|

> True Footage > AMC Resource Guide > OREP E&O |

DOJ vs. Appraiser and Rocket Mortgage

by Isaac Peck, Publisher

As many appraisers are aware, the Department of Housing and Urban Development (HUD) has received nearly 300 discrimination-related complaints filed against appraisers in the last five years.

The majority of these HUD complaints are still currently pending—stuck in investigative limbo. A smaller number of complaints have been dismissed, and an even smaller number have settled quietly for nominal payouts. Some appraisers have seemingly decided that they’d rather settle than deal with the stress of having a HUD complaint hanging over their heads for years and years.

Despite the lack of developments with appraisal-related HUD complaints, on July 15, 2024, the Secretary of HUD issued a formal Charge of Discrimination against an appraiser, as well as the appraisal management company (AMC) and the lender involved in the appraisal. A week later, Francesca Cheroutes (the homeowner who is the alleged victim of racial discrimination), elected to have her claims resolved in a civil action.

As a consequence of that process, on October 21, 2024, the U.S. Department of Justice (DOJ) filed the first lawsuit of its kind—naming an individual appraiser, Maksym Mykhailyna, his appraisal firm, Maverick Appraisal Group, Inc., the AMC, Solidifi U.S. Inc. (Solidifi), as well as the lender in the transaction, Rocket Mortgage, LLC (Rocket). The suit seeks to (1) enjoin all parties from engaging in discrimination on the basis of race or color in real estate transactions, and (2) award monetary damages to Ms. Cheroutes.

The DOJ’s lawsuit is essentially being filed on behalf of Ms. Cheroutes, a process wherein the DOJ stands in and advocates on behalf of an individual victim of discrimination. The first line of the DOJ’s lawsuit states that they are bringing this action to “enforce Title VIII of the Civil Rights Act of 1968…on behalf of Francesca Cheroutes.”

During the Biden administration, the DOJ has shown great interest in getting into the appraisal bias fight. In the well-known Tate-Austin v. Miller case, the Department filed a “Statement of Interest.” The DOJ made a similar filing in a Baltimore case that is still being litigated (Connolly v. Lanham), among others.

HUD’s formal charges, and the DOJ’s lawsuit, represent two important “firsts” for the appraisal profession. Will these efforts survive the incoming Trump administration? That remains to be seen. For now, this case appears to just be getting started. HUD and the DOJ have filed their initial complaints, and Rocket Mortgage has responded by filing its own lawsuit against HUD.

Here are the details of this landmark case so far.

Background

In early January 2021, appraiser Maksym Mykhailyna received an appraisal order for 749-751 Ash Street, Denver, Colorado, a duplex owned by Ms. Cheroutes. Mr. Mykhailyna conducted the property observation with another appraiser whom he was considering hiring.

Cheroutes later alleged that Mykhailyna was generally aloof, that his “facial expressions indicated … he was

not interested in the information provided,” he didn’t take notes when Ms. Cheroutes told him about the $200,000

in property upgrades she had conducted over the last eight years, and he didn’t ask her any questions.

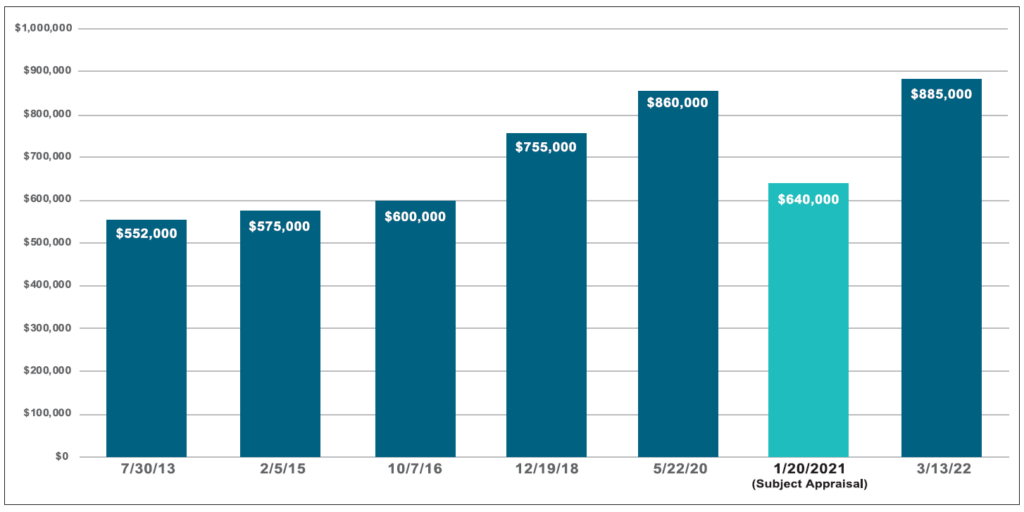

Cheroutes had purchased her property in 2013, and had it appraised six times in the last decade. The DOJ

cites the following history of appraisals Cheroutes has received (See Figure 1: History of Appraised Values for

Cheroutes’ Property).

