and just in case, explain it again. I’ve never been called about the form. A major Government Agency informed us that it must match the 1004 and if not, they expect an explanation, I do, and I have not been challenged. My 1004 never matches the MC, it can’t by definition. Just saying.

-by Dave Griffiths

I disagree with the above writer (Mike Ford). The form is more than a bad joke. It is more than derision and contempt. Any attempt to clarify is useless. I love the way appraisers add addenda in the report to the effect that “There are few comps similar to the subject in the market area” and then do the 1004MC with a total of 70-80 comps within the past year. HELLOOOO!! The thing is, their are actually reviewers and underwriters that get all dressed up in a business suit, go to the office and sit down for a long day of reviewing 1004MC’s. Imagine that!!

-by David Bruun

I recently had a run-in with a Major National Lender over exactly this issue.

Per SOP, I cite my search parameters on pg 3 – usually limited to 6-month sales and local MLS market area(s), with parameters configured to result in a minimum of 30 potential “comparables”. I include a short explanation of the statistical desirability of a pool of that size, or a bit larger. For the market data reporting, pg 1, pg 2 and the MC, I expand the parameters to include 12-month sales, and constrict the geographical area to the neighborhood as defined on pg 1, but otherwise retaining the other parameters. This way, the data presented on pg 1. pg 2 and the MC are consistant, and the reader can easily understand what they represent – the data presented represent “comparable” sales per search parameters, even with a large pool and a large price range.

In a 45-minute discussion during a 30-minute phone conference, the Major National Lender completely rejected this methodology, insisting instead that I “put on my broker’s hat” and select “more appropriate” sales, with no viable protocol, and no indication of what would be an acceptable price range.

The upshot? The Major National Lender summarily dropped me from their approved list, and filed a complaint with my state’s department of licensing.

The MC, and the other market data reporting, is far from perfect, or reasonable. Even more critical, though, is to arrive at a consensus on how this data is to be formulated and reported.

-by Ernie Ramos

Great article, I have always gone along that same line of thinking and explaining. Many of the appraisals I review, I see the same issues as you describe. To me some are confused but much of this falls in line with the blind appraiser, that has canned everything, doesn’t feel the need to really explain or analyze the data they report, just believes they know value and the rest of the appraisal is just filler. I see that many rural appraisers complain about the 1004mc and what you are saying, and I get that, with little data available there are major issues and conflicts but where data is abundant, I don’t see how else rationally it should be handled.

-by Brent Bowen

The 1004MC form puts the appraiser in a catch-22. You are correct in asserting that providing a larger sample size does tend to understate the meaning of ‘comparable’; however, using a smaller sample size also can me misleading. The small sample size may distort the findings of the 1004MC and represent trends which do not in fact exist. I think being critical of appraiser’s who try to make the 1004MC meaningful is a bit myopic. Disclosure is the key. In your method, you will need to disclose that the 1004MC has too little data to be relied upon for the determination of any trend. The appraiser who chooses to utilize a larger sample size will need to disclose that as well. I can be set in my ways, too, but please be careful when throwing your peers under-the -bus next time. There is typically more than one valid approach to solving any problem.

-by Mary Jo Gray

All the “blame” for this should not go to the appraisers. FNMA requires us to use these forms but apparently doesn’t know how to ask for what they want. As you stated, the MC asks specifically for properties that compete with the subject. The lender/AMC for some unknown reason expects the MC to be the same as the neighborhood section of the 1004. The problem is, they are asking for two different things. The MC wants only competing properties while the neighborhood should reflect the information on the entire neighborhood, not just the sales/listings within that neighborhood that are similar to the subject. The MC asks for a “median” value, while the neighborhood asks for a predominant (or mode) value. I have talked with many reviewers who don’t know the difference (hopefully appraisers do). I know many appraisers who simply fill out the MC sheet to match the neighborhood because that is what is expected and it is easier than arguing with reviewers. That could be what the appraisers in the first examples were doing. The final example appears to reflect only competing properties, but I would be curious to see how he completed the neighborhood section, hopefully that represents a much broader analysis.

