|

> The Appraiser Coach

> OREP E&O |

The Attack on Single-Family Zoning

by Richard Hagar, SRA

There are changes afoot that lenders and appraisers should be aware of due to the impact on lending and the value of residential properties. However, these changes don’t seem to align with the type of properties Americans desire to live in. Allow me to look back at history before I explain the attack.

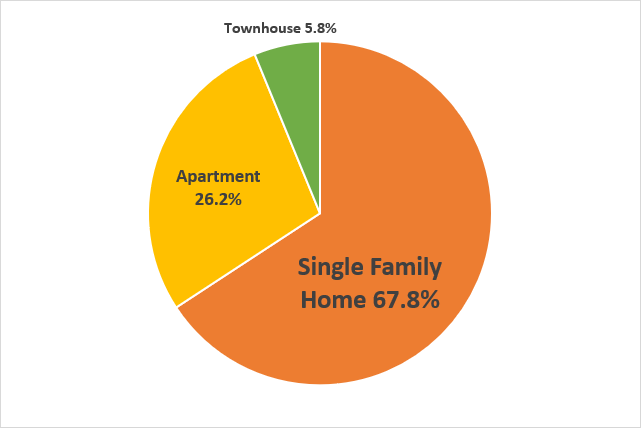

Currently, single-family homes represent the majority of housing types all across the U.S. According to the U.S. Census Bureau, as of 2013 single-family homes (SFH) account for 73.6 percent of all housing units (including 6.3 percent mobile homes and 5.8 percent townhomes) while multi-family housing represents 26.2 percent (See Figure 1).

Figure 1: 2013 U.S. Census Bureau Report on Single-Family Housing

During the pilgrimage of the 1600s to the North American continent, people clustered in small communities which provided a cooperative environment for goods, trade, and protection. Once cities expanded and became crowded, people moved to areas outside those original communities—today we call them suburbs.

Today, the primary reason people live in apartment buildings within cities is to be close to jobs and businesses. Then of course, there’s the added bonus of the low cost of living. However, as families grow, they begin to desire space in the backyard for their kids to play, a garage to park cars, etc. For the most part, once people have a comfortable income, they don’t seek multi-family living; they want some elbow room and are willing to pay for it even if it means moving further away from city centers. It’s the American dream. Unfortunately, this “dream” appears to bother some people and they are trying to pass zoning laws requiring high density multi-family housing throughout single-family zoned areas in cities and small towns—even if the majority of people don’t like it.

A Flashback and Reason for Zoning

In the mid-1800s, Harlem was a desirable place to live or vacation outside New York; it was synonymous with “elegant living” by the state’s wealthy. Families built numerous large and high-end homes. Due to demand and economic growth, the population increased, and row houses and constructed apartments were attached. Without zoning, a developer could build apartments, commercial, and industrial uses adjacent to detached upscale residential homes. As the demand for housing continued to grow, population density increased. This resulted in increased land values and decreasing value of the existing homes (aka economic obsolescence to appraisers).

Wealthy families vacated—selling their homes and allowing new owners to convert the once elegant structures into multi-family buildings. If you have an eye for architecture, today you can recognize that a few of the old brick homes are still standing. However, the most profitable use of the buildings is no longer for single-family but multi-family, which generates higher rents (a perfect example of the highest and best use of the improvement).

In response, New York in 1916 enacted the first zoning codes in the United States. Zoning appeared to reduce the problem, which then supported the creation of the Federal Zoning Enabling Act in 1922, which permitted cities, towns, and communities all across the United States to enact local zoning regulations. One of the original purposes of zoning was to keep incompatible uses separate from residential areas. It was found that when industrial, commercial, and multi-family uses were near residential properties, the value of the residential properties decreased along with the resulting tax dollars. Many property owners complained about the impact on property values and filed lawsuits attempting to stop unregulated construction.

