Sharpening Skills: Are Granny Flats Undervalued?

by Kathy Price-Robinson, The Appraisers Research Foundation

Whether you call them granny flats, in-law units, or something else, residential accessory dwelling units (ADUs) on residential properties excite municipal planners, homeowners, and others for social and environmental reasons. They are “green” by nature because of their small size and can provide great benefits to the owner.

But they can also perplex appraisers and other real estate professionals because of erroneous perceptions and various institutional policies that complicate lending on properties featuring ADUs.

To help clarify the estimation of value of residential properties with accessory units, researchers Martin J. Brown and Taylor Watkins conducted a study to test an income-based approach to valuation of properties with ADUs.

The research was supported by a grant from The Appraisers Research Foundation (TARF), a non-profit foundation that aims to facilitate the research, testing and report development of new methodologies and techniques or procedures to best serve the public who use, own or control property interests.

The study was based on 14 properties with ADUs in Portland, Oregon. Results indicate that an income approach yielded valuations considerably higher than actual sales prices, by 7.2% or 9.8% on average, depending on the formula used.

In total, ADUs contributed 25% or 34%, on average, to each property’s appraised value. The conclusion is that valuation by income can increase appraiser insight as ADUs become more common.

Evolving Housing Landscape

Since 2000, dozens of U.S. municipalities have changed policies to encourage accessory dwelling units (ADUs), including Denver, Arlington, Santa Cruz, and Seattle. However, ADUs with legal permits remain relatively rare. In Portland, which is considered a leader in the accessory unit movement, a recent search showed only 431 permitted ADUs out of more than 148,000 properties where zoning would allow them. This is a market penetration of a paltry 0.3%.

Why the lack? Reasons may include restrictive local limits for size and density, parking requirements, and owner occupancy requirements. In some places there is local opposition to ADUs. Occasional news reports describe homeowner fears of crowding or loss of the “single family” feel.

Plus, recent pushback in communities of short-term rentals via AirBnB, VHBO (Vacation Homes By Owner) and other short-term rental companies may be a contributing factor. This leaves the appraiser who seeks comparables for properties with ADUs in a quandary.

(story continues below)

(story continues)

”

Perhaps as a consequence of this rarity,” researchers Brown and Watkins noted, “we have observed frequent misunderstanding of this type of micro-development among appraisers, owners, brokers, and lending agents—as well as some spectacular variations in appraised values on the same property. There also appear to be variations among key national institutions in language and policy relating to ADUs. Real estate professionals at every level lack a consistent view of functional and monetary value of properties with ADUs.”

To provide needed insight on the value of such properties, the researchers:

• Defined the qualities of ADUs.

• Described the complications of appraising such properties.

• Tested two income-based formulas for valuing properties with ADUs in Portland.

• Used elementary statistics to test several questions about the relationship of these valuations to actual sales prices.

Defining an ADU

An ADU is a small, self-contained dwelling, typically with its own entrance, cooking, and bathing facilities, which shares the site of a larger single unit home. It may be attached, as in the case of a basement apartment, or detached, as in the case of a backyard cottage. An ADU is not a separate property; it has the same owner as the primary dwelling.

Properties with permitted ADUs are similar to duplexes in that there are two independent dwellings on a property with single ownership, but whereas a duplex typically offers two roughly equivalent dwellings within a single building envelope, an ADU is usually significantly smaller and less prominent architecturally than the primary dwelling. In some jurisdictions, owner occupancy is required in one unit, while the other may be legitimately rented out. In other jurisdictions, such as Portland, both units may be rented.

ADUs are typically less than 800 square feet, and could be a significant resource for an aging homeowner. ADUs encourage informal caregiving and companionship, since in practice many are rented to friends and relatives. The potential to create legitimate income from rent is a crucial part of the ADU concept.

But while there relatively few permitted ADUs, there are tens, or perhaps hundreds of thousands of illegal ADUs nationwide. A San Francisco study estimated more than 20% of residential buildings contained an illegal secondary unit.

