|

>> See Past News Editions >> Click to Print >2016-2017 TAF Approved USPAP Online Enroll Now! (7 hours – $143.95) >FHA Checklist/Field Guide |

Repurchase Demands and Unacceptable Appraisal Practices – Part 1

By Rachel Massey, SRA

Visit any social media site for appraisers and you will find this topic of discussion: the repurchase demands of Fannie Mae and other government sponsored entities (GSE) and lenders. Appraisers are worried, and rightly so, that their work may come under scrutiny and be the subject of one of these demands. Since most of us find that it is more efficient to be proactive rather than reactive, these articles attempt to offer strategies to help you avoid questions in the first place. Problems sometimes arise when what may be well-developed support is not clearly communicated in the appraisal report.

The focus for many residential appraisers is on mortgage related work. Those of us who routinely complete residential appraisals for mortgage financing purposes should be familiar with Fannie Mae’s Selling Guide. This is particularly true with the Unacceptable Appraisal Practices (UAP) (Fannie Mae, 2015), as they set the stage for many repurchase triggers. This article, as well as the next few, are going to address a few of these UAPs, and how to better support appraisal communication specifically related to them.

The three UAPs discussed in this article are:

1) Failure to use comparable sales that are the most locationally and physically similar to the subject property;

2) Misrepresentation of the physical characteristics of the subject property, improvements, or comparable sales; and

3) Failure to comment on negative factors with respect to the subject neighborhood, the subject property, or proximity of the subject property to adverse influences.

Although Fannie Mae has moved away from the guideline related to the distance of the sales from the subject, they still are focused on the most proximate, recent, and similar sales as the guiding force on what should be considered as a comparable. This is found under the section “Selection of Comparable Sales” in the Selling Guide, where it states (Fannie Mae, 2015):

“Comparable sales from within the same neighborhood (including subdivision or project) as the subject property should be used when possible. Sale activity from within the neighborhood is the best indicator of value for properties in that neighborhood as sales prices of comparable properties from the same location should reflect the same positive and negative location characteristics.”

This appears simple enough. Per the Selling Guide and published FAQs, appraisers are urged to not expand the neighborhood boundaries to encompass the sales we deem to be comparable. Instead, descriptions should include differences between the locations and provide an explanation as to why the sales chosen were considered. This is particularly relevant when there are other sales available within the immediate neighborhood which may, at first blush, appear to be similar to our subject property. Remember that if it is available to appraisers, it is available to Fannie Mae, so there is no sense in glossing over what appears to be reasonable without discussing those sales. Notice the word “sales,” not “comparable sales.” It is up to the appraiser to determine what is comparable, not Fannie Mae. However, since they do have the same information as the local appraiser, a few words as to why something may not be comparable, actually does make sense and can alleviate some headaches on the back end. Explanation is key but if there are better sales available even a good explanation can fail.

Good Comps

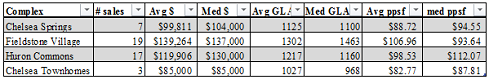

Let’s take a look at four condominium complexes in a small market described in the following example. The subject of the study is in Chelsea Springs in the City of Chelsea. Grouped data is particularly useful in terms of measuring whether there is a marked difference in sales prices between areas or complexes. Looking at these four condominium complexes in some of the small outlying cities in an actual market indicates that it makes sense to skip into a different community if need be rather than staying within the immediate area. If we get an assignment to appraise a property in Chelsea Springs (a small stacked ranch condominium complex on the south side of Chelsea) there would be very slim pickings for sales. According to research in the MLS, there have been only seven sales in the complex since 2013 and only one was within the last year. As the appraiser, we would need to expand our search for comparable properties. We would likely want to restrict the search to stacked ranch properties if at all possible, which results in only two other complexes in the area; one in Chelsea and one in Dexter, which is around seven miles east.

(story continues below)

(story continues)

The second stacked ranch complex in Chelsea is Fieldstone Village. There are many more units in that complex and often more available sales. Using the same criteria back to 2013 produced 19 sales. The average sales price was almost $40,000 more than in Chelsea Springs and the median sales price was $33,000 higher. Part of the reason for this difference is related to size, as the units are larger, but also to having attached garages which are popular in the market.