Cases worked their way up to the Supreme Court with court rulings supporting the establishment of local zoning regulations. The Supreme Court wrote:

The serious question in the case arises over the ordinance excluding from residential districts apartment houses, business houses, retail stores and shops…The coming of one apartment house is followed by others, interfering…with the free circulation of air and monopolizing the rays of the sun which otherwise would fall upon the smaller homes…and depriving children of the privilege of quiet and open spaces for play…until, finally, the residential character of the neighborhood and its desirability as a place of detached residences are utterly destroyed.

The court went on to state:

“New York Set Back Ordinances’ were established to prevent streets from being darkened by the towering walls of buildings and so as to minimize the “stealing of light,” by each successive building which stood taller and taller than its preceding neighbors.”

What court rulings were indicating is that it was legal to establish local zoning—i.e., industrial uses should go down by the river or railroad tracks, commercial uses along the highway, multi-family close to transportation systems and support services and residential uses far away for quiet enjoyment and kid-friendly streets. Cities that have enacted zoning that separates different uses tend to maintain their appeal more than cities with haphazard zoning.

Neighborhoods found in cities such as Chicago or Detroit are perfect examples of what happens when small industrial buildings or apartments are constructed next to single-family homes. Many of these homes now look worn-down and shallowed out. History indicates that we’ve tried mixing multi-family buildings with single-family homes—and it didn’t work.

(story continues below)

(story continues)

Over the years, most small towns and cities have embraced zoning as a way of encouraging different land uses in the most appropriate areas. The overriding goal is for zoning decisions to be made at a local level, not at the Federal or State levels. The origins of democracy are also based on this premise, that decisions must be made at the most local level possible and should not be made by a separate governing body such as royalty or even a dictator.

Article XI, § 11 of the State of Washington’s Constitution also supports this local decision process:

“Any county, city, town or township may make and enforce within its limits all such local police, sanitary and other regulations as are not in conflict with general laws. Because zoning regulations result from an exercise of the police power and, thus, may only be adopted in furtherance of the health, safety, morals and general welfare of the people affected.”

The United States Constitution, State of Washington’s Constitution, and key Supreme Court decisions all clearly state that zoning and land use regulations (police powers) should be made at the local city and community level, not at the federal or state level. However, what we are starting to see is various state governments trying to dictate to cities and towns how their communities should develop, and single-family housing appears to be one of their targets for destruction.

As an example, this past July the people in Washington’s state capital created new laws that override the local decision-making process that America was based upon. Two House Bills require that all towns and cities must rezone and allow multi-family zoning in all residential areas of their communities, not just multi-family zoned areas. House Bill 1337, requires all cities and counties to allow one or two additional housing units on a lot in all single-family zoned areas. While House Bill 1110, requires all cities with a population greater than 25,000 to rezone and allow a minimum of four housing units on all formally single-family zoned lots and a minimum of six housing units on all lots formally zoned single-family, in cities with a population greater than 75,000.

In Washington State, this higher density zoning (three housing units) is even required for towns, regardless of size, if they are near larger cities in King, Pierce, Snohomish, Thurston, Kitsap, Clark, and Spokane Counties. What they are forcing upon the owners of single-family homes is the possibility for a neighbor to construct a multi-family building on the adjacent lot. Imagine a three-to-four-story apartment building with six plus units built right next to a 1930s Craftsman house, and the owner of the Craftsman house has no say in the matter. This is exactly what the new laws allow and encourage.

There will be additional problems that have not been taken into consideration which relate to water, sewer, and electrical lines all designed to service the existing number of homes per acre, which now must serve many times that number. Several small towns will have to upgrade their entire water and sewer systems, significantly increasing taxes and utility bills. Due to increased living costs, housing in these small towns will become more expensive for both owners and renters alike. As housing becomes more expensive the middle class is squeezed out, leaving a larger gap between the “have, and have nots.”