The fact that there are so many unpermitted ADUs, the researchers noted, which are often the only kind local brokers and lending agents know about, real estate listings may downplay the rentability of units that are, in fact, fully permitted.

Approaches to Valuation

The sales comparison approach for ADUs requires multiple recent sales of very similar properties. This kind of data is often difficult to find. The cost approach to value, which might be a useful alternative, can be problematic because of fluctuations in land values and the costs of construction in rising or falling markets. The result is a high degree of variation and perhaps subjectivity. The researchers noted estimates of the contributory value of the same permitted ADU range from $10,000 to $100,000.

(story continues below)

(story continues)

Meanwhile, income-based valuations are the foundation of commercial and investment real estate valuation. This is true even for duplexes. “Any property that generates income can be valued using the income approach,” says the Appraisal Institute, in which “an appraiser derives a value indication for an income-producing property by converting its anticipated benefits [i.e. cash flows] into property value.” Income-based valuations rely on the relationship of market rents to sales prices, data that can be relatively abundant and tractable, since there is less need to find exacting sales comparables.

The majority of American mortgages are for single-unit properties and are originated by banks whose intention is to resell the loans to government sponsored enterprises such as Fannie Mae and Freddie Mac. Often these loans are supported by agencies such as the U.S. Dept. of Housing and Urban Development (HUD), the administrator of the FHA mortgage insurance program. These agencies have their own wording for ADUs and standards for properties, which the mortgage originator must heed for the loan to be marketable. This affects appraisals.

Fannie Mae does not use the term “ADU” in its single-family Selling Guide, however it will purchase loans on properties with illegal units — referred to as “accessory units” — a situation for which it provides detailed guidance. It will also purchase loans on properties with legal accessory units, “if the value of the legal second unit is relatively insignificant in relation to the total value of the property.” Freddie Mac’s position is that: “a property may have an incidental accessory unit that is incidental to the overall value and appearance of the subject property.” HUD uses the wording “accessory dwelling units,” and also stresses their subordinate nature; if the ADU is too similar in size, it is a “secondary unit” requiring a different appraisal form, and more than likely a different lending program.

These guidelines suggest that if an ADU is encountered, it is likely to be illegal, and it may (and perhaps should) be given only insignificant or incidental contributory value.

The case of a legal ADU, where an owner can receive market rent and the contributory value might be estimated with the income approach, is barely touched upon. Indeed, Freddie Mac states: “appraisals that rely primarily on the income or cost approaches to value in order to estimate market value are unacceptable.”

This state of affairs may flow from a mismatch between the setting and legal use of properties with ADUs. A house with a legal ADU offers a seeming contradiction: a two-unit, income-producing property in single unit zoning.

In some cases, though local governments may permit the use of ADUs, appraisers and loan originators tend to apply generic single-family-zone standards from national institutions. The originators and appraisers then struggle with topics such as HUD’s distinction between a “second unit” and an ADU, and whether the income from rent can be included in qualifying the borrower for lending.

(story continues)

“We speculate that as a result of these dynamics, appraisers and originators are likely to be extremely conservative with contributory values for legal ADUs, to the point where the accuracy of valuations may be compromised,” the researchers note.

Testing an Income Approach to Value

To estimate the true value of legal ADUs, the researchers searched the RMLS listings for properties with ADUs that had sold between late 2006 and summer 2011, found 14 that reflected low- to mid-level Portland properties, and applied income-based valuations to them. They then compared those results to actual sales prices.

