|

“One of the best courses that I have had in 17 years!” -Amy H.

|

Editor’s Note: The current edition of Working RE is in the mail. OREP E&O insureds enjoy it free!

Changing Markets

By Rachel Massey, SRA

It is easy to miss the market. Sometimes subtle changes are occurring and it is too early to pick up on a trend. Or there is conflicting information indicating both an increasing and a declining market at the same time, depending on the market segment.

If appraisers had crystal balls into the future, we would be doing something other than appraising. The money would be in predictions, not in measuring the current market. We are expected to be in touch with the market however, but basing our opinions on past, closed transactions is not necessarily the current market. This is one reason analyzing current offerings, pending sales, expired and withdrawn listings, and listening to the chatter of those involved in real estate sales is important.

Between 2007 and 2010 much of the nation experienced significant declines in real property values. Some appraisals that were developed and communicated in that period indicated the market was stable, even with evidence to the contrary. Appraisers were reluctant to mark the declining trends box on the form reports, due to very real concerns of losing lender business by doing so. The 1004MC form, that became mandatory after April 1, 2009, came to being in large part as a way to help ensure that appraisers analyzed the market. Like it or not, this provided structure and direction to lead the appraiser to look at what was happening in the market, at the time of the appraisal. Although many appraisers state this form is woefully inadequate, few supplement it with additional information supporting their market trends decision. This is the thesis of this short article; to be aware of other elements to observe in addition to the MC document, as well as what to watch for as the market starts to change. Because change is inevitable.

Ten years after the market decline, large parts of the country are experiencing significant increases in real property values. Some markets have surpassed the previous highs, and many appraisers are concerned about a repeat cycle reminiscent of the 2007-2010 market. How do we as appraisers, protect ourselves against being accused of incorrectly measuring what market conditions are? How can we analyze what factors are driving the market, and what should we be aware of as possible bellwether indicators of a changing market?

Although not exhaustive, below is a list of some of what is driving an increasing market in many of our individual areas.

- Low inventory

- Low rates

- Few builder specs

- Builder entry prices (due to labor shortages and increasing costs)

- Owners converting housing to rentals

- Taxes making moves difficult (resetting to higher assessments)

- Need to sell to buy and lack of opportunity to do so – making downsizing difficult

- Owners holding on to their residence due to no desire to change circumstances

- Fear of rising rates causing panic buying

- Optimism that prices will continue to increase

(story continues below)

(story continues)

Being aware of what is driving the market is a good first step to being aware of what could ultimately change the market. Each of the points above can cumulatively or individually result in a change to market conditions. In addition, the following factors should be watched.

- Incomes not keeping pace with price increases

- Increased inventory

- Rising rates

- First time buyers priced out of market deciding to opt out

- Property taxes exceeding allowable write-off

Ways to check what is happening

- Contract to listing ratios

- Expired and withdrawn listings

- Days on market

- Price reductions or increases

- Listing prices lower than comparable sale prices

- Widening gap between list and sales prices

- Comments in listings “bring offers” “priced below recent appraisal”