If the MC is filled out using only properties which compete with the subject (so we would assume similar in age, size, location, value range) how is that telling anything about the subject’s “neighborhood” as to whether it is declining, stable, or increasing? I work in a rural type area and I regularly have to use sales from outside the subject’s immediate area. In those cases, my MC is reflecting statistics from outside the subject’s neighborhood so how could that be expected to match the info in the neighborhood section?

Bottom line– I agree with all those who say the form is a useless waste of our time.

-by Elizabeth

Thank you for your interesting observation. These forms are more helpful in more populous areas and are somewhat useful as brackets in my more limited areas.

-by Elizabeth

I work in rural WV. The latest assignment was in a county where exactly 6 sales took place in the span of a calendar year. I reported them all in order to illustrate the limited information available; I also commented that these data included all sales in the county. There is little demand for these properties, and many are listed multiple times, with multiple price reductions prior to selling. These comments are included in my report, and I believe that the information is relevant.

-by patty

I work in Rural WV and find this method unreliable also, the intention of the 1004MC is to show competing and relevant closed sales, not every sale. When in rural areas like this and similar to what I cover it is impossible to provide the data for this form because it does not exist and the results would be mis-leading which is exactly what I describe in the comment section of the 1004MC form along with the lack of sales, lack of good data and my sources. I also am forced to be descriptive in the MLS covered areas that are a major mess because the properties are listed multiple times, the MLS manipulates the listing dates and does not follow the address and incorrectly reports LP, LD & DOM, the agents and brokers also don’t know how to report GLA, type of property or other descriptive details, uniformity and correct data would be a god send.

-by Marc

This is why I always have the comments that The 1004MC form is mostly a flawed design and method in determining market trends. The Lender/Client should never rely on this form to adequately inform them of market trends. Due to the wide sale price range for properties in this market area and the factors that influence those prices, that can’t all be sorted out with this MLS system, the method used in the 1004MC does not work and the design is grossly flawed. I am unaware of any financial market that breaks yearly data down into 3 quarters. If no else does it why would an appraiser. It makes no sense. The buyers’ market, the sellers’ market, the entire real estate profession utilizes the MLS spreadsheets and market trend analysis to make their business decisions. The MLS statistic are a more reliable method in determining market trends and are what I am mostly relying on. I have provided the most current MLS stats in this report. The neighborhood section of the URAR will be marked based on these stats and this 1004MC form is, mostly, being disregarded and NOT 100% relied upon due to its gross inaccuracies. It is unclear what values will do for the future.

-by Dave Anderson

Great comments ! Thanks for the reality check Marc ! I am cutting and pasting your comments. Sincerely appreciated !

-by Edd Gillespie

I think your cautions abut shopping price when selecting comparable properties are well taken. But, at the same time encouraging appraisers to report less than the diversity of prices in the “neighborhood” is as problematic as is reporting only those listings that compare with your opinion of value is dangerous. You have to know that reporting the breadth and depth of “neighborhood” sales prices is not where the real problem lies. Appraisers are rushed and lowly paid to complete forms that are nonsensical when it comes to “accuracy” in offering an opinion. Of course the word “accuracy” is completely antithetical to forming an opinion, but the entire appraisal industry seems to have missed that.

The problem is comp selection not in reporting diversity. Appraisers know that in order to sustain their businesses they must make the client happy. And that means in secondary mortgage market work, cheap, fast and reporting the value the client has already decided upon before the appraiser was hired.

The abuses of the 1004 MC shouldn’t happen if that is what you suggest, but those are hardly the root of the problem, just another symptom of satisfying the client and those who put pressure on the client, which must be done to stay in business.

Besides listings are just someone’s effort to sell as high as possible, maybe at far more than market value. As Eric implies, listing prices are completely unreliable. I worked with a situation yesterday that the subject was listed at $949,000 two years ago and is under contract for less than $700K which is still $100K more than my opinion of value and the “comps” range out to 15 miles.