After Mykhailyna’s appraisal was delivered with a value of $640,000, over $200,000 less than the appraisal she had received roughly eight months prior, Cheroutes was shocked and immediately began contesting the appraisal with Rocket Mortgage and eventually filing a complaint with HUD.

Figure 1: History of Appraised Values for Cheroute’s Property

Click to View Enlarged Image

Discrimination Allegations

The DOJ dedicates roughly 15 pages of its 47–page complaint to attacking the appraisal itself and detailing what it describes as “a series of intentional choices and suspect errors” that Mykhailyna made. Those choices and errors signaled” that Mykhailyna’s view of the subject property was “affected by the race of its owner,” writes the DOJ.

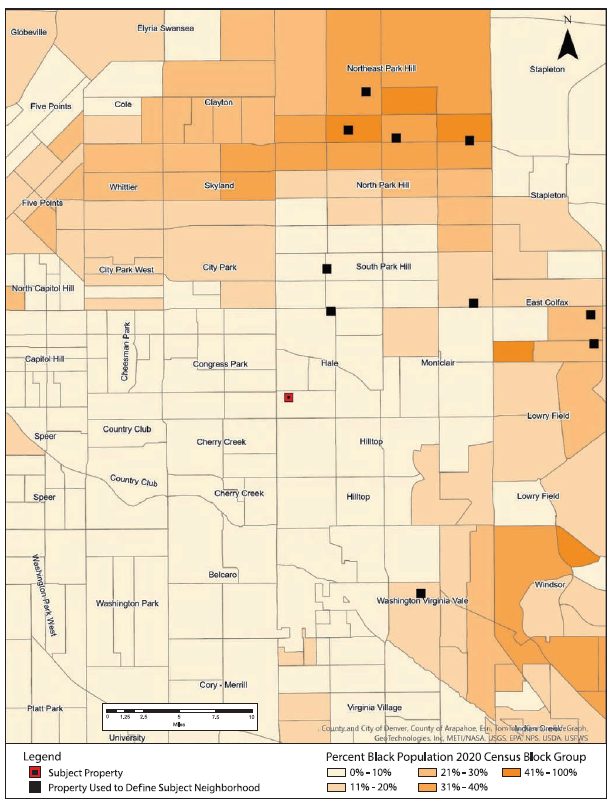

The DOJ argues that Mykhailyna saw that Cheroutes and her family were Black and then deliberately chose as

comparables “properties in neighborhoods with higher percentages of Black residents,” despite the fact that the subject property was located in Hale, a predominantly white neighborhood with higher property values relative

to many of the surrounding neighborhoods. Instead of using higher value comparables in the immediate and surrounding neighborhoods, Mykhailyna grouped the subject property with “faraway neighborhoods with much greater Black populations,” the DOJ argues.

In the section of his appraisal concerning market conditions in the property’s subject neighborhood,

Mykhailyna wrote: “comparable properties currently offered for sale in the subject neighborhood ranging in price

from $400,000 to $750,000.” But the DOJ says this statement is plainly false, pointing out that this price range did not “accurately reflect home prices in Ms. Cheroutes’ popular Hale neighborhood or similar, nearby neighborhoods. Rather, this range was based largely on properties from distant neighborhoods with far higher percentages of Black residents than Hale.”

The DOJ explains in its filing that, during HUD’s initial investigation of the complaint, HUD asked Mykhailyna to provide a list of the properties he used to define the subject neighborhood. Mykhailyna provided the properties marked on the map in Figure 2 with black squares (the subject property is the red square). The shading on the map shows the percentage of Black residents. (See Figure 2: Subject and Comparables used by Mykhailyna.)

Furthermore, the DOJ argues that Mykhailyna selected two comps within a few feet of East Colfax Avenue, “a street with a well-known reputation for activity considered detrimental to housing value, often drawing law enforcement and thus loud sirens and bright lights late at night.” This reputation and activity had a “significant detrimental effect on the value of homes located near this part of Colfax Avenue” and would have been “common knowledge to anyone familiar with the area and certainly to an appraiser in Denver.”

