|

Services Offered this Issue > Appraisal Institute- Career Building > Forsythe Appraisals > NAR – Appraisal Opportunities> Adjustment CE (7 Hrs OREP Education) > OREP Appraiser Insurance |

What’s Your (Appraisal) Problem?

by Bryan S. Reynolds, CDEI, AQB Certified USPAP Instructor

The first step of the appraisal process is identification of the problem. Many appraisal practitioners take this step for granted. A clear understanding of the valuation problem is needed before entering into an agreement for services. Here are a couple of reasons why.

Let’s assume a property owner contacts you and wants their single-family house appraised. This property is located in a tract subdivision in which you have appraised many properties over the years. This is what is considered an easy house to appraise because there are many similar homes in the subdivision, a considerable number of closed comparable sales, and many active competing units. Supply and demand are in balance as is typical for this highly desirable neighborhood.

You can’t wait to arrive at the property because the homeowner has a check waiting for you. She wants a good, honest, ethical, competent, professional, unbiased opinion of value. She has been told that you are the best and she is willing to pay for the best. The house is approximately 1,400 square feet, three bedrooms, and two full bathrooms with a one car attached garage. How long would it take you to inspect or observe this property? Most of my appraisal students indicate about 30-45 minutes. What if I said no one was there? You could get in and out of that sucker in about ten minutes couldn’t you? In this case, the owner said she will leave the front door unlocked for you and a check will be left on the kitchen table. You photograph and measure the property. Now, how long would it take to prepare the report? She’s not in a rush.

So, it’s D-Day (delivery day) and you provide the client (homeowner) with the completed report. She is quite impressed with the professional looking appraisal report. It describes the average rainfall in the area, the traffic count, median household income and other demographics. It further reports that Daniel Boone visited the Yellow Banks along the Ohio River, and describes Dragoons and their activities around Daviess County, KY.

The homeowner is very pleased with the presentation and after looking over it, she asks, “What page is the number on?” After all, that is what interests her the most. You reply page two. She replies “$150,000, that’s wonderful! I am going to tell all my friends, family and neighbors! You will get a lot of work from this and I am sincere about that. I knew you were the best appraiser in the state. I have only one remaining question. Is that the before value or after value?” You probably gulp and say “What?” Do you suddenly feel like you just stepped in something? be solved.

The homeowner now explains that she needs a before and after value because the Department of Transportation (DOT) is taking a portion of her property and she needs to know the value immediately before the taking and the value immediately after the taking. “Oh, and by the way, you testify in court Monday morning at 8:00 a.m.” You have just stepped into something you were not expecting.

Just because you have a credential to appraise single-family residential properties, and do so every day, and it’s a single-family house in a subdivision you have appraised for years, it doesn’t automatically make you competent to appraise the subject for any particular use. While you may be extremely competent to appraise that same residential house for a refinance, purchase, relocation assignment, foreclosure, short sale, divorce, homeowner thinking of marketing the property, construction defects, insurance purposes and a whole host of other reasons, you may not be competent to appraise that same single family house in a condemnation case.

(story continues below)

(story continues)

Reset Button

The first question you should ask when receiving a potential order is “What’s Your Problem?” You might not ask it exactly like this but make no mistake you need to ask the client to state his or her valuation problem. When you get an answer, you are ready to decide if you are competent to assist them in solving their valuation problem.

When you go to a primary care doctor, what is the first thing he or she asks you? “What brings you in to see me today, what’s wrong with you, what’s going on?” In other words, the doctor asks you to identify your health problem. It is probable that if you say, “Hey doc, look at this bone sticking out of the back of my leg,” he or she might respond, “Oh my, you need to go see an orthopedic specialist at the hospital as soon as possible. I am not competent in that area of medicine.”

Similarly, appraisers need to identify the Intended Use, which is part of step one in the appraisal process of problem identification, before accepting the assignment.

USPAP defines Intended Use as:

The use or uses of an appraiser’s reported appraisal or appraisal review assignment opinions and conclusions, as identified by the appraiser based on communication with the client at the time of the assignment.

Standard Rule 1-2b states:

Identify the intended use of the appraiser’s opinions and conclusions;

Comment: An appraiser must not allow the intended use of an assignment or a client’s objectives to cause the assignment results to be biased.

