|

>> See Past News Editions >> Click to Print Protect your license and your livelihood with the Expert’s Guide by Tim Andersen, MAI. Click now 2015 AMC Guide |

What if it Can’t be Supported?

Your Value as a Local Expert

by Rachel Massey, SRA and Tim Andersen, MAI

It is often said that appraisal is part art, part science. So what does that mean to you in today’s business climate?

The science part is the adjustment process. This somewhat mirrors the scientific method, which proposes a hypothesis and then tests that hypothesis, so that others may try to either prove or disprove it. This process strengthens the proposed method or weakens it. There seems to be very little that cannot be disproved because appraisal is not a hard science but a combination of science and human judgment (much like economics or anthropology). What works at one time and in one place, may not work in another time or another place.

Because there is not one single method that we use for extraction of an adjustment that cannot be disproven under certain circumstances, it is best to use more than one method to support an adjustment if at all possible. Not all adjustments in the appraisal process can be quantified to the nth degree. Some of them will not be easily quantifiable at all and the best we can offer is a large group of data, as in regression, through grouped data analysis or even through independent market surveys.

Art and Science

We see an increasing clamor about “proving” market adjustments. Appraisal management companies (AMCs) are losing panel appraisers over the need to prove every adjustment. This is a hot-button issue. When an adjustment can be “proven” without human analysis and judgment, the art part of appraisal no longer exists and appraising becomes the work of computers. There is a lot of judgment that, supported by local expertise, comes into play to tie up the analysis. A computer will never be able to put judgment into the equation about multiple elements that drive market value in real property in all or even in most circumstances.

A computer is not able to accurately judge the typical buyer’s reaction to a house that has numerous functional and external issues. Judgment is very real in this instance and although a computer algorithm may be able to isolate various adjustments individually, the presence of many different variables will likely throw off the answer. Judgment backed with logic and reason from an appraiser with good familiarity of the market and with what drives buyers, is the best one can hope for. Of course, the appraiser would always attempt to quantify the adjustments first, but in the end, it is a judgment call based on the logic of the support.

Take for example grouped data (or grouped paired analysis) for a garage in a certain market. The subject does not have a garage while all of the sales do, and it would be imprudent to make an across-the-board adjustment without offering support for this adjustment. The grouped data analysis indicates that a garage, in this particular area and age/size range, is valued in the market at about $21,000 for a one car garage, or $22,000-$23,000 for a two-car garage. The thing is, to build a 400 sq. ft. garage in this market costs around $15,000, so penalizing the subject for more than the cost of a new garage, is likely absurd (unless the market is oversupplied, which is addressed later). If it is possible to measure that a typical property in this particular market is around 20 percent depreciated, by doing depreciated cost studies, then that figure can be reasonably applied to the garage. Both of these methods are just that, methods. They both offer support, but in the end, it is the judgment of the local appraisal expert to reconcile what the effect of not having a garage in this market is. This is the human judgment factor and anyone working with regression will see that sometimes the indicated adjustment just does not make sense.

(story continues below)

(story continues)

The grouped data shows that one should adjust for garages between $21,000 and $23,000 but since cost indicates that it would be no more than $15,000 to build, it makes sense to test both of these adjustments in the analysis with other items already extracted from the market. Further reconciliation will either show that the adjustment is in the right direction or disprove it entirely. Say you render a $21,000 adjustment for the sales with the one-car garages- do the adjusted sales price ranges widen or do they narrow? If they narrow, then we might be on to something. If they widen, then something is not adequately analyzed. Next, try the depreciated value of a garage. Does it widen the adjusted range or does it narrow it? This widening and narrowing is commonly known as “sensitivity” and is what appraisers intuitively do when they are analyzing adjustments within the sales comparison approach.

Do you notice what just happened? Three different methods for supporting adjustments were applied, but in the end, the appraiser simply uses their best judgment to determine what that adjustment will be. This is using support for what ultimately is a judgment call. If the market is slow and oversupplied, the best answer might well be the grouped analysis but in a market that is undersupplied and active, the lower adjustment may be the most appropriate.

In addition to what we find that is actually reasonably quantifiable, there is also the issue of what is not quantifiable. What happens, for instance, if this house without a garage is in a market that expects one and not only does it lack a garage but the house also has only one bathroom where two are expected, and has only two bedrooms when three are common. To top all of these issues off, the house backs up to a busy expressway. How can we quantify each of these and then expect the overall adjustments to equate to a good supportable answer? If each of the quantifiable adjustments are made it may even show on paper that there is practically no value to the house, when in fact, that could not be further from the truth.