I suggest that those of you who review take a less stringent perspective on what belongs in the 1004 MC because the form itself asks for absolutely unreliable and therefore meaningless information, regardless of Fannie Mae says.

-by gary m

wow so true no one pays attention about the differences in requirements but they should. one asks for neighborhood data 1004mc ask for com data. but clients want them to match why i don’t know

-by Mike Ford, CA AG, AGA, GAA, RAA

Dave, while I agree with your underlying premise that too many 1004MCs are being improperly completed; I respectfully do not agree with your ‘solutions’. The fault lies in the form-not in the appraisers.

The biggest problem is appraisers trying to make a silk purse from a sows ear. The form is NO GOOD. Period. There is no sugar coating it. The presumption by GSEs that ‘something is better than nothing’ is the same kind of idiocy lead to FNMA creating a CU database that they ADMIT is based on adjustments made to their old guidelines rather than to market data. IE WRONG!

The URAR form uses the term “neighborhood”. Neighborhood is rarely used by appraisers in larger urban areas anymore because subjective perceptions of “neighborhoods” change, or become less clearly defined over time. Instead we use ‘competitive market area’ and then WE define what THAT area is AND WE define what competitive properties are for a specific subject.

Urban or metropolitan areas RARELY have MLS regions or zones that match appraisers definitions of competitive market areas. They may or may not match locally known “neighborhoods”, or they may arbitrarily bisect them.

Example: Beverly Hills 90210. It includes multiple geographically separated “sub neighborhoods”; each ambiguously defined in relation to their north-south canyon Blvds that are used to access them. It ALSO includes huge areas that are not even Beverly Hills at all, though they have the same city mailing address and share the same canyon access Blvds. They are in the City of Los Angeles and include BOTH higher and lower value properties RIGHT NEXT DOOR TO EACH OTHER. The MLS search for any ‘area’ in 90210 is either C01 or C02. On page One of the URAR the range of values in the immediate neighborhoods (under a mile to a mile and a half) in BOTH C1 and C2 areas is about a $million and a half to over $forty million. You can find a 3,000 SF on a 30,000 sf lot selling for more than the house across the street that is 3,300 sf on the 40,000 sf site because of topography, city light and distant ocean views. I actually made THAT example easier. You can find a 5,000sf house on a 170,000 sf lot selling for less! ALL have to be investigated. Now, with considerable effort you CAN find true comparable sales and listings, but you can never quantify them to a single searchable or repeatable parameter that reasonably or meaningfully ‘fits’ in a 1004MC. I use published broader area statistical data to show general trends but no single data source is so reliable that I can assert that I got ALL the listings, or ALL the sales in a specific “neighborhood” that are “competitive” to the subject.

In the end I use county wide published data for overall value-increase trends support; explain they may or may NOT hold true for ‘above’ super jumbo value ranges; and then cross check that with ALL 90210 sale average values for specific comparative periods to identify ‘trends’ within the zip code. THAT data may or may not match or even fit within the 1004MC reporting periods.

I may well have very dissimilar or non competing properties included in those trend analyses. I prefer to state that “the 1004MC is inherently unreliable for the reasons cited,” and explain the alternative methods used to ‘support’ conclusions on page one.

Some underwriters insist the 1004MC be filled out. OK. They can do that, but then I have to say the data contained in it (paraphrased for want of a shorter description) is C R A P!

Then again, Im comfortable defending my views and methods used. The potential “comparables” on my current assignment ran from 2.5 million to over forty million. THAT is how I learned the area range. BEFORE you say it is too broad, consider that THAT is the range required to bracket my GBA AND my site area AND ocean view characteristics. Admittedly, ever tighter screening and investigating whittled that range down to $6 million to $24 million. By the time I am done I suspect it will be between $6 MM and 12MM but I only assume THAT because my subject expired unsold for less than 13 MM previously. Coincidentally the highest sale is the only one with similar large flat site area and similar view though MUCH smaller gross site area. Oddly enough I walked its lot completely years ago when it was vacant, so I KNOW its actual view and don’t have to rely on MLS agent “puffing”

I wont be done for a couple more days so I don’t KNOW where the data will ultimately take me. Its not a 6 hour assignment. …nor a 6 hour assignment fee.

