|

> The Appraiser Coach

> OREP E&O |

When Is Single-Family a Multi-Family Appraisal?

by Richard Hagar, SRA

Appraising a single-family property is becoming increasingly complex, and we can partially blame some local governments for the mess (so be careful who you vote for).

Once upon a time, it was easy to classify single-family homes, duplexes, triplexes and multi-family buildings. Though there have always been exceptions, if a property was zoned single-family residential (SFR) and there was a single home on the site, you’d use a 1004 form for bank appraisals. If a property was zoned multi-family and there were two to four units on the site, an appraiser would use the 1025 form. And, if there were five or more units on the site, it would be something a commercial appraiser would handle via a narrative format.

Ah, the good old days. Then, along came accessory dwelling units (ADU), which in some states and cities are messing with established appraisal and lending systems.

Before I explain how a single-family property magically becomes a multi-family property, some background and definitions are necessary. Let’s start with the following from the U.S. Census Bureau and American National Standards Institute (ANSI):

Single Family: Housing units that are fully detached, semi-detached, semi-attached, side-by-side, row houses or townhouses. In the case of attached units, each must be separated from the adjacent unit by a ground-to-roof wall in order to be classified as a single-family structure. Also, these units must not share heating/air-conditioning systems or utilities.

In other words, this is a structure designed for use by a single family (or family unit) situated on a single parcel of land. On the other hand, the Census Bureau defines multi-family as:

Multi-Family: Residential buildings containing units that are built side-by-side or one on top of another which do not have a ground-to-roof wall and/or have common facilities (i.e., attic, basement, heating plant, plumbing, etc.).

This means there are one or more structures or units used by multiple people and/or families sited on one or more parcels of land, with the entire complex typically owned by a single entity (person, partnership or corporation). Properties zoned multi-family do not require the owner(s) to live on the site. We all understand what these types of properties look like and how they function.

While this zoning varies from state to state and from city to city, here are two general examples from King County, Washington:

- SFR Zoning: The R-1 through R-8 zones, [provide] for a mix of predominantly single detached dwelling units and other development types, with a variety of densities and sizes in locations appropriate for urban densities.

- Multi-Family Zoning: The R-12 through R-48 zones, [provide] for a mix of predominantly apartment and townhouse dwelling units, mixed-use and other development types, with a variety of densities and sizes in locations appropriate for urban densities.

In multi-family zoning, it’s important to note that there’s “no requirement for the owner(s) to live on the site.” This is a point I will expand on a little later.

Accessory buildings are those that are “in addition to a primary building.” Examples of these include garages, storage buildings, workshops, detached swimming pool buildings, and barns. A common accessory building is an ADU, also known as mother-in-law units (MILs), garage apartments, backyard cottages, etc.

The following text from a county zoning code (King County Ordinance 17841 § 6, 2014) describes it from a legal standpoint:

Accessory Use: a use, structure or activity that is:

A. Customarily associated with a principal use;

B. Located on the same site as the principal use; and

C. Subordinate and incidental to the principal use.

Accessory Use, Residential: an accessory use to a residential use, including, but not limited to:

A. Accessory living quarters and dwellings.

In most zoning codes and descriptions, an accessory use is a structure that enhances the primary use of the lot or primary structure, and since they are considered an enhancement to an existing residential use, they do not have to follow the same rules as structures permitted under conventional zoning. They aren’t the primary purpose or use of the lot and are usually smaller and less noticeable than the main building.

Fannie Mae, Freddie Mac, the Department of Veteran Affairs (VA), and the Federal Housing Administration (FHA) all have additional definitions, descriptions and requirements regarding access, size, kitchens, bath facilities, privacy, and the number of allowable ADUs (explained in my webinar How to Handle ADUs and MILs available here). Typically, accessory dwelling units are not allowed in areas zoned multi-family.

(story continues below)

(story continues)

Things Get Twisted

Many counties and cities that allow ADUs do not “change” the official zoning; SFR 5000 still means one single-family home per 5,000-square-foot lot (and allow an ADU). What a few politically and emotionally driven cities have done is bypass the normal requirements for changing zoning (public hearings, notifications, etc.) and passed laws that overlay additional uses and requirements on to existing zoning codes. It’s their “clever” way of changing things without following the historic path to … well, changing things without informed consent by the citizens.

So, here we are: appraisers looking at zoning codes trying to determine the highest and best use for the subject’s site (as if vacant) and the structure as improved. We see SF7500 and say, “great, single family.” But did you look to see if there are overlay additions to the code? If so, did you read them? Did you look at regulations related to accessory dwelling units? If you didn’t, you’d better start looking because these things are popping up in numerous counties and cities across the United States, and they have a massive impact on unit density, the highest and best use, land values and depreciation rates.

Search for the term “accessory dwelling” on your local government website, where you would normally research local zoning codes (and keep a copy of what you find in your work file). It’s also important that the next time you have the opportunity to take a class on highest and best use, I strongly suggest doing so! Understanding what the zoning allows and allowances for an ADU is one of the things that separate Tier 1 appraisers from the rest. And no automated valuation model (AVM) that I know of is currently adjusting for an ADU. Every AVM that I’ve seen undervalues a property that has an ADU, sometimes by tens of thousands of dollars.

