|

“One of the best courses that I have had in 17 years!” -Amy H.> Switch to OREP E&O Insurance: Enjoy Free 14 Hours of Free, Approved Continuing Education |

>> Take OREP/Working RE’s Bifurcated Appraisal Survey

FHFA Puts Brakes on Fannie’s Bifurcated Program

by Isaac Peck, Editor

Many appraisers took Fannie Mae’s new Value Verify pilot program, featuring bifurcated appraisals, as the beginning of the end of the profession. Now Working RE has learned that a part of the Value Verify process has been put on hold.

Over the last few months rumors have circulated around the industry that the Value Verify program was “dead.” Well, not exactly. But the news does indicate there may be a watchdog on duty.

Fannie Mae told WRE this week: “In early 2020, at the instruction of FHFA, we will adjust the Value Verify process to pause the Data & Done option (our bifurcated valuation process that does not ultimately result in the delivery of an appraisal). We will continue to offer the Data & Appraisal option within Value Verify on a limited pilot basis as a means to evaluate possible improvements to our collateral risk management and create a more efficient appraisal process.”

In other words, Fannie’s Value Verify pilot program of testing bifurcated appraisals is continuing but in a modified, more prudent fashion.

Fannie Mae, which is still in conservatorship, is currently regulated by the Federal Housing Finance Agency (FHFA). Starting in 2017, FHFA tasked Fannie Mae with “Modernizing the Appraisal Process,” and the result was Fannie’s bifurcated appraisal pilot program, which it calls Value Verify.

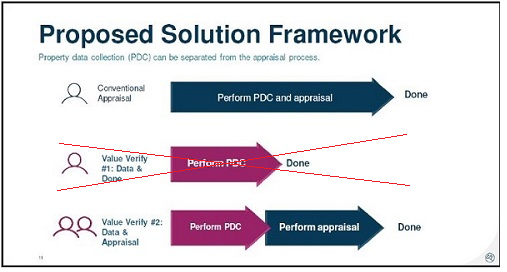

In order to understand what has changed, we first have to understand Fannie’s Value Verify initiative. Under Fannie Mae’s initiative, a property data collector, not necessarily a licensed appraiser, would inspect a home and report back on the condition of the property (click Bifurcated Appraisals for more).

Based on the characteristics of the property indicated by the Property Data Collection (PDC), Fannie’s Value Verify initiative offers the lender (and the borrower) one of two options:

(1) Data and Done (an appraisal waiver based on PDC data).

(2) A desktop appraisal (Fannie’s new 1004P).

So while Fannie’s Value Verify pilot is continuing, starting in early 2020, FHFA has instructed Fannie to pause its “Data and Done” alternative that would completely waive the 1004P desktop appraisal and allow for loan approval based only on the PDC.

Lyle Radke, Director of Collateral Policy and Strategy at Fannie Mae, presented the Proposed Solution Framework slide (Figure 1 below) in his presentations at various appraiser conferences throughout 2019.

FHFA is essentially halting the Value Verify #1 Option: Data and Done, while allowing Fannie to continue with its bifurcated pilot model Value Verify #2: Data & Appraisal.

Figure 1

This is good news for consumers because the non-biased eyes of a professionally trained and licensed appraiser will continue to be present.

Working RE has reached out to FHFA seeking additional information on why it has halted this part of Fannie’s initiative, as well FHFA’s vision for Fannie’s “Appraisal Modernization” efforts.

Bifurcated Appraisal Survey

According to the OREP/Working RE National Bifurcated Appraisal Survey, which now has over 3,000 respondents, most appraisers still have not participated in the pilot program, and most do not intend to. The main reasons are liability concerns regarding the quality of data furnished by a non-licensed appraiser, as well as the difficulty appraising a property without inspecting it or visiting the neighborhood.

The completion rate of the survey is 100%, meaning everyone answered every question. The average time to complete the survey is three minutes. You can add your voice and comments by taking the Survey here.

Nearly 800 of the 3,000 respondents have left comments as well, such as this one: “FNMA is contradicting themselves. When CU started, Fannie was sending warning letters to appraisers sating the ratings used for condition and quality were different than another appraisers. Now it is OK to have an untrained third party making those calls? How ridiculous is this?”

And: “Not sure what the advantages are, versus just the appraiser completing the process as usual. It appears that no one else cares about USPAP but the appraiser, who is held to its standards and integrity.”

This is a developing story. Check back at WorkingRE.com regularly for the latest news and information.

>> Take OREP/Working RE’s Bifurcated Appraisal Survey

About the Author

Isaac Peck is the Editor of Working RE magazine and the Vice President of Marketing and Operations at OREP.org, a leading provider of E&O insurance for appraisers, inspectors and other real estate professionals in 50 states. He received his master’s degree in accounting at San Diego State University. He can be contacted at isaac@orep.org or (888) 347-5273.