The only thing I AM sure of at this point is that there will NOT be a 1004MC in it the final report. There are enough meaningful explanations that are far more critical to adequately understanding this property. I think I’ll spend my time on those.

-by Wade Howie

Let’s talk about the real issue hear. The problem with the 1004MC form is that it should ONLY be tied to the information in the neighborhood section on page 1 of the URAR which is what the form itself suggests in the very first sentence of the instructions. All sales from the neighborhood or market area, regardless of comparability, should be included on the 1004MC form because all of the sales effect the overall market conditions of that neighborhood or market area. The 1004MC for SHOULD NOT be tied to the number of comparable sales and active listings used on the top of page 2 of the URAR. Only using the “comparable” sales does not give a full picture of the neighborhood that is described on page 1 of the URAR. I would argue that if you are only using the “comparable sales” then the information in your neighborhood section of the URAR will not be correct. For instance, let’s say your are appraising a property in a particular neighborhood with 100 home sales of various style, size, age, quality and condition that range in price from $100,000 to $500,000. You determine that your subject has a value of $300,000 based on only 6 of the 100 sales actually being “comparable” to your subject. These 6 sales range in price from $275,000 to $325,000. Your neighborhood value range on page 1 of the URAR is not $275,000 to $325,000. It may not even be $100,000 to $300,000, as most of us know that there may be higher or lower value homes in the neighborhood which have not sold in the last year, so they would not be in your analysis over the last 12 months. However, the 100 sales gives a better picture of the market trends over the last year which is reported in the neighborhood section on page 1 of the URAR. Using only the 6 “comparable” sales on the 1004MC does not give you a true picture of the neighborhoods actual market conditions, as the market is not just made up of sales that are “comparable”, but most times it is made up of various other homes too. The number of “comparable” sales and active listings at the top of page 2 of the URAR SHOULD be pulled from the total sales in the neighborhood, but DOES NOT necessarily have to be all of the sales from the immediate neighborhood. Therefore, the 1004MC needs to be ONLY be tied to the data in the neighborhood section on page 1 of the URAR as this is what the form is intended for. Using the 1004MC form for the neighborhood section on page 1, and the sales and listings on page 2 is where the contradiction and confusion comes from. The first sentence in the instruction on page 1 of the 1004MC, and the 2nd to last sentence on the 1004MC contradict each other. How can you use only “comparable” sales and listings to describe a neighborhood if that neighborhood is not just made up of “comparable” properties? It is my opinion that the way the 1004MC form is written causes every appraiser that uses it to violate USPAP by not giving credible results. We MUST get this form changed to be more credible for what it is intended. As for your comments about which of your 3 cases is correct. I disagree with you. The first cases have chosen to provide data in accordance with the 1st sentence in the instruction on the 1004MC which give a more accurate depiction of the market conditions on page 1 of the URAR. The 3rd case has chosen to complete the 1004MC in accordance with the 2nd to last sentence in the instructions on the 1004MMC form which ties in with the number of sales and listings that are considered “comparable”. None of these 3 cases is really correct or incorrect based on the instruction. The first 2 cases give inaccurate information for the number of sales and listings on page 2 of the URAR, but give more accurate information of the market trends on page 1 of the URAR. the 3rd case gives more accurate information for the number of sales and listings at the top of page 2 of the URAR, but inaccurate data for the market trends on page 1 of the URAR. Therefore, how can you say which ones are right and which ones are wrong?

Thank you,

-Wade Howie

Gillette, Wyoming

by Steve Kahane

Mr. Towne, excellent article. Often times an absence of data for the MC Addenda is equally as telling about the market as the data it contains. Fannie Mae says as much in the selling guide. Fannie also says not to expand neighborhood boundaries to find enough comparables, but to use comps outside the neighborhood and explain and adjust accordingly. A further suggestion not to expand the comparable parameters.

