|

>> See Past News Editions >> Click to Print >> RE Agent / Broker E&O Insurance >> Am I a Working RE Subscriber? |

Editor’s Note: Many agents and brokers argue that lack of appraiser geographic competency can cause otherwise good real estate deals to fall through. To address this problem in Louisiana, Realtors and appraisers have worked together to pass legislation requiring AMCs and lenders to pay a Customary and Reasonable fee to appraisers. These new regulations are expected to improve appraisal quality throughout the state.

Appraisers Win Customary and Reasonable Fees in Louisiana

By Isaac Peck, Associate Editor

There is some very good news for appraisers regarding fulfillment of the promise of customary and reasonable fees, as envisioned by the framers of Dodd-Frank. For now, the good news extends only as far as the borders of the state of Louisiana but new legislation has the potential to change the rules of the game nationwide.

As most appraisers know, the concept of “Customary and Reasonable” appraisal fees was written into Dodd-Frank legislation, only to be neutered by the Interim Final Rule, which interpreted the concept of customary and reasonable (C&R) as the lowest fee an appraisal management company (AMC) can persuade an appraiser to accept (find link to related story below). With the passage of new regulations, low-fee bidding, in Louisiana at least, may be a thing of the past.

Louisiana is not the first state to pass AMC regulation that addresses C&R fees, but it is the first to empower its Real Estate and Appraisal Board to determine whether a fee meets the C&R threshold and if not, to sanction the offending AMC. While it remains to be seen if other states will follow, the latest regulations passed in Louisiana should be of interest to appraisers nationwide.

How It Works

Joseph Mier, SRA and an Louisiana appraiser over 20 years, has been actively involved with industry partners such as the Louisiana Home Builders Association, Louisiana Realtors Association, Louisiana Banker’s Association, and the Real Estate Board, to craft the new AMC rules that passed in November of last year. Mier says that complaints have already been filed reporting AMCs for not paying C&R fees. “Appraisers have been notifying the Real Estate Board when they find a company they feel is not paying a customary and reasonable fee. For example, when a firm offers $200 for a full 1004 UAD appraisal, and then, when questioned about it by an appraiser for being too low, just sends the order to a different appraiser,” says Mier.

The Executive Director of the Louisiana Real Estate Board, Bruce Unangst, previously a Market-Area President for a Louisiana based bank, confirmed that the Board is currently investigating several complaints relating to C&R fees. “I can’t comment on the complaints we have received because they are not public record and we may find that no wrongdoing has occurred. However, I suspect you will see some enforcement actions relating to C&R fees over the coming year,” says Unangst.

When someone reports an AMC to the State Board for not paying a C&R fee, the Board contacts the AMC to inquire how its fees are determined. “The first thing we do when we receive a complaint,” said Unangst, “is to write the AMC stating the allegations against them and giving them a timeframe to respond. Once we get all the facts, we can determine whether we need to audit their activities, inspect their records, or take other actions such as fines or license suspension or revocation.” According to Unangst, the Board has the authority to fine AMCs up to $5,000 per violation and up to $50,000 aggregate per year.

Unangst says that the Board is doing its best to educate AMCs about what the requirements are. “We did not pass these rules to be punitive and our goal is voluntary compliance. With that said, these rules do give us the tools we need. If we have an AMC that would seek to gain unfair competitive advantage by not paying C&R fees, we plan to take enforcement action,” says Unangst.

In addition to empowering the state board to enforce C&R fee requirements, the new Louisiana AMC regulations have also empowered the board to conduct “full or partial compliance audits…to determine compliance with all provisions of applicable law and rules.” This provision is meant to assist the Board in conducting investigations and ensuring AMC compliance.

(story continues below)

(story continues)

Fee Survey Said

Just like under Dodd-Frank, AMCs may choose between two presumptions of compliance. The first presumption, clarified in the Louisiana legislation, is “Evidence for such fees may be established by objective third-party information such as government agency fee schedules, academic studies, and independent private sector surveys. Fee studies shall exclude assignments ordered by appraisal management companies.”

