|

“One of the best courses that I have had in 17 years!” -Amy H

> OREP E&O |

Editor’s Note: Share your experience with trainees in Working RE’s Survey for Trainee Supervisors and help the entire industry. Take the four-minute survey now.

Appraisal Discrimination Claims on the Rise

by Isaac Peck, Editor

If you’ve been paying even passing attention to local, national or appraiser specific news, you know that the issue of discrimination and race in the real estate industry at large—and in the appraisal profession specifically—is all the rage.

Appraisers are facing a barrage of regulatory, legislative, and civil challenges and threats. Several states have already passed legislation addressing fair housing and discrimination in valuations and mandated anti-discrimination education for appraisers. California has even gone so far as to set up a unique complaint form for members of a “protected class” who believe their appraisal came in “below market value”—effectively streamlining the filing of state board complaints alleging discrimination of any kind. Other states, as well as the U.S. Congress, are still considering legislation that addresses discrimination in appraisals through a variety of means.

However, the emerging threat that looms largest for appraisers on this issue is the filing of “Housing Discrimination Complaints” with the U.S. Department of Housing and Urban Development (HUD).

Dozens of HUD discrimination complaints have already been filed against appraisers and such cases are expected to increase in the coming months.

Here’s an inside look at what’s involved in a HUD discrimination complaint and what appraisers are up against.

HUD Complaints Galore

HUD is the federal agency that handles discrimination complaints. HUD’s Office of Fair Housing and Equal Opportunity (FHEO) is responsible for enforcing fair housing law and “works to eliminate housing discrimination,” according to HUD’s website.

Consequently, HUD is the federal agency that the consumer public is turning to when suspecting discrimination in their appraisals. The incidents involving appraisers allegedly discriminating against Black homeowners that have made local and national news have, in many cases, included a HUD complaint being filed against the appraiser.

For example, a recent national story involving Cora Robinson, a Black homeowner who tried to refinance and received an appraisal allegedly $400,000 too “low,” saw Robinson file a HUD complaint shortly afterwards. Robinson worked with the Fair Housing Advocates of Northern California (FHANC) to file multiple HUD complaints. “I really hope that this complaint makes appraisers and lenders start to look more carefully at their practices and policies,” said Ms. Robinson.

And so, when an appraiser comes in low, more and more BIPOC homeowners are filing complaints with HUD. Each HUD letter starts the same: We have received a formal complaint alleging that you have engaged in one or more discriminatory housing practices under the Federal Fair housing Law, 42 U.S. C. Sections 3601-3619. We are required by statute to send you a copy of the complaint.

(story continues below)

(story continues)

The appraiser is then given a copy of the original complaint that alleges discrimination, and the appraiser is required to reply to the complaint as well as send in a variety of documentation.

Craig Capilla, Partner at Franklin, Greenswag, Channon & Capilla, LLC, says that he has seen the requests for information from HUD vary widely. “In some cases, HUD will request three or four other reports that you did in the same neighborhood. Or they might request every report you’ve done in that neighborhood in the last 18 months. There is no set standard they are using. They are clearly casting a wide net and looking well beyond just the appraisal in question. Presumably what they’re looking for is a pattern of activity. If the appraiser says they always do X, Y, and Z, HUD may want to see if that’s always the case,” says Capilla.

Capilla is actively defending several appraisers who are facing HUD complaints. Because of his extensive experience defending appraisers in civil and regulatory matters, Capilla is on the roster of experienced lawyers that represents those insured with OREP’s primary carrier.

After submitting all documentation that HUD requests, the next step is that HUD will interview both the complainant and the appraiser. “A lot of the complainants aren’t particularly sophisticated in valuation and it is up to the investigator to ask questions, find out what happened and why they felt there was discrimination, etc. Then they will interview the appraiser: tell me your process, what did you do, why did you do it this way. Why did you find comparable sales in this neighborhood and not in that neighborhood?,” reports Capilla.

Following the interviews will come a request for even more documents.

Conciliation

All throughout the “discovery” phase of HUD’s complaint process, Capilla says the HUD investigator is simultaneously encouraging “conciliation” to both the appraiser and the complainant. These are basically settlement agreements, according to Capilla. “The HUD discrimination claim handbook stresses that the investigator should hold a dual role and convey conciliation talks between the parties. So far we have seen HUD conciliation requests for hundreds of thousands of dollars,” says Capilla.