I agree with all the responses that the MC Addenda is awful. But as you noted, it is supposed to augment our analysis of market conditions. It was never meant to be the sole analysis. True, larger samples can reduce the margin of error, but if you are adding dissimilar sales you are increasing the variance and therefore reducing the statistical accuracy of the sample. The coefficient of variation of the 4 similar sales in the last MC grid is likely much less than the 85 dissimilar ones in the first MC grid.

I use DataMaster to complete my MC addenda and it takes all of 2 minutes. I spend an additional 3 or 4 minutes to do an annual or year over year analysis of the market which includes an analysis of distress sales, seller concessions and supply/demand indicators. My fees are high enough to cover 5 or 6 minutes worth of market analysis.

-by perrymason

Mr. Townes devotion to the MC form is a useless exercise. By his own admission the form is “poorly designed” and “somewhat confusing” and I am not aware of any appraiser or lender who assigns any weight to this form. Additionally, he claims to read appraisal reports from other states that he considers “inaccurate” containing comparables that are “probable not”. This he knows, sitting at his desk, hundreds of miles from the subject property that the field appraiser was standing in of.

-One last comment …there is a difference between a “competing” property and a “comparable” property, Its possible to find 15 competing properties and select from them 3 comparable properties (I think they call that appraising).

by Tom Mirkovich

Briefly, tight parameters tend to create small data sets that place too much emphasis on individual properties to produce reliable conclusions on market trends. Sometimes wider parameters create huge price ranges, however, price should not be a consideration in determining similarity. This is particularly true in the current markets where properties are still being ‘dumped’ by lenders and sellers put prices on properties “like its still 2005”. At the same time, picking through search results can lead to accusations of putting a thumb on the scale.

Let’s face it, the MC Addendum is a lame attempt to corral appraisers into doing what they should be doing in the first place: analyzing the market! My work files tell a lot more than these forms with their typically quirky results: The MC is not worth a lot of time. Advice: take a basic statistics class, gather your own data and don’t get too worked up over this stuff. I pity the knucklehead that draws too much out of 13 sales in an MC form. TRM

-by Rachel Massey

Want to add to what I said earlier, and that is that we can add to information in our reports even when doing the 1004MC exactly as it should be done (which the article addresses correctly). There is nothing saying we cannot provide more information as long as we also provide what our client is looking for in terms of the analysis of the market.

Thank you for this article Dave.

-by Patti

Richard, finally someone talking about this! I’ve seen ranges at the top of the URAR grid “$50,000 to $6,650,000”. Truly. Certainly it may be necessary and useful to use more sales to analyze the market, make conclusions about the market, and extract adjustments but these two parts of the report are clearly to be used for “competing” properties, i.e., the same buyer of the subject property would consider the sales and listings as competitive substitutes. It is hard not to question errors/misinterpretation of these parts of the report not being translated to other errors in the analysis.

-by Rachel Massey

I believe that the best way to analyze the market is to do both a macro study of prices over time (and by this I mean the city, or area) as well as the submarket in which the subject property competes. Tim Andersen and I presented a case study in doing this based on my market data which was presented earlier in Working RE (https://www.workingre.com/supporting-market-conditions-adjustments/). It does provide information as to how the market in general is doing, and then to specifics of competition.

Agree with the comments that more is better from a statistical standpoint, because when you do this on a daily basis, you start to see how very much data can be skewed by having a limited number of data points.