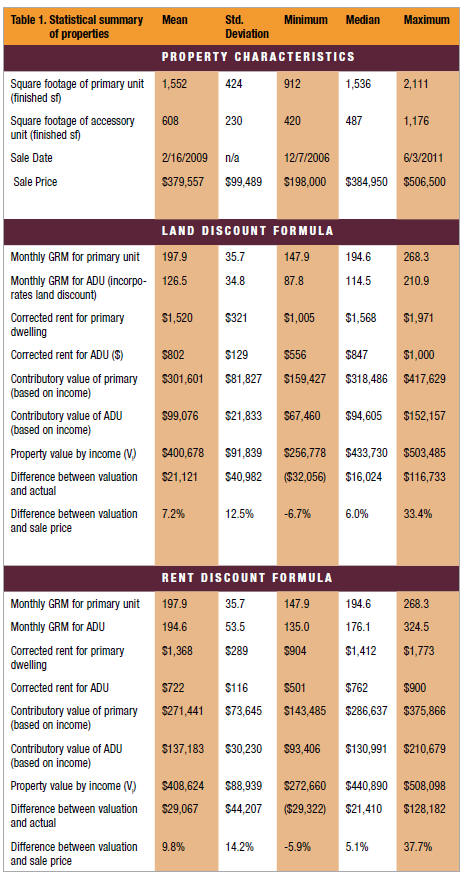

In Table 1, the researchers provide a summary of the properties they studied and the key results.

Click to See Image in Full Size

Click to See Image in Full Size

Appraised values using the income approach were typically higher than sales prices. Using the rent discount formula, appraised values exceeded actual sales prices by an average of $29,067 or 9.8%. Using the land discount formula, appraised values via income exceeded sales prices by an average of $21,121 or 7.2%.

By either formula, ADUs provided a substantial proportion of appraised value. In the land discount scenario, contributory values for ADUs ranged from $67,460 to $152,157, or 17% to 38% of total appraised value. The average contributory value was $99,706 or 25%.

In the rent discount scenario, contributory values for ADUs ranged from $93,406 to $210,679, or 23% to 48% of the total property value. The mean contributory value was $137,183 or 34%.

While both the land discount and rent discount formulas give similar total appraised values, the land discount formula assigns more of that value to the primary unit.

Practical Matters

When a working appraiser encounters a residence with an ADU, they should immediately consider the highest and best use of the property, and the format or institutional form their reporting will use.

“In our experience,” the researchers note, “applying the income approach to a residence with an ADU creates a scope of work that is similar to the appraisal of a duplex.”

Fannie Mae Form 1025 — For an income approach, the most appropriate form might be Fannie Mae form 1025, the Small Residential Income Property Appraisal Report, frequently used for 2-4 unit income-producing properties. It can describe the particularities of a property with an ADU and report the development and results of the income approach to value.

Fannie Mae form 1004 — As an alternative, it is commonly used for single-family-residence appraisals, but is flexible enough to adequately describe a house with an ADU.

Fannie Mae Form 1007 — This will be necessary to report the opinions of market rent, one for each home. Additional analysis and discussion can be included in the Income Approach section of the 1004 form as well as any type of Comment Addendum.

Conclusion

For working appraisers, an income approach to value can provide valuable perspective to the sales comparison approach when the property features an ADU. This should be especially useful when precise comparables are rare. Over the long term, though, given their growing popularity, appraisers may eventually find them common. For more information, contact the research project’s co-author Martin J. Brown at http://martinjohnbrown.net.

CE Online – 7 Hours (approved in over 30 states)

How To Support and Prove Your Adjustments

Presented by: Richard Hagar, SRA

Now you can improve your skills and earn CE credit conveniently online. Richard Hagar’s, SRA highly acclaimed adjustments seminar is now available online for CE credit in most states. Do you have the proper support for your adjustments? Stop taking the same old CE courses and learn proven adjustment methods with instructor Richard Hagar, SRA. Fannie Mae states that the number one reason appraisals are flagged is the “use of adjustments that do not reflect market reaction.” Stay out of trouble with Fannie Mae, your state board and your AMC/lender clients with solid, supportable adjustments. Learning how to make defensible adjustments is the first step in becoming a “Tier One” appraiser, who earns more and enjoys the best assignments. Up your game, avoid time-consuming callbacks and earn approved CE today!