Standard Rule 2-2a(ii) and Standard Rule 2-2b(ii) state:

state the intended use of the appraisal

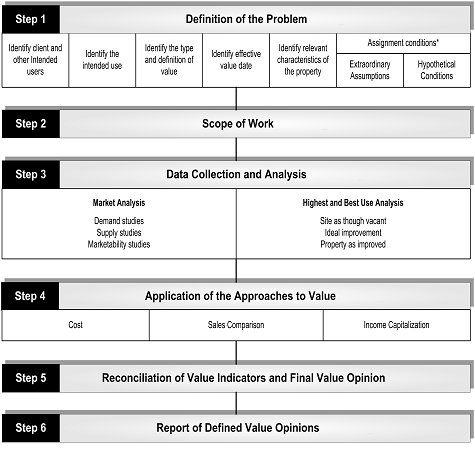

Appraisal Process

(Click image below to view Appraisal Process Flowchart)

Lesson Learned

Here’s a story about what happens when you don’t think things all the way through before you take on a new assignment. Now this is many years ago: I received a telephone call from an attorney in Florida. I have no idea how he got my name and information but he said his father owned a farm in the nearby area of Union County, along the river bottoms of the Ohio River. I was excited because I had recently completed several farms for the Kentucky Department of Finance. He said his father had a partial interest in a 700 acre farm and needed to know the value of his father’s interest. I was disappointed because at that time I had limited experience in the appraisal of partial interest estates. I recommended a colleague and said I would be able to assist him. The attorney said that would be good. I was now excited: I was going to learn something about partial interest appraising. My colleague said, “Bryan, you are going to do all of the work.” I said I know, and then he said he was going to keep all of the money (fee) and I again said I know. Still, I was excited because I was getting more than money: I was gaining an education. I was going to become more knowledgeable about partial interest appraising.

During the process, my colleague said he probably should communicate with the attorney and of course at that point it was his client. I provided the name and contact information. My colleague convinced the attorney we should do a fee simple estate appraisal instead of a partial interest appraisal and simply let the partners work it out. I could have done that! My buddy made all the money and I received no education. Wait, I did receive an education but it was not on valuing a partial interest real estate! It was about thinking things through ahead of time.

(story continues below)

(story continues)

1004 Form- Beware

Appraisers should beware of using the Fannie Mae 1004 form/Freddie Mac form 70 as a catch all. Many appraisers utilize this form for everything they do. Keep in mind, this form is designed for appraisals prepared on properties for the intended use of a mortgage finance transaction. Using pre-printed appraisal report forms intended for mortgage finance transactions that contain specific language in the form for any other intended use results in a misleading appraisal report. For example, if you appraise a house for a homeowner thinking about selling their home, where is the mortgage finance transaction? If you are appraising a property for a divorce case, where is the mortgage finance transaction? There isn’t one!

If the appraiser is accustomed to pre-printed forms and prefers to use such forms, most appraisal software companies have provided an alternative form which is customizable. A General Purpose Appraisal Report (GPAR) or what some refer to as gee-par form, is an option that allows the appraiser to tailor the report for a different intended use.

Appraisers should also consider the specific need of each client and not force a 1004 down everyone’s throat. For instance, does a client who engages an appraiser for their professional, unbiased, independent, expert opinion of market value of their home for potential marketing purposes, really need a picture of their own house? Think about it, he knows what his house looks like. Does he need a floor plan of what he walks every day, or a copy of his deed, heck he has the original! Everyone has a GPS on their smart phones so do they really need a location map with little stick-on arrows?

Is it so hard to comprehend keeping all that information and just providing an opinion of value? If you tell a typical homeowner he has functional obsolescence, he likely will look at you funny, and then think he has a disease. Can you keep all of that paperwork and provide the client with what he actually wants? Clients just want to know the market value of their homes. They are willing to pay for your opinion, an independent, unbiased, professional, expert opinion, not a massive written appraisal report containing information they don’t want or don’t understand.