CE Online – 7 Hours (AQB Approved)

Identifying and Correcting Persistent Appraisal Failures

Richard Hagar, SRA, is an educator, author and owner of a busy appraisal office in the state of Washington. Hagar now offers his legendary adjustments course for CE credit in over

40 states through OREPEducation.org. The new 7-hour online CE course Identifying and Correcting Persistent Appraisal Failures shows appraisers how to avoid CU’s red flags, minimize callbacks, save time, and earn more! Learn how to improve the quality of your reports and build defensible reports! OREP insureds save on this approved coursework. Sign up today at

www.OREPEducation.org.

Sign Up Now! $119 (7 Hrs)

OREP

Insured’s Price: $99

>Opt-In to Working RE Newsletters

>Shop Appraiser Insurance

>Shop Real Estate Agent

Insurance

Send your story submission/idea to the Editor:

isaac@orep.org

by Cotton

How about we bifurcate your job? We will give 50% of your job to a person who is not remotely qualified. You accept 100% of the liability and risk. We will pay you 1/4 of your current pay check. The good news is you get to do it in your PJs. Sound familiar?

Bifurcation is a money making scam. The AMCs and the lenders will make all the money. The appraiser and the unqualified property inspector receive a pathetic fee.

The consumer is scammed into believing they received a reliable appraisal. The investors purchasing these mortgages where a bifurcated appraisal was utilized are also scammed into believing the GSE’s performed their due diligence.

Those working at Fannie Mae reviewing these bifurcated appraisals have indicated they are completely flawed and not remotely reliable. The results are so flawed that the FHFA has already received hundreds of complaints. I have personally received orders to appraise properties where the bifurcation appraisal was deemed significantly flawed.

The truth of the matter is the AMCs have employed appraisers and instructed them to obtain appraisal licenses in states they have never stepped in. This is extremely misleading and fraudulent!

This is modernization? Are we supposed to believe this nonsense? This is what happens when you allow non-appraiser’s and appraisers who have a license yet never worked in the field come up with dumb ideas yet nobody is smart enough to realize how dumb of an idea this is!

Is the government going to sit back and watch as the consumer and investors are harmed?

The fix is to allow the appraiser to train their own trainees who are directly supervised by the signing appraiser . Realtors and unlicensed individuals are not remotely qualified to perform property observations. Realtors sell houses. if they want to value real estate they should be required to obtain an appraiser’s license.

The appraiser shortage myth can be 100% debunked by the fact the AMCs offer appraisal orders at 50% of the market rate. The AMCs charge the borrower over $500-$600 per appraisal yet send the appraisal assignments out with a fee of $250-$300 and a 3 day turn time? If there was a shortage wouldn’t the fees be much higher and the turn time requirements be much longer? These lies need to stop!

As stated bifurcation is a money making scam! The consumer, taxpayer, investor and appraiser will suffer the fall out from these poor decisions made by the GSE’s. Interview any appraiser any you will get the same answer. Bifurcation is a money making scam and 100% flawed!

The government needs to step in and put an end to this before it ruins the entire housing market and national economy!

-by JStachow

As appraisers we have to take a certain number of classes to be Certified, ongoing continuing education, USPAP classes, and abide by Federal, State, USPAP, FHA, VA guidelines lest we get fined by those entities. It appears that the so called Property Data Collectors would be the cheapest people that FannieMae could locate, or have a real estate agent do it; they can’t in most cases even fill out an MLS Property Description correctly or fully. As a NY State Certified Residential Appraiser, I’m just going with the flow and it looks like the flow is going to be more REO assignments coming down the pike.

-by Mary Thompson

…”We will continue to offer the Data & Appraisal option within Value Verify on a limited pilot basis as a means to evaluate possible improvements to our collateral risk management and create a more efficient appraisal process.” HOW WILL THIS BIFURCATED PROCESS CREATE A MORE EFFICIENT APPRAISAL PROCESS? IF THEY ARE NOT WILLING TO REMOVE THE APPRAISAL PART OF THIS EQUATION THEN WHY IN THE HELL WOULD THEY NOT HAVE THE APPRAISER DO THE DATA COLLECTION AS USUAL. IT WOULD BE EVEN MORE CRAZY TO HAVE 1 APPRAISER DO THE DATA COLLECTION AND LET ANOTHER APPRIASER DO THE DESK TOP REPOORT. THEY MUST THINK NON APPRAISERS CAN COLLECT DATA BETTER THAN AN APPRAISER. I AM HAPPY THEY ARE NOT DOING DATA AND DONE FOR THE CONSUMER’S SAKE, BUT IF THEY STILL WANT THE DESK TOP APPRAISAL THEN WHY NOT GET THE WHOLE THING DONE BY AN APPRAISER? I JUST DON’T GET THIS PROCESS AT ALL!

-by Michael Ford, American Guild of Appraisers (AGA ™)

One small step forward…partially negated by the two steps backward that remain.

-by Candy

When you do a full field review, you witness the errors of

-experienced certified appraisers (and usually you are only observe the exteriors).

I can’t imagine the mistakes you will encounter when a rookie real estate agent

tells you what he/she saw. Remember, you are making adjustments from those

observations. These bi-furcated appraisals are a sure way to get your E & O doubled.