The DOJ digs in on this point, explaining that one of Mykhailyna’s East Colfax-adjacent comps was “across the street from an abandoned building and adjacent to a car shop specializing in oil changes.” These characteristics are remarkedly different than the tree-lined residential street where Cheroutes’ property is located—and would naturally be expected to depress the value of those comps, the DOJ explains.

Here, the DOJ compares how Mykhailyna handled the adjustments with how he had appraised another fourplex with white homeowners. “Mykhailyna chose to make only small upwards adjustments ($10,000 and $14,000, or two percent of the sales prices) to account for these substantial differences in location and attractiveness. In contrast, when Mr. Mykhailyna conducted an appraisal for the white owners of a fourplex property less than a mile from the subject property, [he] made upwards adjustments of $74,000 and $87,000 (10 percent of the sales price for these comps) for comps he chose that were in locations with lower property values,” the DOJ writes. Mykhailyna’s fourplex appraisal happened just one month before his appraisal of the subject property.

In addition to the allegations that Mr. Mykhailyna discriminated against Ms. Cheroutes in his selection of comparables and location adjustments, the DOJ goes on to allege several other errors in the appraisal.

(story continues below)

(story continues)

1. Lot Size Adjustments:

Mykhailyna made very large downward adjustments to two of the highest value comparables in his appraisal due to them having larger lot sizes compared to the subject property. The DOJ argues that he used “an inexplicably large” multiplier of $40 per square foot for the difference in lot size and points out that in dollar terms this adjustment resulted in a decrease in value of $96,800 and $93,600 for the two comps.

The $40 per square foot for the lot size adjustment was “not only unjustified but also inconsistent with Mr. Mykhailyna’s prior practices,” according to the DOJ. Citing the data that HUD collected in its investigation, the DOJ alleges that “in the sixteen appraisals of two-to-four-unit properties that Mykhailyna had completed in Denver between 2020 and 2022, he had never used anywhere near such a large multiplier. In fact, in 12 of those appraisals, his lot size adjustments applied a multiplier no greater than $5 per square foot.”

The DOJ also draws comparisons between Mykhailyna’s appraisal and the prior appraisals that Cheroutes had received from other appraisals of the property in 2015, 2018, and 2020, pointing out significant discrepancies between Mykhailyna’s adjustments and those of his peers. “The 2020 appraisal applied no lot-size adjustments. The 2018 appraisal applied a $1 per square foot adjustment. And the 2015 appraisal also applied no lot-size adjustments, despite two of the comparable properties having 50 percent larger lots than the subject property,” the DOJ writes.

2. Excluding Third Bedroom in Subject Property:

Mykhailyna also allegedly excluded the third bedroom in the basement of each unit of the subject property, while including basement bedrooms on the comparable properties, according to the DOJ. “Mr. Mykhailyna’s unjustified exclusion of the basement bedrooms significantly lowered the value he assigned to the subject property. In the appraisal report, he wrote that the value per bedroom of the comps was $160,000. By that metric, if he had included the two basement bedrooms, the value of the subject property would have been $320,000 higher,” argues the DOJ.

3. Incorrect Elementary School:

Mykhailyna also incorrectly listed the subject property’s neighborhood elementary school as Palmer Elementary School, which is northeast of the subject, when the actual elementary school is Steck Elementary School, which is south of the subject and much closer than Palmer. “Palmer has a much higher concentration of Black students (19 percent) than Steck (only four percent). On the other hand, when appraising a nearby property owned by White homeowners, he correctly identified the closest neighborhood school,” the DOJ explains.

4. Other Errors:

According to the DOJ, Mykhailyna made a series of other errors in addition to the ones explained in detail here, including using gross living area as opposed to gross building area; undercounting the subject property’s gross living area; failing to mention improvements that had been made to the property; incorrectly stating that the property lacked a fence, attic, and energy-efficient appliances; and incorrectly rating the condition of one of the comps. “These errors demonstrate a lack of attention to detail that mirrored Mr. Mykhailyna’s cursory inspection of the subject property and his dismissive attitude towards Ms. Cheroutes,” the DOJ concludes.

Figure 2: Subject and Comparables used by Mykhailyna (Percentage of Black residents overlayed onto the map; Credit DOJ)

Solidifi Liability

After detailing its criticisms of Mykhailyna’s appraisal, the DOJ turns its attention towards Solidifi’s and Rocket’s culpability in the matter.

According to the DOJ’s complaint, the day after his observation of the subject property, Mykhailyna submitted his appraisal to Solidifi, and Solidifi reviewed the appraisal and submitted it to Rocket that very same day.