Even MORE Twists

Some people at government approval hearings assume the ADU will be part of the main house, typically in the basement or attached converted garage. However, once these units are approved, there are later “updates” to an ADU law, zoning or building code (or all three) which allow for a detached accessory dwelling unit (DADU). Even later, some of the cities/states have gone so far as to allow one attached ADU and one DADU in addition to the primary house. So, now, as if by magic, you can have a primary house, an attached ADU and a detached ADU … three living units all on the same site. Oh my!

Did you consider these potential additional uses in your highest and best use analysis and valuation? Were they considered when determining how hard you were going to work in searching for comparables, the cost and income approaches, explaining things and your appraisal fee?

Conflict With Lending

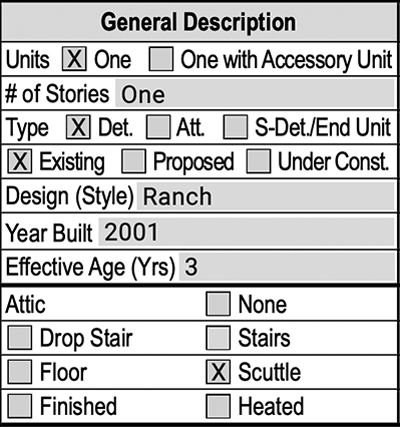

The Federal National Mortgage Association (FNMA) will buy a loan where the single-family home has a single ADU. Look at the below form (Figure 1) and note the two options: Units “One” and “One with Accessory Unit.” There is no space on the 1004 form to identify a second ADU. FNMA explains the use of the form as:

This report form (Figure 1: Form 1004) is designed to report an appraisal of a one-unit property or a one-unit property with an accessory unit …

Figure 1: Form 1004

Now we have a conflict between cities allowing two or more ADUs and the lending world of FNMA, the Federal Home Loan Mortgage Corp. (FHLMC), the VA and FHA. These entities will not buy loans with two or more ADUs. And when FNMA won’t buy (or VA and FHA insure) a loan from a lender it results in fewer lenders offering loans, higher interest rates and possibly larger down payments. In a city’s zeal to lower the cost of housing, they’ve increased the cost of housing.

From an appraisal standpoint, if you have a subject with two ADUs, you have a conflict and must try to find other comparables with the same number of ADUs. Finding one comparable is tough enough; now the lenders want comparables with the same house style and size and with the same number of ADUs as the subject. Oh, for joy— twice the research. And, if you can’t find them now, you must determine the adjustments between properties without ADUs, with ADUs, DADUs and maybe even two ADUs. You can’t pick just any sale with a home similar to the subject’s; you also need the same number of ADUs.

1004 Form, Certification Page, paragraph 7 requires:

I selected and used comparable sales that are location-based, physically and functionally the most similar to the subject property.

And is the property still SFR with one or two ADUs, or is it really a multi-family property?

(story continues below)

(story continues)

Transformation of SFR Into Multi-Family

Most cities have ADU requirements that the owner must live in one of the units. This little requirement is one of the primary differences between multi-family and a single-family home with an ADU. Zoning is the other important component. Several areas, including Washington, Oregon and California, have recently changed laws (not necessarily zoning codes) and no longer require that the owner live on the site. This means that a house and its ADU, or two, can be 100 percent rented.

Whoa! Isn’t that the general description for a duplex or triplex? Yep! Presto, change-o!

Magically, cities have turned SFR zoning into multi-family zoning, even when the zoning code still indicates a single-family designation. This is a highest and best use valuation nightmare! The appraiser must consider if two or three units in single-family zoned areas are legal or illegal. Were permits required for the property you’re appraising or was it somehow magically “grandfathered” in, which also impacts value, but in a different way? Does your city, like several others, require the property owner to renew a license for the ADU every year? If a city allowed an ADU, did it also require a recorded deed restriction requiring owner occupancy of one of the units? To be sure, check the title report that many listings include in the multiple listing service (MLS).

All of these questions (and many more) must now be researched and explained in an appraisal. Why? Legal units have one value; illegal units likely have another. The Uniform Standards of Professional Appraisal Practice (USPAP) requires that you either figure this out or disclose that you didn’t, which then taints your value conclusion.

ADUs weren’t an issue years ago, but now they are and clients require more related information. Appraising any property with an ADU is complex, and according to many state laws, only certified appraisers can appraise these properties (licensees are out). Now add SFR vs. multi-family to the mix, and things can go terribly wrong for any appraiser who doesn’t handle this properly!

Every appraiser must have the right license, explain the issues and make the right adjustment between properties with and without ADUs. Appraisers must have geographic competency as it relates to zoning codes and ADU regulations specific to that city. I strongly suggest that you add a brief explanation of the applicable ADU regulations to your appraisal addendum. Simply stating “SF5000” is not enough information to help your client understand the property and the impact on value. If the appraisal includes only the zoning designation, the report does not meet FNMA’s requirements and is not USPAP compliant.

To make this section compliant with banking requirements, make sure the appraisal has more than the zoning designation; it should include a summary of what the zoning allows (especially if there’s an ADU on the property).