- Agent interviews – agent chatter

- Falling rental prices

- Incomes not keeping pace with price increases

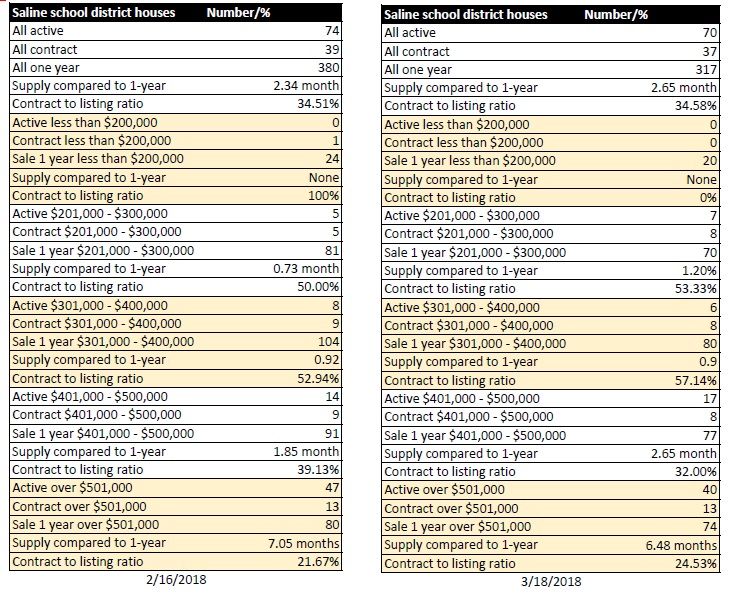

- Increasing relocation assignments

Contract-to-listing ratios are a concept that agents use, but most appraisers do not seem attuned to. It is simply taking a pool of competitive properties into consideration, and looking at the percentage of the listings on the market at that time that are under contract. If the determination is that the competitive market for the subject property is a 1,000 – 1,500 sqft ranch house built between 1940 and 1960 in such and such an area, the appraiser may find there are 100 listings on the market, but of those 100 listings, 40 are under contract. That is a 40% contract to listing ratio, and indicates the market is strong and houses are absorbing into the market. If on the other hand, there are 100 listings but only ten are under contract, that is a 10% contract to listing ratio and is weak, showing the market is not strong. This can be used to measure whether the market is favoring buyers, sellers, or is generally balanced. Through keeping track of this type of information in various market segments over time, it can be used to predict near-term changes in the market. For example, price pressure may show all the listings 20% higher than the sales, but if very few are under contract, it is unlikely there is going to be a jump in prices, but if most are under contract in spite of the spike in prices, it is likely they will close higher and it affords a chance to be left behind. Take for example, this sample that I ran (by price, not by market segment for the simplicity of this article) for my market on 2/16/18 and run again on 3/18/18 for comparison, to see what areas in the market were experiencing the greatest pressures:

Overall the market shows extremely tight, with less than 2.75 months’ worth of inventory as a whole in the entire school district, and by price, in the same realm through to the $500,000 price range. Over that, there is more inventory and a much lower contract to listing ratio, at 24.53% compared to 32% for just a bit lower priced, between $401,000 and $500,000, and even greater at 57.14% in the $301,000 – $400,000 range. How does this type of information help inform the reader of the current market? It simply shows what inventory is like as well as how active the market is. It doesn’t show price increases if they are occurring, but it is pretty unlikely that a market with 50% of the houses on the market under contract is going to be either stable or declining. If your opinion of value on the property was $190,000, there would be no active competition as of this date and it would be a good bet that the house would be in high demand. Conversely, if your opinion of value was $650,000, there would be much more competition and the expectation would be a longer marketing period. In addition to how the subject of the appraisal might be positioned, keeping track of ratios over time can be useful in noticing a trend before it becomes well known in the market, realizing that figures could vary in a day. In the example above however, the trends appeared similar, showing the highest levels of activity in this market in the $201,000 – $400,000 range, with no inventory under $200,000.

When markets are tight and increasing, it is just as important to discuss the market and any changes that are evident, as it is when the market is declining. Ignoring an increasing market is just as incorrect as ignoring a declining market. Stating that one only adjusts downward for declining markets, but not upward for increasing markets is an incorrect procedure. Document the changes and include what you can in the report.

Document, document, document, as silly as it may seem, using Trulia, Realtor.com and other online tools can help you with keeping a record of trending information on top of what you present in your report. Realtors Property Resource has a tool which provides trending analysis for the property under consideration, the zip code and the county. Realist also provides for price trends, as do Trulia, Realtor.com, Movoto and other sources. Although these data sources provide broader market data, simply having the information you pulled related to trends in the market, in your workfile, is helpful in the event someone comes back years later saying you should have marked declining on the report when all indications were that the market was stable to increasing at the time you completed the assignment.

Markets can change overnight. For those of us appraising in 2001, we can remember how the world stood still on 9/11, and how it took a month or two for the country to breathe again and get back to doing business. Significant market changes can happen quickly, and we have to be able to be aware of what is going on in our market, even with these events. Agents who are active in the market will be in a perfect position to talk with us about what they are seeing as well. It is a good idea to build trusting relationships with agents, who will share their concerns as well, even if it is “off record”. These relationships do matter.