The next most similar complex is Huron Commons, which is a series of stacked ranch style buildings in Dexter. These units are slightly older than Chelsea Springs but reasonably competitive. The average price, using the same criteria, is just over $20,000 more and the median price $26,000 higher. The relative sizes are much more similar indicating a market preference for Huron Commons over Chelsea Springs.

A third small complex found in Chelsea, is a small handful of townhouses adjacent to the railroad tracks. These are a few years older and not stacked ranches but are included to show the lower end of what condominiums in the Chelsea market sell for. These units sold on average over $14,000 less than Chelsea Springs and on the median $19,000 less were also smaller units.

(story continues below)

(story continues)

This shows Chelsea Springs is one of the lower-priced complexes in Chelsea. Much of this relates to the lack of garages in a market that often experiences harsh winters. Since there are inadequate sales for analysis within the complex, we could go farther back in time to use older sales or go out in distance to find other alternate sales. If Chelsea Townhomes are included, we would need to adjust upward for location and if Fieldstone Village and/or Huron Commons are included, we would need to adjust down for location. Chances are, we would do both – include older sales as well as distant sales, and support location adjustments through the use of grouped data as shown above. We want to be able to defend the conclusions in the event of a push back from a lender or GSE and this type of information can be a good defense. Explaining the similarities at the outset would simply make it less of an issue to start, and likely save headaches on the back end. It never hurts to be proactive when you know something might raise an eyebrow for a client who is unfamiliar with the market.

Distance Sales

Using distant sales when more proximate sales are available is considered an unacceptable appraisal practice, in particular if those proximate sales are also most physically similar to the subject property. Although recent sales are ideal, as long as they are proximate and similar, an older sale that is a model match to the subject and just down the street may well be preferable to a more recent sale that is dissimilar in style and/or age. Market condition adjustments are some of the easier adjustments to extract from the market. Therefore if you have an 11-month old sale that is virtually identical in most respects, it may well be a good sale to consider, especially in light of fewer similar recent sales. There could be proximate sales that appear to be good comparable properties but after research is conducted, turn out to be inappropriate for one reason or another. A quick sentence or two as to why these sales are not reliable would be beneficial.

Consider an example of a property that is sold at a discount because someone had a job transfer and needed to move quickly, with the relocation company giving an incentive to the seller to sell within a 90-day time frame- when 180-days is normal for the market? What about a buyer whose child lives next door and wants to be close to the grandchildren? Could that buyer have paid more than the market? These are two among many factors that can result in either a higher or a lower price for an otherwise comparable property. The same could be said for some unapparent physical problem with the property. Communication with market participants is critical at times in determining these issues. Again, information in the report pertaining to why these sales may not be comparable goes a long way in avoiding needless callbacks or worse.

Physical Characteristics

Misrepresentation of the physical characteristics of the subject property, improvements or comparable sales seems like it should no longer be a factor but there still are circumstances where an appraiser may not accurately read the comments in the MLS, examine the photos in the MLS or even transpose properties when switching comparable sales. These circumstances can result in an appraisal stating that a completely renovated house is in an inferior condition to one that had no updating, when the opposite is the case. Many appraisers still incorrectly say that remodeling is remodeling and that a house with a kitchen that was remodeled in 1985 with the old white and wood cabinetry and laminate counters popular at that time, is equal to one that was remodeled in 2010 with high quality wood and granite. This could easily be construed as a misrepresentation of the physical characteristics. Using a different gross living area than what is available, either through public records or MLS, without providing an explanation as to why. Be careful when reading the MLS commentary and public records data and be liberal in interviewing market participants as a way of avoiding unintentional misrepresentation of physical characteristics.