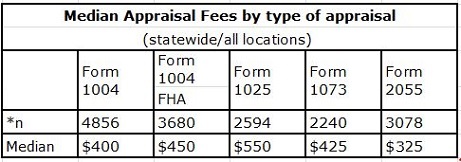

To assist in the determination of what constitutes a C&R fee, a statewide survey was conducted by the Southeastern Louisiana University Business Research Center (SLUBRC). The survey focused on fees being paid by banks, not AMCs, to determine the C&R fees for specific assignments in specific areas. The survey also included appraiser input for comparison, based on their work with banks and other non-AMC clients. The table below represents the median appraisal fee reported in the survey paid by banks directly to appraisers. (Read the complete fee survey report here.)

*n represents the number of orders surveyed.

The result, in many cases, is that AMCs are simply using the fees from the statewide survey conducted by the SLUBRC. “A lot of very reputable AMCs are now paying the fees outlined in the survey and we have had AMCs change their fee structure to be in compliance,” said Mier. “I really think AMCs want to do the right thing now, but they are also under pressure because they don’t want to tell the bank that they need to pay more than they’ve been paying because they fear the bank will go elsewhere.”

Under the second presumption of compliance, AMCs have an option of not using a third-party fee survey, but they must then provide extensive documentation and justification for paying fees other than those supported in the surveys. Unangst reiterates that the fee survey is not a mandated fee schedule. “The survey was done because one of the complaints that many out-of-state AMCs had was that there is nothing out there giving them an indication of what C&R fees are in our state. Our rules simply state that if an AMC chooses to establish C&R fees that are not based on an independent fee study, they can as long as they verify certain quality provisions. There are six factors an AMC must consider in determining C&R fees under the second presumption of compliance. These conditions are required at the federal level and we simply wrote them into our state law,” says Unangst.

How It Began

According to Mier, the momentum for the new rules began in 2012, as many AMCs were rapidly entering the appraisal market with few regulations on how they should be conducting business. “It was a free-for-all and no one was following Dodd-Frank, so a group of fee appraisers approached our Real Estate and Appraisers Boards in Louisiana and asked them to take a look at what was going on,” says Mier.

Mier says that what started as a dialogue between fee appraisers frustrated with what was happening in the appraisal industry, soon became a statewide discussion that involved real estate professionals from many different fields. Mier describes how he and other fee appraisers began reaching out to not only the Louisiana Appraisers Board, but also to the state’s Realtors Association, Home Builders Association, and Bankers Association. “We told them ‘Look, this is hurting our industry as a whole because low fees are causing geographic competency to be compromised.’ AMCs are just looking for the cheapest appraisal fee in general, regardless of geographic competency. And one of the problems we recognize is that there were no policies in place to enforce the provisions of Dodd-Frank,” says Mier.

Louisiana appraisers found common allies among Realtors, bankers, and home builders, each of whom has an interest in quality appraisals that are compliant with federal laws. “We called in the other associations and partners in our industry. None of us were happy with the way some AMCs were doing business in the state. Realtors and builders were not happy with the way appraisals were being ordered because they had appraisers coming into their market who weren’t geographically competent,” says Mier.

According to Unangst, the issue of low appraiser fees was one that adversely affected appraisal quality. “I read an article in Working RE a few months ago regarding low-bid appraisal ordering and that’s exactly what we were dealing with here in Louisiana. Speaking strictly in terms of residential appraisals, what we saw happening was that more experienced appraisers, who weren’t dependent on AMCs, were declining assignments when they felt they couldn’t do an adequate quality job for the fee being offered. So the bottom 20 percent of appraisers in terms of experience, quality, and geographic competence were getting a lot of the residential work and it resulted in a lower quality product. Some AMC’s argue that price has no bearing on quality. However, our experience in Louisiana, working with the Banker’s Association and Realtor’s Association, is that price does have a significant impact. We were getting appraisers who lacked geographic competency, experience, and didn’t put time into doing quality appraisals,” says Unangst.