The DOJ points out that many of the adjustments that Mykhailyna made for lot size, location, “attractiveness,” and so on, were improper and unsupported. Indeed, the appraisal did not meet Solidifi’s own standards, which require a clear and detailed explanation for any gross adjustments to a comp which exceed 25 percent—a threshold that Mykhailyna reached, but did not offer any explanation for, according to the DOJ.

In addition to the appraisal violating several specific standards of Solidifi, the DOJ argues more generally that the appraisal did not comply with Uniform Standard of Professional Appraisal Practice (USPAP) because of its many errors, and that Solidifi failed to take any action regarding these USPAP violations. The DOJ’s theory of liability here is that Mykhailyna was acting as an agent of Solidifi, that his actions were taken within Solidifi’s actual or apparent authority, and that Solidifi has a “significant amount of control over how the appraiser completes an appraisal” and its agreement makes clear that Solidifi “owns” the appraisal.

Rocket Liability

For Rocket’s part, the DOJ basically says that even after Cheroutes told them she believed the appraisal was discriminatory, Rocket stuck to its guns, adhered to the appraisal, and cancelled Cheroutes application. Cheroutes made it clear to Rocket that Mykhailyna had undervalued her property because of her race. Her loan officer initially agreed that a 25 percent decline in value (compared to the appraisal Rocket had procured for her the year prior) didn’t make sense and referred her to a Solutions Consultant at Rocket, who subsequently referred her to Client Relations. Before she could speak to the Client Relations department, Cheroutes’ loan application was cancelled and she was referred to Rocket’s legal department, which never reached out to her, according to the DOJ complaint.

The DOJ argues that “Rocket was reliably informed that the appraisal undervalued Cheroutes’ property because of race or color. Defendant Rocket had the authority to correct the discriminatory appraisal, or cause it to be corrected, but failed to do so.”

(story continues below)

(story continues) |

Rocket Countersues

Shortly after the DOJ filed its lawsuit, on December 4, 2024, Rocket Mortgage countersued, filing a lawsuit against HUD arguing that HUD’s position on lender liability for discriminatory appraisals flies in the face of Dodd-Frank’s appraisal independence requirements and places Rocket between the proverbial rock and a hard place.

In its complaint, Rocket cites former Maine Attorney General Andrew Ketterer, who observed that HUD’s application of the Fair Housing Act (FHA) “set[s] a dangerous new precedent in the mortgage industry that runs contrary to a central tenet of [appraiser independence]…and risks derailing the regulatory framework established by Dodd-Frank,” effectively removing the “firewall between the lender and appraiser.”

Rocket points out that the Truth in Lending Act (TILA) and Dodd-Frank make it illegal for anyone, including a lender, to take an action for the “purpose of causing the appraised value assigned, under the appraisal, to the property to be based on any factor other than the independent judgment of the appraiser.” Moreover, any violation of TILA’s appraisal-independence provision carries an initial civil penalty of $10,000 and then penalties up to $20,000 for each day the violation continues. That provision can also be enforced through private civil actions, meaning lenders can be sued privately even if HUD doesn’t pursue action.

This, Rocket argues, puts lenders on the horns of a dilemma, facing two irreconcilable requirements: “If [lender] takes action with an appraiser regarding an allegedly discriminatory appraisal, then it faces the prospect of a government enforcement action or private lawsuit alleging violations of statutory appraiser independence requirements. But if it complies with those independence requirements by not taking action to ‘directly or indirectly’ attempt to influence the ‘independent judgment’ of a third-party appraiser, then it faces the prospect of government enforcement actions and private lawsuits for alleged violations of the FHA,” argues Rocket.

In short, Rocket’s position is that appraisal independence requirements prevent it from “exercising the kind of oversight needed to meaningfully scrutinize” whether an appraisal violates fair housing laws. As a result, Rocket argues, “liability runs to the appraiser, not the lender.”

Rocket concludes by asking the court for a declaratory judgement that “HUD’s policy of requiring lenders to take responsibility under the FHA for appraisals performed by independent, third-party appraisers is a significant departure from the federal government’s longstanding practice of requiring lenders to honor appraiser independence.”

Rocket also seeks a determination by the court that by promulgating its new policy without notice and comment, HUD violated legal requirements that agencies must offer new policies up for public comment. Rocket argues that HUD “has avoided public scrutiny over that tension [between appraisal independence and its new bias requirements] by failing to provide notice of, and an opportunity to comment on, its new policy of seeking to hold lenders responsible for the actions of independent appraisers under the FHA.”

Rocket Pops Off

In an interview with National Mortgage Professional (NMP), Rocket Companies President Bill Emerson was defiant, telling NMP: “Our reputation is not for sale” and that the countersuit, which had been filed that day, was based “purely on principle.”