Negative Factors

Finally, there is failure to comment on negative factors with respect to the subject neighborhood, the subject property or proximity of the subject property to adverse influences. Negative factors can be as straightforward as backing up to an expressway in an area where this is not common. It could be backing to or proximate to a toxic waste site. It could be being adjacent to an airport without disclosure, even if the comparable properties also have similar influences. It all depends on what is expected in the market. Expressways in major cities tend to be less of a value influencer than in a less dense area where few properties have this type of influence. Because many intended users are not from the area and don’t know what influences value in that local market, a bit of discussion is warranted.

Negative factors could be something as timely as the issues in Flint, Mich. with the tainted water supply or the methane leak in Porter Ranch near Los Angeles, Calif. Although the appraiser is not expected to be an environmental expert, and these types of influences may be temporary, they need to be disclosed and discussed. Negative factors can include externalities such as the closing of a factory that employs a large portion of the community or can be impacted views, proximity to power lines, shopping malls and the like. Some of the most common problems relate to a failure to comment on the fact that a subject property backs up to some external factor. Just because it is a non-issue to a local market participant does not mean that the client five states away will have a good understanding of whether it affects value. When in doubt, it is always better to disclose and discuss. A friend recently shared a quote by Aldous Huxley that I think is quite apropos, that “Facts do not cease to exist because they are ignored.”

The Selling Guide addresses externalities in both the neighborhood (B4-1.3-03) (Fannie Mae, 2015) and site sections (B4-1.3-04) as well as the Unacceptable Appraisal Practices section.

(story continues below)

(story continues)

What is a simple way to talk about an externality? Here is an example from an appraisal that discusses the problem and how the adjustment was extracted from the market:

The property is on the stretch of X street that is adjacent to I-94, a heavily traveled freeway. The immediate neighborhood consists of a variety of housing but primarily smaller manufactured homes and modular houses built in the 1990s, as well as some older housing from the 1950s through 1980s, with the exception of a couple of old farm house style properties. The area is serviced by private well and septic which is commonly accepted in the market place. The subject is on the corner of X and Y street. There is commercial and industrial use along X to the west, as well as along W street to the northeast.

Adjustments for the subject’s location adjacent to the expressway are arrived at through a market survey of 36 local REALTORS which indicate that 41% of the respondents consider a 10% reduction in value for the highway, whereas 23.53% consider 5% or below to be the reduction, and 35.29% of the respondents consider it to be 15% or greater. Based on previous market studies of sales backing to the highway, it has been 15% or more on higher priced houses. Since the subject is a more moderate priced house, the predominant 10% figure that was suggested by most participants became the adjustment.

Although Fannie Mae prefers seeing paired sales data for adjustments, the adjustments must reflect the market reaction to the differences in the properties. Market participant polling is one of a number of methods for extracting adjustments and was the method in this instance, due to a lack of competitive sales adjacent to the expressway. A caveat on using a method such as this with work intended for Fannie Mae, it is recommended that a secondary source of adjustment data also be included, such as paired sales from a different community. This can bolster the primary method used.

The sections addressed here are just three of the sixteen bullet-pointed Unacceptable Appraisal Practices cited in the Selling Guide. These UAPs are important to know and consider as they set the stage for many of the repurchase demands that are made to lenders when appraisals deviate from what is expected. As such and as appraisers operating within the mortgage realm, we should take the time to learn what these triggers are and how to build a better report that keeps our clients and ourselves out of the crosshairs of a random audit gone awry.

*B4-1.1-04 of the Selling Guide Selling Guide. (n.d). Retrieved February 11, 2016, from https://www.fanniemae.com/content/guide/selling/

March Webinar:

Appraising Complex and Unusual Properties (Two-Parts)

Part 1: March 17th, 10 – 11:30 a.m. PST

Part 2: March 23rd, 10 – 11:30 a.m. PST

In this two-part webinar, Richard Hagar, SRA shows you what to do when faced with out-of-the-box properties and how to appraise expensive and odd-ball properties like a pro. Hagar takes you step-by-step through how to handle oddball properties, including log homes, dome homes, historic properties, waterfront mansions, and even properties with their own airport or hanger on the subject site. Plus, learn how to handle an appraisal when there is an unusual power source such as a water wheel, generator, or solar panels. Expand your expertise and diversify your practice so you can become your clients’ go-to appraiser! Sign Up Now!