There is more than one way to look at things, and as long as the appraiser provides a cogent and intelligent argument for what they do, I think we are all good :)

-by Albert Mattheis

That is an interesting perspective, and does bring up 1 valid point, but at the same time it avoids mentioning a few other things. For one, I think that the criteria used in the search should be stated, thus it is repeatable. Otherwise, and I have seen this done, the appraiser can cherry pick whatever they want and make the MC form say whatever they want. The MC form you liked did not show an explanation of the search criteria, so is it credible? It had better be because “Believing” is all the reader will have, it isn’t provable, not verifiable. The MC form also asks for data (the number , ratio, trends, analysis) etc. of distressed sales. I’m sure your MC report would throw all those out and show none. Would that accurately reflect what is going on in that market, or even in the same subdivision? Also, clearly the MC form is designed to show some sort of trend. With such cherry picked data of such a small sample size, any real trend is not identifiable to a statistically relevant degree. In the end, the truth is, the MC form itself is inadequate as it asks for a variety of things and gives rules (must be truly comparable) that eliminate the ability to provide them. So at least the appraiser that lists his criteria can say, yes, they are comparable based on this, this and that data.

-That’s the best we can do on a form that is meant to use larger sample sizes in order to produce statistically reliable data and trends. The MC form you approve of is totally useless, because as you point out, it’s just a pale rehash of what is already presented in the sales grid.

by Gil Rogers

Dave,

I agree 100%, however when appraisers receive instructions from AMC’s that say that we are to include our search criteria in the report and that price MAY NOT be one of the criteria, what are we to do?

I was an agent before I was an appraiser and I know that a buyer looking for a $500,000 home is not interested in seeing a $600,00 home or a $400,000 home. This form and the reporting requirements of AMC’s (and some large national lenders) are not consistent with reality which results in skewed and worthless data.

-by Bruce Flanagan, SRA

Dave: When it comes to statistics, More IS better! you say that drawing conclusions about an entire market segment, from a sample size of 13 is credible? Seriously…Take a statistics class! The reason it is sometimes necessary to expand the parameters beyond the comps, is to obtain a statistically valid sample size.. The larger the sample size, the better representative it will be of the market trends. This is particularly important if the appraiser is relying on these statistics as a basis for market change adjustments.

-by Mike Ford, CA AG, AGA, GAA, RAA

Concur re sample sizes. That’s why I distrust regression software that purports to produce valid returns with as few as ten or twenty sales. Frankly I trust the local area agents opinion on what a pool is considered to be worth by buyers, than some software hucksters product. Regression is probably ok for basics like GLA and lot sizes, but for anything else Id much prefer another source.

-by Mary Thompson

I agree. Many of the appraisals I have reviewed have the same issues. The form does clearly state that the numbers for this section of the report should only represent those sales whichwould compete with the subject. End of sentence! Yet, I see a HUGE range of values in these sections of the report and huge number of comparables. There are many times when the numbers may be very small when you are talking about truly comparable properties and therefore you may have a more limited or restricted analysis in the 1004MC to show a true trend in the marketplace. I think Appraisers want to include more numbers in this section of the report in order to produce more numbers for analysis, but this is NOT what you are supposed to be doing and will not produce credible results. Thank you

-by GE

You cannot search by price, you cannot seaarch by bedrooms/baths as in our two MS systems that would included the basement bedrooms/batahs. You cannot search by GLA as that would eliminate all properties with no GLA reported. Furthermore, many realtors include the basements in the MLS reported GLA. How can you compare 6 months to two periods of three months. One of the periods most likely include a holiday/vacation season. If a neighborhood search reveals 100 sales and 120 listings, are appraisers supposed to go through every single one of these???? That would take more than a chunk of time. The 1004MC form is totally useless. The only items that are reasonably reliable are the high/low/pred values and ditto ages. That is if the information is correctly entered into the MLS.

-by Eric

Six years later and still nobody knows how to do it. The form is a joke. Do you think a single appraiser who enters 25 competing sales (or whatever the number is) is going to examine each one to see if it truly competes? How much are we getting paid to do these forms?

-by Mike Ford, CA AG, AGA, GAA, RAA

Correction, respectfully submitted.

The form is a BAD joke. Until it is universally treated with the derision and contempt that it deserves, we’ll keep seeing time wasted on people trying to ‘clarify’ how to use it.

…now if my printer could only print reports on rolls of Charmin.

-