(story continues below)

(story continues)

Passing the Legislation

Along with Realtors, bankers, and home builders, the Appraisal Institute was also very supportive and actively involved in helping to draft proposed rules to present to the legislative branch in Louisiana, Mier says. “The state took a really hard look at Dodd-Frank with help from the Appraisal Institute. Most of our proposed rules were already in Dodd-Frank. Obviously we had some pushback from the Real Estate Valuation Advocacy Association (REVAA) but we persisted and got the legislation through and it was signed by Governor Jindal,” says Mier.

Mier explains that once the rules were agreed upon, there was a need to implement enforcement mechanisms to ensure statewide compliance. “Our regulations allow the Real Estate Board to implement a process that will be followed if AMCs don’t comply with the law. That’s been the missing key of everything. Dodd-Frank is out there but there was no way to enforce it. The Louisiana law allows for our State Board to enforce the C&R requirement directly by sanctioning AMCs that fail to comply. Dodd-Frank states that appraisers must be geographically competent and the AMC must pay a C&R fee for the area and the type of the assignment, and now our state has been empowered to enforce these requirements,” says Mier.

AMC Perspective

Throughout the drafting, and eventual passage of Louisiana’s AMC regulations, REVAA has actively participated in crafting the legislation according to Don Kelly, Executive Director.

However, REVAA opposes several parts of the regulations that were eventually passed into law and currently holds the position that the Louisiana’s State Board does not have the authority to act on its own to determine C&R fees. “We disagree that the Board can enforce their own version of what C&R fees are. We think it is illegal for a state to enforce federal law. Our understanding of the C&R provisions of the Truth in Lending Act (TILA) is that a Board has the authority to sanction an AMC only after the AMC is found to be in violation of the C&R Fee requirement. That finding can come through the state Attorney General or through a federal agency action, but cannot come directly from the Board,” says Kelly.

Kelly says that the regulations create unnecessary confusion and additional bureaucracy. “It ultimately leads to inconsistent standards. The Louisiana Board is applying its version of C&R fees and then we have federal C&R requirements, based on the presumptions that are articulated in the Interim Final Rule. Ultimately the cost of doing business will go up. The more regulations, the more it costs to ensure compliance. Banks aren’t typically the ones who pay these costs. Who pays? The consumer often pays. In this case, we just don’t think that added regulations are justified,” argues Kelly.

REVAA also objects to the idea that the State Board can audit AMCs or mandate timely payments on the grounds that the board lacks authority over these issues as well. Louisiana’s Licensing and Registration Act, passed in 2010, forbids AMCs from “withholding timely payment for an appraisal.” “We don’t think they have jurisdiction to audit AMCs. They are also trying to dictate when AMCs should pay appraisers and we can’t find any statutory authority for them to do that,” says Kelly.

Kelly makes it clear that despite its opposition to parts of Louisiana’s AMC legislation, REVAA is committed to paying C&R fees. “REVAA companies (members include Clear Capital, CoreLogic, DataQuick, and ServiceLink) pay and will pay C&R fees to the appraisers that we engage. The problem is that because Louisiana wants to strike their own C&R rates, it will be a state that is different than all the other states. I believe, and our members believe, that appraisers absolutely deserve to be paid C&R fees. That is the law of the land throughout the country. But fees are set by the marketplace and if the Louisiana Board comes in and sets a fee, I don’t know that the appraisers, or AMCs, or anyone else involved can be sure that those fees are going to be C&R,” says Kelly.

According to Kelly, REVAA plans to address the Louisiana State Legislature in spring 2014 and encourage it to reopen this issue. REVAA plans to continue advocating that Louisiana’s State Board lacks the authority to determine C&R fees and is hoping to convince state legislators to reconsider the current language in the AMC regulations.