Working RE Winter Series Savings

January: Persistent Appraisal Failures ($49 – Available Now)

February: Appraisal Adjustments: Solving Common Problems (two parts – $79)

March: Complex/Unusual Properties (two parts – $79)

Save $48 when you purchase the Winter Series Season Ticket (five webinars)!

About the Author

Rachel Massey, SRA, AI-RRS has been in the real estate field in the Ann Arbor area since 1984, first in sales, and then as a full time appraiser since 1989. She has a Bachelor’s degree from Siena Heights University with a real estate concentration, and is an AQB Certified USPAP instructor. Rachel was one of the original members of the Michigan Council of Real Estate Appraisers and has a passion for helping other appraisers through writing, teaching and with peer review. She has expertise in lake appraisal, Relocation appraisal work and other residential work in Washtenaw County and surrounding communities. When not appraising or thinking about appraisal, she can be found enjoying sunsets, walking, and the occasional toss about the mat in aikido. Rachel can be reached at rachmass@comcast.net or through her website, www.annarborappraisal.com

>Click to Print

>New: Collateral Underwriter Blog: Find answers, offer solutions.

>Opt-In to Working RE Newsletters

Send your story submission/idea to the Editor: isaac@orep.org

by Dorothy Lee

It’s surprising that misrepresentation of physical characteristics still seems to be an issue in the appraisal process, despite the availability of tools like MLS and public records. I agree that appraisers should be more diligent in reviewing the details, especially when it comes to comparing properties with different levels of renovation. It seems like a simple interview with market participants or a deeper dive into MLS photos could prevent a lot of these errors. Thanks for sharing this issue!

-by stephen fenton

I appreciate the article and the attempt to outline ways appraisers can be proactive in complying with FNMA’s buying guide and avoid repurchase demands. However I feel a discussion of this topic is not complete without pointing out that the field review work the GSE’s rely upon to identify unacceptable appraisal practices, and by extension, risk in their loan portfolio is often deeply flawed and undergoes far less scrutiny than appraisals backing loan origination do in the first place.

Among the things I have observed in repurchase demands I have had to respond to over the years:

– The use of comparable sales with obvious adverse external influences not suffered by the subject property without comment or adjustment, things like properties adjacent to busy railroad tracks or major highways, that happen to be slightly closer in proximity to the subject than the comparable sales used in my report. The first bullet point on the cover letter on the repurchase demand read: “Failure to use comparable sales that are the most locationally and physically similar to the subject property.”

– Extensive use of boilerplate language, which often does not pertain to the appraisal under review (e.g. “The condition adjustment on comp 3 was not warranted based on reviewer’s analysis.” In fact there was no condition adjustment made to the third comparable sale).

– Basic math errors that result in skewed market analysis. My favorite on this one was a defined market area with 95 sales in the last year per, 45 of which were REO. The review stated that 45 of 50 sales were REO, or 90%, when in fact there were 95 total sales.

– Indicating that the sales used were not MLS listed when in fact they were. When a review says this, it automatically triggers the following language in the repurchase demand: “All sales were derived solely from public records. Our guidelines state the appraiser must make appropriate adjustments for sales or financing concessions, terms and conditions of sale, date of sale, location, and the physical characteristics of the properties, as well as certify that the sales meet the definition of market value, Because public records were used as the data source for these sales, the information was not available for the appraiser to determine appropriate adjustments for the aforementioned items. Further, market data was not available to support the opinion of market value (buyer and seller typically motivated and acting in their own interests: well informed or well advised parties; reasonable market exposure; payment in US cash; and a price representing normal consideration unaffected by special or creative financing or sales concessions).” In one case the appraisal was over 5 years old and the data had been expunged from the MLS database. But in others it was readily available. All I could do was send copies of the listings.

– In one case I discovered that the location map in the review had been manipulated, with all but one of the review sales being over 1 mile from the subject, and as far as 3.9 miles, but all showed within a mile and therefore were “more proximate and locationally similar to the subject.”