I have experience valuing homes that are next to duplexes, fourplexes and apartment buildings; I see what’s happening in these neighborhoods. Once zoning is changed from single-family to multi-family, developers move in and start competing against families for older homes. Unfortunately, the builder always wins because they have more money and are willing to pay cash. Homes, perfect for a starter family or in need of being rehabbed will be purchased by a developer who will tear the house down to make way for a new multi-unit building on a small 5,000-square-foot site. (It’s called the highest and best use of the land). The moment construction starts, the value of a nice condition single-family home next door goes down; the appraisal term is called external obsolescence. Welcome to capitalism in America.

The lower-priced older home is gone and replaced by a higher-value building with higher rents. So, despite what the decision makers in the state government say about creating more affordable housing for lower-income people, often this process does the opposite. It creates more housing, but not what people with low incomes can afford. Maybe rent and prices will be lower in 20 years or so when these new units are older but not when they are first constructed. Once again, people with lower incomes are on the losing end of this change in zoning.

Impact on Lending

The banking system of America is designed around providing loans to people who desire to purchase a home. When there’s a house on a property zoned single-family house, banks have numerous loan programs to support its purchase. Due to the way our lending system is set up, buyers can put as little as 3.5 percent down and purchase a house. Loan payments are spread over 30 years and interest rates are low due to the decreased risk provided by owner-occupied single-family homes.

This lending system has evolved over the past 85 years and is one of the most efficient on the planet. However, once zoning is changed to allow five or more units on a lot, this is considered a “commercial” property which increases the down-payment requirements, increases interest rates plus there are tougher qualification requirements. Simply changing the zoning to multi-family (regardless of the spiffy name they give it) changes everything and increases lending costs to all homebuyers.

Impact on Appraising

As I explained, the lending system has issues with properties capable of being used for five or more units. One to four units are considered to be “residential” however, lots that are capable of supporting five or more units are considered commercial.

Appraiser licensing across America is similarly divided, “residential” appraisers are qualified to appraise one to four units while “commercial” appraisers are needed to appraise properties capable of supporting five plus units. 70 percent of appraisers are licensed to provide appraisals for residential properties and only 30 percent are qualified to appraise properties with five or more units. Once zoning is changed to multi-family, there will be far fewer appraisers capable of valuing these homes and appraisal fees will, at a minimum, double, again, making home buying more expensive for the very people these laws state they are “helping.”

Solutions

Clearly the officials passing these state zoning laws, and their unelected bureaucrats believe that the people in towns and cities are too ignorant to make local community zoning decisions. The laws these people pass display absolute arrogance and disdain for the 76.3 percent of people who live in single-family homes. They are attacking the people who own or desire single-family homes, and they are doing it by changing the zoning to allow multi-family in single-family neighborhoods.

- The first solution is to educate or un-elect these people; they do not understand the wide implications of their zoning decisions. They appear to be ignorant of America’s history or suffering from the Dunning-Kruger Effect (look it up).

- The next solution is to prevent or eliminate statewide laws that force multi-family zoning into single-family areas. Zoning decisions should be made by our local communities.

- Next, allocate more land to multi-family zoned districts. These areas should be close to existing transportation corridors allowing better access to jobs and the services they need to prosper; not just plopped down in the middle of Single-Family Residential (SFR) neighborhoods. As more properly zoned land is made available, there are builders waiting to jump on the opportunity to build new units; supply and demand will work.

- Next, reduce government cost burdens. A minimum of 25 percent of housing costs are due to government fees, not counting the new upcoming increased costs due to the 100 percent electrification requirement for all new homes.

- Cities should try and hire competent people for their building departments, people who understand history and work towards shortening the processing time it takes to obtain building permits. I understand that good people are hard to find and firing less productive people is even tougher, especially in some West Coast states. The hiring and firing processes need to be improved.

- People who have well-rounded knowledge in the real estate and lending industry need to get involved with their elected officials by communicating with them directly and not via their trade organizations where politics get involved. You’d be surprised how easy it is to send a short email with pertinent information to an elected official. The officials need help, so provide it. Who knows, complaining and helping might bring about big results and allow Americans to obtain the type of housing they desire and not put up with what’s being forced upon them.