Emerson says Rocket’s Board is in full support of the lawsuit because “you have to stand up when you are wrongly accused! Here’s the reality of life. The way this works is if you’re wrongly accused and you write a check to settle, it just empowers the next time that they do this. I can appreciate a small lender not having the capital to do that, but there have been some larger lenders who have just decided that it’s easier to write a check. We are not that company. We have 15,000 team members who do the right thing every single day,” Emerson says.

Emerson also refutes the DOJ’s allegations that Rocket simply dismissed Cheroutes’ concerns and cancelled her loan application, calling the DOJ’s story a misrepresentation of facts. Instead, Emerson explains, Rocket offered Cheroutes a Reconsideration of Value (as required by law) but that Cheroutes declined it. “When the client said they didn’t want the reconsideration of value, our team member said, ‘I’ve got to refer you to another area of our organization to see if we can help you out. I can’t help you any longer.’ Unfortunately, [the borrower] took that as us canceling her transaction,” Emerson explains.

Emerson also denies that Rocket factored in the incoming Trump administration and how it might likely affect HUD and anti-discrimination policy. “Changes of administration have different focuses, but let’s remember that there is a bureaucracy that exists at every agency, and when the politicals swap, the folks that have been in there for a long time are still there and they still have whatever ideology or belief that they have. Sometimes the folks that are coming in new can affect that and sometimes they can’t, so we’ll just have to see how that plays out,” Emerson tells NMP.

Mykhailyna Loses License

On January 6, 2025, Maksym Mykhailyna, the appraiser in the DOJ’s lawsuit, signed a Stipulation and Final Agency Order with the Colorado Department of Regulatory Agencies (DORA) wherein he agreed to a fine, public censure, and revocation of his appraisal license. In its press release, DORA writes that after investigating multiple complaints against Mykhailyna, it determined that he had “improperly retained the services of unlicensed individuals located outside of the United States to complete appraisal assignments and then affixed the signatures of credentialed appraisers to the reports, often without their knowledge. This business model was not only misleading to the clients, but also to his credentialed appraisers on staff.” Mykhailyna’s appraisal license was surrendered and he was also fined a total fine of $97,500, which was entirely waived provided he does not apply for an appraisal license in Colorado. If he wishes to reapply for his appraisal license, then he must first pay the fine. DORA’s press release conveniently omitted that the fine would be waived in full provided this condition was met.

This is a developing story. Subscribe to Working RE‘s free digital newsletter at WorkingRE.com/Subscribe to stay up-to-date on the latest news and information in the appraiser profession.

Postscript: Rocket Mortgage Attacks Appraisers

In addition to washing their hands of appraisal-related responsibility (and liability), Rocket Mortgage has also launched several social media advertisements that reference appraisers in a derogatory way, including an advertisement which starts with: “The only thing worse than having an appraiser come to your house is preparing your home for an appraisal,” and then goes on to pitch Rocket’s Automated Valuation Model for its Home Equity Lines of Credit (HELOC) product. To view Rocket’s social ad online visit: WorkingRE.com/Rocket-Social.

About the Author

Isaac Peck is the Publisher of Working RE magazine and the President of OREP, a leading provider of E&O insurance for real estate professionals. OREP serves over 10,000 appraisers with comprehensive E&O coverage, competitive rates, and 14 hours of free CE for OREP Members (CE not approved in IL, MN, GA). Visit www.OREP.org to learn more. Reach Isaac at isaac@orep.org or (888) 347-5273. CA License #4116465.

OREP Insurance Services, LLC. Calif. License #0K99465

by steve lanham

Shane in Baltimore is still fighting ..Here’s a little tid bit.. Connolly said in his deposition that he didn’t put ant weight on the higher value because he knew it was ” way higher then we ever thought “,and he or his law firm still didn’t verify..,Connolly proceeded to go on his media tour knowing the higher value was bogus but insisted Shane was a racist based on that value…Do you think Connolly and Relman Colfax could be in trouble ? It’s obvious … It’s in summary judgement and she should rule in a couple weeks . Fingers crossed and still praying, going on 3 years.. Thanks to all !!!

-by Douglas Kues

Among the overwhelming dilemmas that threaten the valuation industry is how one industry standard tool being used against appraisers cannot likewise be used against the accuser. Like…. wow….. lo and behold, where in the hell did the neighborhood map in the above lawsuit, clearly showing (ironically by degrees of shading) where the largest concentrations of minorities are residing. Geez….. maybe I could use such a map in my reports to illustrate the efforts made to avoid bias. Predjudice and bias at its finest if you ask me.

-