As if this was not bad enough, the GSE’s are hardly objective parties in this process. Far from it, they seem quite content to apply the boilerplate language of their buying guide without reviewing any of the facts at hand. In fact based on my own experiences it is not clear at all that pointing out review errors, fallacies, and in some cases, outright fraud has any impact on the outcome. As one loss prevention manager at a major national bank (I’ve been advised not to disclose which one) said while discussing a repurchase demand we were dealing with, “you put the information together and hope for the best.”

Putting in the effort to construct a well-supported appraisal document doubtlessly goes a long way in preventing repurchase demands, state board disciplinary actions, and litigation. However, no amount of due diligence can protect one from the fallout arising from faulty or fraudulent review work. And as along as Fannie Mae and Freddie Mac are simply using this review work as ammunition in furtherance of pushing bad paper off their books, so it will go.

-by Mike Ford

I hold Rachel Massey in very high regard for her helpful articles. I concur with the points she is trying to make but offer a couple observations:

1. The terms neighborhood, community and competing area have all been used interchangeably . The AI’s basic text urges appraisers to abandon the outdated concept of “neighborhood” in favor of the more fluid term ‘competitive market area.’ While some parts of the country MAY still have clearly defined, static “neighborhoods”, many dynamic areas do not. I no longer use the term neighborhood by itself, at all. I can cite far too many instances where neighborhood are at best sub-market areas with far too few transactions to be definitive value indicators within themselves at any given point in time. Maybe its a California anomaly.

2. FNMA does NOT get to tell me “not to expand the neighborhood to include the most similar comparable sales.” Period. They MAY ALSO tell me I am required to explain any area or locational differences. I have no argument with that.

3. FNMA’s broad statement that sales from the same neighborhood are (universally) the best indicators of what property is worth in a given ‘neighborhood’ is simply without support. IF there are only three sales; and one is a legitimate open market, non distressed sale and the other two are not, then how could those other two sales be deemed “best indicators” in any definition of the term?

4. Perhaps nitpicking, but WHAT exactly is a “stacked flat ranch condominium?” Stacked flat condo and ranch style are oxymorons. Perhaps it is a highly localized market term but I fail to see how it would differ significantly from a pseudo-Tudor style stacked flat condo or a pseudo Chateau-Style stacked flat condo or a “Mediterranean” style stacked flat condo. The “style” is usually derived from slapped on afterthought fenestration and has little to do with significant market appeal for the given project. How on earth could one suggest ranch style flat condos are preferred and then make the transition to a row type townhouse style condominium as being relevant? It is FAR more important to use all stacked flat condos, than pseudo ‘ranch style’ condos!

5. I liked Ms Massey’s grouped data to demonstrate area differences, but it raises more questions than it answers. Her narrative description to us explains the differences, but the grouped data if left by itself, would not. Additionally, Look how much time and space we have devoted to the simple concept of one area being ‘different’ than another. In the real world of mortgage transaction related RE appraisal under AMC fee structures we simply aren’t gong to see this level of detail.

I’d be more concerned that the overall opinion of market value as defined, has been adequately supported, rather than whether an appraiser adequately explained why they went outside of the subject’s CENSUS TRACT number which is what FNMAs flawed collateral Underwriter ACTUALLY looks at.

Real estate appraisals are no longer communicated via self contained appraisal reports. Lets stop pretending that they are or trying to make them that way. At best, in transactional appraising we ‘summarize’ data contained in our work files.

Anyone that has read a post or appraisal by me knows I’m not adverse to writing the Great American Novel on simple topics, but at some point we must also be practical.

We could sum the three issues raised up by saying:

“Don’t lie about comparables, or cheat in describing the subject in order to hit a value; and comment in more detail than most do, but in less detail than the text books themselves use.”

I for one am tired of FNMA calling MY profession liars, cheats and thieves when they themselves use phony and misleading systems like CU to ‘rate’ our appraisal risk, and ultimately “us!”