- Appraisers need far more training on how to calculate the increased depreciation rates for homes on multi-family zoned land and understanding the extensive highest and best use analysis that will be required, all of which will become necessary if the above suggestions are not implemented.

I’m trying to tell you what’s headed your way and keep you safe out there, because it won’t be easy once these multi-family zoning laws kick in.

About the Author

Richard Hagar, SRA, is an educator, author and owner of a busy appraisal office in the state of Washington. Hagar now offers his legendary adjustments course for CE credit in over 45 states through OREPEducation.org. The 7-hour online CE course “How to Support and Prove Your Adjustments” shows appraisers proven methods for supporting adjustments. Learn how to improve the quality of your reports and defend your adjustments! OREP members save on this approved coursework. Sign up today at OREPEducation.org.

OREP Insurance Services, LLC. Calif. License #0K99465

by Gerard Pomert

This article smells. The writer ignores the fact that zoning regulations were designed to promote exclusivity, I suppose that’s what he’s fighting for. Gerard Pomert gpomert@yahoo.com

-by Vince Slupski

The first thing we have to acknowledge is that what we’ve done in Seattle has not been working. We have had a rapidly growing economy, especially in well paid jobs, and very slow housing production. This is primarily caused by the low densities of much of the city, as well as the surrounding cities. Other cities with higher densities have lower housing prices, including Chicago, Montreal, and Tokyo.

I would also say that both opponents and proponents make too much of the effect of this change. Seattle allowed three units on SF lots several years back – a main house, a detached accessory unit, and an attached accessory unit. Essentially this is already triplex zoning – the attached unit only has to be attached by a breezeway, and the units can be sold separately via a condo declaration. There has been some activity of this sort in my neighborhood, sometimes involving demolition of the existing pre-war bungalow, sometimes a remodel of it, and sometimes no change to the existing house at all. It seems there is always a project going on in the neighborhood, but the pace of change is slow. On my block of 20 houses, none have added a unit. I’m not going to add a unit, at least anytime soon. On the other hand, the units being built aren’t cheap, and the volume isn’t going to decrease home prices anytime soon.

No one is going to build four or six unit apartments. Builders would rather build townhouses and earn out their equity via sale. Is it possible that someone could assemble multiple lots and build 8 or 12 units? I don’t know. Still, there are setback and FAR limits. The real killer for higher density is parking. No one wants to be on a street that’s parked out. No one wants to look at a parking lot. But that can be a problem today with existing zoning – few people park in their garages, and lots of homes have 2 or 3 adults with cars. That’s a real problem to solve. Most cities solve it via excellent transit and close neighborhood services.

-by Andrew Re

Thanks Mr. Hagar… add Austin, Texas to the list as the Austin City Council just passed the “Home Options for Middle-Income Empowerment” (HOME Initiative) which allows up to 3-units per single-family lots. I’m actively looking at other areas for research on how this will impact property values — this article is a huge help.

-by Sharon

Richard thank you for your insight on this topic. I’ve questioned this many times but have been faced with challenges of inequality for low income residents. It’s marketed in a different way, which never sat right in my bones.

-by Tammi Loving

Great article, Mr. Hagar, from your lips to government’s ears

-by Brent Bowen

Richard, I appreciate that you have taken the lead with regards to creating more awareness about this issue. There is a lot of wisdom in the article, and I’m in alignment with you overall. With that said, I do take issue with your point about who is qualified to appraise a property which has less restrictive zoning regarding the number of units. Zoning is only one piece of the puzzle with regards to highest and best use. Just because the zoning changes, doesn’t mean that the highest and best use automatically changes. In this way it is similar to a property with no zoning at all. A property with no zoning by definition has a wide range of legally allowable uses, yet I don’t think anyone would suggest that only commercial appraisers should appraise properties with no zoning. If that were the case, there wouldn’t be a single residential appraiser in Houston!

-Good food for thought…especially good given that we have an election coming up. Thanks for helping us be informed about an important issue to consider when it’s time to vote.