Oral Reports

Let’s go back to the doctor’s office. As stated earlier, he or she attempts to identify your health problem. They will ask questions and examine you, kind of like a physical inspection an appraiser preforms. He states he still doesn’t know what’s wrong so he orders an X-Ray (the subject photos). Do you see the x-ray? Probably not and if you do, can you understand it? He then needs further investigation and sends you to the lab for blood work and urine analysis (the location map). Do you see those results? What next? You probably are sent home and then a day or two later receive a call from the doctor’s office. They give you the doctor’s diagnosis, or OPINION, and you say what? “I’m not going to accept that without a 44-page written report, with the x-ray, and lab results attached with a copy of your license and, oh yeah, include a copy of your malpractice (E&O) insurance policy!” Of course you are not going to have that response. You will accept the doctor’s diagnosis, or opinion, over the phone. Appraisers can do the same thing. What?

Consider exploring Oral Appraisal Reports or Restricted Appraisal Reports. Most appraisers resist these two reporting options but they are permissible under USPAP and many times provide an excellent service to clients who do not want a lengthy report as required by the secondary market.

(story continues)

Some appraisers say it looks better with a form report or the client will want a written report to place on the coffee table as a marketing technique to show potential buyers. The fact is that you don’t really know what a client wants unless you ask them. Would the report look better if you added the average rainfall, the traffic count, or history of the county? Most clients don’t want all that stuff or fluff, as some refer to it. Finally, are you sure he/she wants to place a written report on their coffee table? What if she thinks her house is worth $250,000 and your appraisal reflects $190,000. I don’t think she will place that report on her coffee table. Some would destroy that written report. An oral real property appraisal report would be more beneficial in this case.

Let’s not forget that the appraisal and the appraisal report are two different things. Many appraisers and users confuse the two. Standard Rule 1 deals with the development. It is everything you have to do to get the number. Standard Rule 2 deals with the report. It is the method in which you communicate the results of the appraisal to the client. Within the report mechanism there are three different options: Appraisal Report; Restricted Appraisal Report and Oral Real Property Appraisal Report.

One intial question that should be asked is what level of detail in communication of the appraisal does the client actual want. Do they want a written report or an oral report? You might be surprised that many just want to know what their house is worth. An oral report is perfect. If they do want a written report, ask how much detail they want. Do they want to see the anaylisis (the x-rays and lab work) or are they really just more interested in the results/diagnosis?

Appraisers resist things they haven’t done before. Change is hard and we simply don’t like it. Rest assured, most things change. If you don’t believe that, look in the mirror. Think outside the check box. USPAP does not require you to even physically look at a property (inspect or observe) and provides three different reporting types to communicate your opinions and conclusions.

This article is taken in part from Bryan’s new course Appraiser’s Guide to CYA (Covering Your Appraisals).

CE Online – 7 Hours (approved in over 30 states)

How To Support and Prove Your Adjustments

Presented by: Richard Hagar, SRA

Now you can improve your skills and earn CE credit conveniently online. Richard Hagar’s, SRA highly acclaimed adjustments seminar is now available online for CE credit in most states. Do you have the proper support for your adjustments? Stop taking the same old CE courses and learn proven adjustment methods with instructor Richard Hagar, SRA. Fannie Mae states that the number one reason appraisals are flagged is the “use of adjustments that do not reflect market reaction.” Stay out of trouble with Fannie Mae, your state board and your AMC/lender clients with solid, supportable adjustments. Learning how to make defensible adjustments is the first step in becoming a “Tier One” appraiser, who earns more and enjoys the best assignments. Up your game, avoid time-consuming callbacks and earn approved CE today!

“Why wasn’t this taught years ago?” – Jackie Henry

How to Support and Prove Your Adjustments

Sign Up Now! $119 – 7 Hrs. Approved CE

(OREP Insureds Price: $99)

About the Author

Bryan S. Reynolds is the owner of Bryan S. Reynolds & Associates, Reynolds Appraisal Service. He provides various educational offerings, mentoring, residential and commercial valuation services, consulting and litigation support services throughout the region as well as being available for lectures and is well known for his Think Outside the “Check” Box approach.

Send your story submission/idea to the Editor: isaac@orep.org

by Rachel Massey

Great article Bryan!

It is particularly germane (and necessary) to understand what your client intends to do with the report, how they will use it. I think your analogy of the doctor is helpful for people to understand the questioning, as often it seems that people can confuse intended use with a directed report when all it is, is the “why” of why they called you in the first place.

Thanks for sharing your knowledge and your first-hand experience.

-by Thomas Trojnar

Great article. Thinking outside the check box is important and this is a valuable lesson. Thanks much.

-