The problem is that even if the conciliation request is reasonable, or even minimal, HUD’s settlement agreements are public in the vast majority of cases. “Whether it’s one dollar or one million dollars, whatever that monetary component is will be reduced to a written template for conciliation unless both parties and HUD agree to make it confidential. On top of that, HUD will almost always request or mandate that some sort of educational remediation will take place. Combined, this makes settling very challenging as appraisers are not going to want to have a public settlement agreement out there that references discrimination,” says Capilla.

Another option is to resolve things with the complainant via private settlement outside of the HUD process. If the appraiser settles with the complainant privately and they withdraw their complaint with HUD, then HUD will not pursue it further and the matter will be resolved.

Headed for Lawsuits

The bad news is that HUD’s entire investigation process is (arguably) designed to end in a lawsuit. HUD’s unique position as an enforcer of fair housing laws means that it has the legal authority to sue the appraiser itself, refer the case to the Department of Justice (DOJ), or authorize the complainant to sue the appraiser themselves (essentially creating a private right of action).

(story continues below)

(story continues)

Capilla explains that if the parties are unable to reach a resolution in conciliation during the investigatory process, HUD will conclude the investigation and write up its findings. “HUD will provide a narrative from the investigator that outlines who the investigator spoke to, what documents the investigator reviewed, and based on the facts whether the investigator believes the claim of discrimination IS or IS NOT substantiated,” reports Capilla.

If the investigator decides that there was discrimination, HUD will pick up the claim and call the appraiser into an administrative hearing to stand trial, in a sense. However, there is also a civil process available to appraisers at this point. If the parties decide they want to go the civil route, the case goes from HUD over to the DOJ and the DOJ can file a claim in federal court.

Likewise, if the appraiser doesn’t think they’re going to get a fair shake in front of a HUD hearing officer, the appraiser can take it to court.

“While not all HUD complaints will move forward, the most likely scenario for those discrimination claims that do move forward is that they are going to end in federal lawsuits,” says Capilla.

First Lawsuit Filed

On Dec. 2nd, 2021, in the U.S. District Court of Northern California, one of the first discrimination lawsuits was filed against an appraiser. Plaintiffs Tenisha Tate-Austin, Paul Austin, and the Fair Housing Advocates of Northern California (mentioned earlier in this story) filed a lawsuit against Jannette Miller, a white appraiser, and her appraisal firm, Miller and Perotti Real Estate Appraisals, Inc.

The lawsuit alleges that Miller undervalued the Austin’s home by nearly $500,000, that race was a motivating factor in her appraisal, and that she committed multiple violations of the Fair Housing Act.

The lawsuit also names AMC Links, LLC, the AMC responsible for placing the appraisal order with Miller, since California law requires an AMC to “review the work of all…appraisers with whom it contracts to ensure that appraisal services are performed in accordance with [USPAP].”

Among the claims that the lawsuit makes is that the use of the sales comparison approach, and Miller’s use of comparables that are restricted to Marin City, the city where the property was located, is evidence of racial bias. The lawsuit cites this fact as evidence that Miller “believes that Marin City’s demographics make it so much less ‘desirable’ than surrounding areas” and argues that the use of comps strictly in Marin City “perpetuates the effects of discriminatory appraisal practices.”

The lawsuit quickly attracted national attention with dozens of news outlets picking up the story. Miller is being scrutinized as well, with Newsweek running a story titled “Who is Janette Miller? Appraiser Sued by Black Couple Who Accuse Her of Lowballing Them.” The Yelp page of Miller’s appraisal firm has also been frozen by Yelp because of an onslaught of negative reviews by members of the public accusing Miller of being a racist appraiser. As the first actual lawsuit of its kind, all industry stakeholders will no doubt be watching it closely. (Be sure you are subscribed at WorkingRE.com to follow this rapidly developing story!)

Appraisers’ Best Defense

Given the nature of how these complaints are materializing, there is obviously no one size fits all way for appraisers to avoid trouble on this front.

In fact, in a presentation at the Appraisal Summit in November 2021, Dr. Sam Henderson, NAA reported that his son is a Black appraiser in TX and he received a complaint from a Black homeowner for, you guessed it, racial discrimination.

So for appraisers, it really comes down to being proactive and producing quality work. “The best protection appraisers can offer themselves is the strength of their workfile. The more you can document, the better. List all the different sales you looked at, exactly why you selected the ones you did, why you made the adjustments you did, how the market drove your conclusions, and provide as much detail as possible in your workfile,” recommends Capilla.