If you are in an area where the owner does not have to live in one of the units and you are appraising a single-family home with an ADU (or DADU), then you are likely appraising a multi-family building.

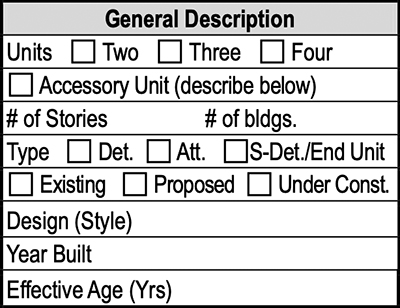

Which form are you using: the 1004 or 1025? If there are two to four units, which is multi-family, then 1025 is the proper form (See Figure 2). Have you included the rent income and income approach, or dismissingly indicated that it doesn’t apply (like many have done in the past)? Use the wrong form and presto … you are a sad Tier 3 appraiser on a lender’s “do not use” list. Do it right, notify the lender and increase your fees to compensate for the extra work!

Figure 2: FNMA Form 1025

Required Information

When you run across properties with ADUs, all sorts of additional information is required in the appraisal. ANSI requires the square footage to be separately indicated. Fannie Mae needs additional information specific to the ADU, and just wait until you see FNMA’s new appraisal “form,” along with its 20-plus new information fields in the special ADU section. If you want an example of how we provide square-footage information, email me (See author bio) and I’ll provide you with a copy of the form we use.

The appraisal will also require fully supported adjustments, explanations on how you determined the adjustments, and the ADUs impact on value measured by the cost, income and sales comparison approaches.

Know Your Stuff

Is it an SFR with one or two ADUs, or is it really multi-family? Is the owner required to live on the site, or is the property located in one of the cities or states (like California and Washington) that have gone rogue and no longer require owner occupancy? Is the parcel zoned SFR, SFR with an ADU overlay, “middle housing,” or multi-family? Make sure to describe what’s allowed.

Are you in California or Washington where they’ve rezoned most residential areas within city limits to multi-family? Are you aware they’ve done the same in many other cities? Geographic competency requires that you become aware of these laws and zoning quirks. All these questions and facts must now be analyzed and answered. In supplying this information, our appraisals have become pages longer and take hours more than they did just six years ago in the PADUA (pre-ADU age).

AVMs do not properly value these properties. Appraisers providing desktop appraisals often aren’t aware that an ADU or DADU exists, resulting in undervaluing properties by the tens of thousands and possibly $100,000 or more. So, here is a business opportunity for any appraiser who understands and properly adjusts for a home with an ADU. Do it right, and earn higher fees!

What to Do

There are so many twists and turns to ADUs that I created a special CE class on the topic. Take it if you have the chance. You will also need a good class on highest and best use, and you should complete it before you appraise any property with an ADU.

Start learning about ADU regulations in your area. An educated appraiser is one that will likely survive the downturn. So, get educated now, and provide clients with a superior product. I’m trying to keep you safe out there.

About the Author

Richard Hagar, SRA, is an educator, author and owner of a busy appraisal office in the state of Washington. Hagar now offers his legendary adjustments course for CE credit in over 45 states through OREPEducation.org. The 7-hour online CE course “How to Support and Prove Your Adjustments” shows appraisers proven methods for supporting adjustments. OREP members save on this approved coursework. Sign up today at OREPEducation.org. Reach Richard Hagar via email at rh@richardhagar.com.

OREP Insurance Services, LLC. Calif. License #0K99465

by Michael Daniel Briant

I would like a copy of the form you use for the ADU. Thank You,

-by Todd Redington, SRA AI-RRS AGA

Great article Richard,

Obviously you are writing from a WA perspective, but as noted, these changes are happening all over. The mere fact that statewide the requirement of having a owner occupant for an ADU improved property has been removed MUST be addressed per USPAP. I despise pre-typed comments, but with all the mandated changes going into effect, every appraisal I am doing has the following statement included on Page 1 of the site section:

Per USPAP 1-3(a)(ii) the impact of Land Use Regulation changes mandated by HB 1110 / HB 1337 / HB 2321 / HB 1998 whether they have already occurred or are proposed, along with those reasonably probable land use regulation changes being made by the subject’s municipality are disclosed, and their impact analyzed in text addenda

As far as I am concerned, any appraisal done in WA should have something similar, if only to comment that you as the appraiser are aware of the changes (geographic competency), but because your particular property is in a rural area or has deed restrictions or whatever reason the changes don’t impact your property, the appraisal has disclosed and addressed the changes per USPAP and the appraiser has come to the conclusion that no impact exists.

Just my $0.02 but I am reviewing a lot of appraisals that do not even acknowledge that changes are coming, when those changes are well known to the agents/buyers/sellers in these markets and anyone not addressing them is not only a tier-3 appraiser, but in violation of USPAP.

-by Paul J Maloney

I believe I may have a credit that I would like to use. My wife signed me up for an adjustments class, that I already took. I would like to apply it towards this ADU class or adjustments part 2 class instead. Is that something you could help me with? Thank you for any help. Thank you.

-