Going Forward

With REVAA planning to push for revisions to the current AMC legislation, appraisers in Louisiana are preparing to push back and defend their hard-won victory. According to Mier, REVAA and other AMCs have had attorneys at every Board meeting and committee hearing about this issue. “They recently had a committee hearing to discuss whether or not the state has the right to enforce these rules. Attorneys representing the AMCs showed up in full force. But we also had dozens of fee appraisers, home builders, Realtors, and consumers show up to that committee hearing and we filled the room! They decided not to go ahead with the meeting because there was such a large representation of people against their position,” says Mier.

Mier says that the argument coming from the AMC industry is that fees should all be market based. This argument only works based on the presumption that there is a fair playing field, he adds. “There isn’t a fair playing field because there are major banks that own some of the AMCs. They’re charging the consumer what would be a C&R fee for an appraisal and then telling the appraiser ‘this is going to be your fee, take it or leave it,’ so the appraiser takes the fee under duress, afraid they won’t get any more work if they don’t accept the fee,” says Mier.

In response to the position of many AMCs who believe that state boards don’t have the right to enforce federal rules, Mier believes that this is what the Federal government intends. “Our state board is simply trying to follow federal law,” Mier says. “I think that’s what the Feds intend. They want states to take it into their own hands. What the state has done, with the help of the Appraisal Institute, is to help all of us stand up on the same platform, voice our concerns and put some things in force. REVAA says states don’t have any right to do that. Well then, who is going to do it?”

Unangst rebuts REVAA’s position that the Board lacks authority to enforce the new rules. “We have absolute confidence that we are legally within our power under Dodd-Frank to do what we are doing. Dodd-Frank mandates that states license and regulate AMCs. The opposing viewpoint is that C&R fee provisions under TILA must be enforced by federal regulators. However, we are not enforcing or trying to enforce TILA or federal law. We are enforcing our own state law,” says Unangst.

According to Mier, the fight taking place in Louisiana offers a lesson for appraisers across the country. “Appraisers need to look up from their monitors for a moment and pay attention to what’s happening in their industry and become active in protecting the consumer. First and foremost, we are protecting consumers on the biggest investment of their lives. By doing that, we need to pay attention to what’s happening in our industry and be prepared to voice our opinion as one group wherever you’re located. We can make a difference, but we have to step back from our monitors, talk to our peers and get involved in our industry,” says Mier.

When asked what advice he can offer to appraisers in other states who want to enact similar legislation, Mier says that appraisers should start by reaching out to others in their industry. “The first discussion that needs to happen is with your partners in your industry, Realtors, home builders and bankers. They are having the same problems and issues as appraisers, they want to be in compliance, they want to help the consumer purchase their home, they want to help the Realtor sell the house, the builder build the house, and the banker make the loan. It takes all four of these parties to voice their opinion and desire to change what’s going on in this industry,” Mier says.

Mier also urges appraisers to join an industry association. “Join somebody who’s out there doing something for you. It costs less than a dollar a day to join most appraiser organizations. If you don’t have the time to be at meetings trying to make our industry a place that protects quality working conditions and compliance on your behalf,” argues Mier.

Mier says that he is sure that the new regulations are going to be challenged by REVAA and other AMCs. “We are prepared for that and we are ready to address those items when presented. They are going to have to introduce a substantial reason why this should be changed or repealed, and that is going to be difficult to do as the state is just following federal law.”

About the Author

Isaac Peck is the Associate Editor of Working RE Magazine and Marketing Coordinator at OREP.org, a leading provider of E&O Insurance for appraisers, inspectors, and other real estate professionals in 49 states. He received his Bachelors in Business Management at San Diego State University. He can be contacted at Isaac@orep.org or (888) 347-5273.

*To Read the Louisiana Regulations in entirety, click here.

We’re always listening: Send your story submission/idea to the Editor: dbrauner@orep.org.