In addition to the workfile, the appraiser should also include full explanations in the body of their report. “I hate to heap more work on the appraiser but another thing they can do is explain more thoroughly in the body of the report. This is my sales comparison approach, I viewed X type properties with Y characteristics. Because XYZ, I adjusted for this and here is how I arrived at that adjustment. This is how I arrived at those conclusions. At the end of the day, you can’t stop someone from asking questions or filing a complaint, the way out of that is to have a defensible appraisal and a robust workfile that shows what you did and why you did it,” advises Capilla.

Insurance Exclusion?

The bad news for appraisers is that when it comes to professional liability (E&O) insurance for most professions, the majority of policies come with an exclusion for discrimination related issues. Just like you would expect to find a fraud exclusion on your policy, exclusions for discrimination are incredibly common across many different professions, including the appraisal profession.

For example, here is an exclusion found in the policy of one of OREP’s competitors:

Discrimination of any kind by the Named Insured, including but not limited to discrimination due to or on the basis of age, sex, race, color, religion, disability, marital status, pregnancy, national origin, HIV or AIDS status, sexual origin, sexual orientation, or sexual preference;

In other words, most appraiser policies have exclusions for discrimination. This is bad news for appraisers.

However, the good news is that OREP has been closely monitoring this issue and proactively worked with its primary carrier to address it. OREP’s primary appraiser E&O policy, for example, now includes $100,000 in coverage for any claim brought against appraisers alleging discrimination.

Here is the wording straight from OREP’s policy:

The Company will pay, as part of the applicable Limit of Liability, up to $100,000 to the Named Insured for Damages and Claims Expenses as a result of all Claims…for discrimination on the basis of race, creed, color, age, gender, national origin, religion, disability, marital status or sexual preference, including resulting Personal Injury.

Including $100,000 of coverage for discrimination claims makes OREP’s primary policy uniquely positioned to keep appraisers protected in today’s litigious climate. Not every OREP policy includes the coverage, so please ask your agent to ensure the coverage is included. (Visit OREP.org/appraisers to learn more)

Increasing Liability

The bad news is these types of claims and complaints against appraisers are likely going to get worse. “My overall sense is that it’s going to get worse before it gets better. Everyone is talking about discrimination. Every major publication is talking about it. The more people find out this is going on, the more people with frustrated expectations think this might be what happened to them, that begets another claim or complaint, and so on. I don’t think it’ll be receding anytime soon. There are going to be consumers who are genuinely concerned they’ve fallen victim to these bad acts—whether justified or not,” says Capilla.

For now all appraisers can do is produce the very best appraisal report, develop a detailed and highly defensible workfile, and make sure they have a policy that offers a minimum of $100,000 of coverage for discrimination coverage. (Shop OREP.org today to make you’re covered for discrimination claims.) Stay safe out there!

About the Author

Isaac Peck is the Editor of Working RE magazine and the President of OREP, a leading provider of E&O insurance for real estate professionals. OREP serves over 10,000 appraisers with comprehensive E&O coverage, competitive rates, and 14 hours of free CE for OREP Members (CE not approved in IL, MN, GA). Visit www.OREP.org to learn more. Reach Isaac at isaac@orep.org or (888) 347-5273. CA License #4116465.

Tips for Smoother Appraising

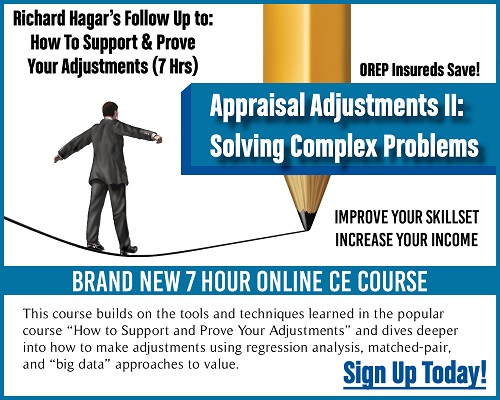

CE Online – 7 Hours (45 states)

How to Support and Prove Your Adjustments

Presented by: Richard Hagar, SRA

Must-know business practices for all appraisers working today. Ensure proper support for your adjustments. Making defensible adjustments is the first step in becoming a “Tier One” appraiser, who earns more, enjoys the best assignments and suffers fewer snags and callbacks. Up your game, avoid time-consuming callbacks and earn approved CE today!

Sign Up Now! $119 (7 Hrs)

OREP Members: Save 10%

>Opt-In to Working RE Newsletters

>Shop Appraiser Insurance

>Shop Real Estate Agent

Insurance

Send your story submission/idea to the Editor:

isaac@orep.org