If the market in your area begins to decline, do not be afraid to report what you see – even if the short-term repercussion is decreased work from such and such lender. The long-term benefit of being truthful is more important. Appraisers must work with integrity and not be afraid of losing business for doing the right thing.

“I have recently completed the best appraisal class of my 30 year career (How to Support and Prove Your Adjustments through OREP.) ” -Susan D.

Continuing Education: How To Support and Prove Your Adjustments

Presented by: Richard Hagar, SRA (7 Hrs. Online CE)

“One of the best courses that I have had in 17 years!” -Amy H.

Must-know business practices for all appraisers working today. Ensure proper support for your adjustments. Making defensible adjustments is the first step in becoming a “Tier One” appraiser, who earns more, enjoys the best assignments and suffers fewer snags and callbacks. Up your game, avoid time-consuming callbacks and earn approved CE today!

Sign Up Now! $119 (7 Hrs)

OREP Insured’s Price: $99

About the Author

Rachel Massey, SRA, AI-RRS, is an AQB Certified USPAP instructor and has been appraising full-time since 1989. She is a Certified Residential Appraiser in Michigan, specializing in review work for various clients, as well as lake properties and other residential properties in and around the Washtenaw County market.

Send your story submission/idea to the Editor: isaac@orep.org

by Hans G. Schaetzke II

Great article Rachel, I appreciate the discussion of things to watch as reasons for change in markets. Once you recognize a change you need to be able to explain why.

I have been actively making TIME adjustments since 2009 because I DO offer alternatives to the 1004MC. I perform a year over year analysis of ALL sales (SFR, Condo, or 2-4) in the same school district by quarter. Q1 2016 median verses Q1 2017 median, Q2 2016 vs Q2 2017, Q3 2016 vs Q3 2017, Q4 2016 vs Q4 2017. These measurements track annual change so I then reduce them to monthly. Breaking it up this way solves for seasonal market factors. I am left with 4 monthly figures (percentage figures for amount of change during those periods). Most of the time I then average those 4 numbers to arrive at an estimated rate of change per month in the market. BOOM!

If there is something showing up in these figures that sticks out like a sour thumb I address it but most of the time I find a very obvious trend. I apply time adjustments when there is a change of 5% or more annually using the final estimated figure.

I always profile Active/Pending Listing comps in my reports to test the validity of the time adjustments (a sort of bracketing because list comps are not adjusted for Time since they are current). I arrive at very consistent and well supported time adjustments that are incontrovertible – no crystal ball, no argument from underwriters or reviewers or even mortgage brokers. No ambiguous line graphs, no contradictory indications because, I use a statistically significant data sample of complementary data – not just the comps. Time effects everything the same because it is the measure of the 4 forces affecting real estate. If there is something extraordinary affecting my market segment (comps) then I address that thing but most of the time there isn’t. But change is always happening.

And I land great clients who trust me. I would love to share this method with anyone who wants to know how to adjust for time and be right every time. Or, you could just re-read that short description I just gave. It’s simple, it’s elegant, and it is a very big deal. Please reply with your opinion on my process for measuring TIME.

-by Rachel Massey

Hello Hans,

I replied to your message earlier but it disappeared. I’d love to see your example because I am visual. It sounds interesting, and if it works for you, I would imagine it is a good process. Sorry, just a bit fuzzy about exactly what it looks like, but do agree that year to year, month to month, and even the annualized monthly runs make a lot of sense.

Thanks for your message.

-by Mike Ford, AGA, GAA, RAA, Realtor(r)

Another great article by Rachel Massey. Well done. A word of caution though. In changing markets rarely do al or most of the factors noted in the article present themselves as a neat and orderly consistent trend. Just the opposite. When change takes place its often messy.

Recently a Georgia appraiser pointed out rapidly changed, high percentage rate increases in the Atlanta area. To me, the stats recited are classical evidence of at least a current trend change. Whether it is or will be sustainable is not in anyone’s crystal ball yet.

-by Rachel Massey

Hi Mike, thanks for the comments. Yes, in changing markets, there are numerous factors that may, or may not be in play. That is why I wanted to give a list of things to watch for. Not that all will happen, and sometimes they will be contradictory, but to watch. We just want to be thinking about what makes a market and what can make it start to change, and that overall, we need to observe it.

-