-Mike Ford, AGA, GAA, RAA Realtor(r); National Appraisal Peer Review Committee Chairman; American Guild of Appraisers, OPEIU, AFL-CIO

by Rachel Massey

Thanks Mike, I need to get with the program on that. Guess it is showing my age as an appraiser.

Yes summarize and have market data available in your workfile if nothing else. Really the biggest issues seem to revolve around “adequate explanation”. Adequate may be very different to me, than to you, than to someone else. Fannie Mae does not define what “adequate explanation” is in the Selling Guide and we are left to our own interpretations. The best thing we can do is continue to explain why we chose the sales that we did, and to outline differences when we know something is going to raise an eyebrow.

What raises eyebrows? Dissimilar looking properties, in particular when similar looking property sales are available. Distant sales when proximate are available. The ubiquitous comments about the best sales being used without further elaboration, etc.

Stacked ranches are a local term. Should have made that more clear. They are single story ranch units stacked one on top of each other in a low rise (usually 2-3 units high) in my market. I just write about my market and this is a reminder to explain a bit more.

Lastly, the market statistics and grouped data (or any market statistics) need some explanation as to what it means. Rote numbers and graphs look nice, but you still have to analyze the trends and explain it.

Thanks again for your comments, I am very happy to see them as it helps me think about what else I need to include.

-by John Pratt

Demand for Repurchase by Fannie

-This article was well thought out and well written however I think we have missed the most important part of the “Demand for Repurchase by Fannie”. I would estimate that at least 95% or more of demands for repurchase by Fannie are made after the loan has gone into default or foreclosure. This is merely an attempt by Fannie to reduce or eliminate their loss and challenging the appraisal report is the best way for them to do that.

Fannie should review the complete loan package including the appraisal upon submission by the lender and if there are any deficiencies, including deficiencies in the appraisal, at that time they should reject the loan. If the borrower made the payments for 2, 3 or 4 years then the loan goes into default it is not because there is an appraisal in file that has some deficiencies.

It is the lenders responsibility to review the appraisal and all other documentation and make sure that it meets Fannie’s requirements prior to submitting the loan package.

Let’s be honest here, loans go into default for many reasons but very seldom would it be due to a deficiency in the appraisal. All loans have a risk factor and that must be realized at the inception of the loan process and the lender must take the necessary steps prior to funding to minimize the risk not after the loan has been closed.

My over 20 years of experience in the lending industry, mostly in upper management, tell me that most loans go into default due to unforeseen changes in the financial status of the borrower or failure of the lender to recognize the poor character and or the inability of the borrower to make the payments.

Most of this demand for Repurchases by Fannie and other was brought on by the Real Estate crash of 2007 and after. The crash was not due to bad appraisals. During the lead up to this crash most sales of residential properties has several offer, most over the listing price and potential buyers were bidding up the price. The market was fueled by speculation. The appraisals only reflected the market at that time.

Side note: If the lending industry wants a complete appraisal with a complete analysis of the market as suggest in your article they should require a narrative appraisal similar to that of commercial appraisals and be willing to pay for it and wait up to a month or more for the completed appraisal report.

John M. Pratt

by Rachel Massey

There are a number of repurchase demands on performing loans. This is not restricted to the older non-performing loans. Part of the reason that appraisers find as many stipulations as they do on review relates to the lender trying to ensure that what needs to be addressed is.

Thanks for providing feedback.

-by Mike Ford

Agree absolutely! USPAP is written for textbook appraisal. So is Ms Massey’s article. We can comply with USPAP in appraisal reports that (still) ‘summarize’ our findings and conclusions.

The REAL issue is AMCS; lenders and ultimately FNMA being complicit in driving fees so low that they only marginally cover costs for ‘drive by’ levels of detail. The old URAR form (UAD modified) has ceased to be a vehicle for summation of market data, and has become a form for mere statements of market data. The more FNMA tries to micro manage; the worse it becomes.

You folks ARE aware I assume, that the CU “process” was developed without the identified participation of even ONE licensed appraiser, right?

-