The market in which the appraisal is functioning also has a significant effect on what type of adjustments to make and simply taking rote information that is extracted from the market, without explaining the requisite logic, will likely become a point of debate. In markets where there is an oversupply of inventory and buyers have many options, that two-bedroom house, without a garage, backing to a freeway, may not sell or the price may be penalized significantly. If there is no inventory, that same house may have multiple potential buyers and the deficiencies may well be overlooked due to the issue of scarcity. How can you use the same factors in an undersupplied versus oversupplied market, even if you can support the analysis with good sound data from multiple directions? This is where judgment is applied and adjustments can and sometimes do change.

(story continues below)

(story continues)

Supporting Conclusions

Here is another route to supporting your conclusions. Consider the value of the property backing up to the expressway. We conducted market studies in the past related to locations bordering the highway and have extracted adjustments that ranged the gamut from five to over 20 percent. Right now, however, the market is smoking hot where the property is located and because the subject is a starter home (less expensive than many) and in a rural market, there is very little to go by. The way around this, because support is needed, is to do a market survey through an online form. We asked what people thought the effect on value the property would suffer from backing up to the highway. The participants were able to write on the survey so that varying opinions as to the marketability and value could be expressed. This was first opened to Realtors in the market, then to appraisers throughout the U.S. and ultimately to anyone who wanted to participate.

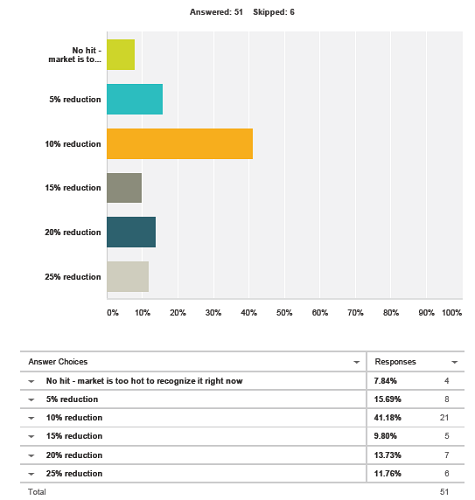

The goal was 100 responses but we did not get that many. Nevertheless we did have an adequate sample of responses with which we could then combine our judgment, based on the current market, to extract an adjustment. With 51 responses, the market was pretty decisively leaning towards a 10 percent reduction in value for a property backing to the expressway but more participants leaned to 15 percent and greater (18 total) than less than 10 percent (12 total). Anything between the five-20 percent range of reduction would have been supported based on this data. In the end, the majority indicated that a 10 percent reduction is most likely based on the data available, plus one sale that backed up to the same highway in the same market. This is support backed up with logic but it is not irrefutable proof.

What is Support

What is support, how much support is needed and can you actually prove anything- are all valid questions. Does the support have to be recognized by the Appraiser Qualifications Board or can it be recognized through older recognized texts? Do you need to support an adjustment through only one source, two, three or more? Is one method better than the others or should you have a wide range of tools in your toolbox that you can pull out to use in combination or as a standalone?

Not every feature in the appraised property needs this same level of analysis. Some adjustments may not be quantifiable but the local expert knows that the market prefers the feature. An example is landscaping. In most markets, a well landscaped yard will help a property sell quicker than one that is minimally landscaped but try to extract that adjustment! Reconciliation works well in this instance, and the sale with the well landscaped yard may sell at a premium over others but there is often the interior upkeep that ties in with the exterior upkeep. If the subject has similar good quality and condition landscaping, it can be reconciled towards the top, related to this sale. Conversely, if the subject lacks any upkeep and landscaping, the value could be reconciled towards the sale that also lacks the landscaping.

Nowhere is it written that you have to unequivocally “prove” your adjustments. Maybe in a court of law, with a crack team of lawyers, there will be the need to “prove” them but, then again, almost anything that is proven can be disproven. To be safe, any support is better than no support and in the end, the appraiser’s logic and judgment based on their intimate knowledge of the market still are necessary.

August Webinar: Efficiencies & Increasing Your Business Bottom Line

Presented By: Dustin Harris, The Appraiser Coach

Part 1: August 11th, 10:00 – 11:30 a.m. PST

Part 2: August 18th, 10:00 – 11:30 a.m. PST

“The seminar was very helpful and encouraging in time-saving mobile applications! Thank you for making it available!” – James W.

Are you still hung up on old ways of doing business? Have you adopted the latest technology to help you be more efficient and get more done? Today’s appraisal industry is rapidly changing. With increasing demand on appraisers’ time and attention, it’s more important than ever for appraisers to have the tools, systems, and knowledge they need to leverage technology and run an effective, efficient appraisal office. Whether you’re new to appraising with mobile tools, or you’re looking to sharpen your skills, this webinar gives you actionable steps that you can take today to be more efficient and effective with mobile tools and run your business like a pro. Sign Up Now!

On-Demand Webinars

Did you miss the acclaimed How to Support and Prove Your Adjustments webinar by Richard Hagar, SRA? Expand your knowledge and learn quick and simple methods for proving adjustments that improve the quality of your reports and help you avoid problems, blacklisting and legal actions. Sign Up Now!

Save with a Season Ticket!

Increase your value as an appraiser with all six webinars from our Summer Series, including How to Support and Prove Your Adjustments. Enjoy these on demand webinars at your leisure!.

Regular Price: $237 Season Ticket: $149 (six webinars)

>Click to Print

>New: Collateral Underwriter Blog: Find answers, offer solutions.

>Opt-In to Working RE Newsletters

Send your story submission/idea to the Editor: dbrauner@orep.org

by Ed Riley

Great job Rachel keep up the good work.

-by Alan Hummel, SRA

Rachel & Tim,

With attributions, I have forwarded the article to every single one of our staff appraisers. Thank you for a well written “this is the way it really works on the street” type of article. Bottom line – you have successfully reinforced that adjustments are based on more than “my experience”; statistical analysis is a great tool, but common sense cannot be overlooked; and, an adjustment is still an opinion (based on supportive facts). When is Chapter 2 coming?!?

-by Rachel Massey

Thanks Alan!

We are very glad you found this useful. Everything we are doing is simple practical application of what we learned in basic appraisal principles and procedures type classes, just with a real-world spin. We hope it helps, and it is great to hear when people find it beneficial.

Thank you for sharing with your staff, and of course, stay tuned here for more of our little ditties.

-by Timothy C. Andersen

Hi, Allan!

That’s for the note! Do you have any suggestions for Chapter Two?

Thanks! My best to You and Yours!

TIM

-by Tom Mc Sherry

Rachel, we have been friends and colleagues for over a decade, so you know I don’t tend to read online articles (let alone comment)…I like all my ” fluff” in a goose down pillow where it belongs. But, your writing is coherent and well reasoned, and your common sense, expertise, and hard work are prominently evident within it. Kudos for that and for the effort to help out your fellow appraisers. I found the article useful and, in addition to everything else, I think I have just become a fan.

-by Rachel Massey

What, you weren’t a fan before? ;)

Thanks Tom, in all seriousness. I think it is tremendously important for appraisers to help each other. None of us come out of the womb knowing how to appraise, and as long as we are alive, we are still learning, myself included. Thanks for your kind words, and for your long friendship and support.

-by Mike Ford, CA AG, SCREA, AGA, GAA, RAA

I really wanted to disagree with you over the lower cost garage and depreciation adjustments comments versus market indications, but the rest of your article just make so much sense, I can’t bring myself to quibble over variable / subjective minor points. Nicely done, and THANK YOU BOTH for taking the time to help your fellow appraisers.

-by Rachel Massey

Thanks Mike, go ahead and quibble. I think arguments can make us stronger and if there are weaknesses then I am all about trying to address them. Thank you for your kind words. We are trying to bring common sense approaches to the general residential appraisal audience just as a means of opening a dialogue, and hopefully thoughtful analysis.

-by Timothy C. Andersen

Hi Mike,

All that stuff in the article about the garage adjustments is purposefully vague. The point Rachel and I wanted to make was that of working with the data you have which, as you know, is not very much sometimes. In this example, the “contributory” value of the garage is more than the depreciated cost of the garage. Neither is “right” since both come from market-supported sources. The point here is that we get whatever support we can from as many market indicators as we can then, is the market is not speaking clearly to us, we make a judgment call based on the support we have, then we move on. USPAP/CU do not ask for “proof”; they ask for support. With this article, we hoped to show how to support such an adjustment when the market was not all that supportive of an adjustment. Thanks for your comments! My best to you and yours! TIM

-by Dale Leitzke

Its interesting that the article is labeled as Your Value as Local Expert. Most AMC’s scoff at the idea of any locational competency. We are commodity, and everyone from any location must therefore be equally competent so long as we meet the client specific requirements. Rachel & Tim’s article is one of the best articles that I have ever read on making adjustments. First gather the best available support and then use the necessary amount of appraiser judgment. Way to go guys. Dale Leitzke

-by Rachel Massey

Thanks Dale! Judgement is critical. We take what we can and then synthesize it into something that makes sense. Computers can do a lot of modeling, but they cannot replicate the human factor, in particular when it comes to many different nuances. That and the market is constantly changing. Thanks for writing in.

-