“Why wasn’t this taught years ago?” – Jackie Henry

How to Support and Prove Your Adjustments

Sign Up Now! $119 – 7 Hrs. Approved CE

(OREP Insureds Price: $99)

About the Author

Kathy Price-Robinson is a veteran journalist who writes about the building industry, architectural design, green building, and other real estate issues. The Appraisers Research Foundation is a non-profit foundation that aims to serve the appraisal community. TARF is actively seeking proposals for research projects to fund. Topics of interest include current residential, commercial, and agricultural valuation issues, trends in housing designs and demands, non-market supported sales, conversion of big box properties, and so much more. For the complete listing of all qualifying topics of interest and sub-categories, visit http://www.appraiserresearch.org/topics-of-interest.html.

Send your story submission/idea to the Editor: isaac@orep.org

by Mike Ford, AGA, SCREA, GAA, RAA, Realtor(r)

Interesting article appears to be reasonably well written on a topic that is demonstrably ineffectively researched in the study being reported on. Typical statistical analyses producing wildly disparate results that ‘demonstrate’ nothing other than variance exists in a given market.

I have concern that the author or participants think they ‘give value’ to anything rather than finding out what the market actually gives.

The other issue is highest and best use as improved. Either a property use is permitted, or it is not. FNMA, Freddie and anyone lese can have whatever underwriting policies they want, and allow myriad exceptions however if the value to be determined is market value according to most traditionally accepted definitions; applying generally accepted sound appraisal policies if the ADU is NOT permitted, then it is not (usually) going to be credibly shown to be a contributor to a defined market value. Of course there are always going to be possible exceptions.

Its undeniable that the ADU or”Other utility use” may be perceived in a given market as having some degree of value (positive OR negative); but trying to apply formulaic analyses on one size fits all scenarios is just asking for trouble. I’ve owned such units; sold such units and appraised many such units….legal and otherwise. Contributory value or value impact has ranged from modest negative numbers to nearly a quarter of a million dollars in certain markets.

The income approach is merely a tool as is any form of regression analysis. Proper use of the tools in the given assignment are necessary for credible results. The superficial study merely identified price to appraisal anomalies but then reports them as being either high or low values for a given component of value in situations where we have zero information about specific buyer or seller motivations…or their willingness to gamble a “value” being derived from illegal uses that may or may not be allowed to continue; have fines or other financial correction burdens associated with them.

It would be far less confusing to underwriters, agents and the general public if they simply made sure their appraiser is certified and competent to perform these complex appraisals; and paid a fee commensurate with the degree of difficulty. The one size fits all AMC/TRID Lender set fees for an sfr or duplex rarely compensate adequately for the amount of work required to research, analyze and develop proper appraisals for these type properties.

Too often, the issue is treated by employing unsupported extraordinary assumptions rather than tried and tested generally accepted sound appraisal practices and techniques. Alternatively, somehow regression that may only account for 70% of a properties total characteristics is currently deemed acceptable ‘market support’.

I encourage all to first determine what the exact ownership rights (and burdens) are before espousing a ‘best’ approach to evaluate those rights of property ownership before they are even known. That approach may be income; cost or sales comparison using a host of techniques applicable to any or all of them.

Run that same study in Portland on houses that have green pained trim and I bet you’ll find similar price to “value” variances.

Just my personal view. Mike Ford, VP/Chairman, National Appraiser Peer Review Committee, American Guild of Appraisers.

-by Mike Turner

The article states: “Any property that generates income can be valued using the income approach,” says the Appraisal Institute”.

Really? Your grow house is an income producing property? I think the mystery source at “AI” should add the word “legally” to that sentence. Here in Los Angeles County, in most cases, an ADU is NOT legally rentable and should not be valued as an income producing property. Part of the highest and best use analysis states “legal use” – see https://en.wikipedia.org/wiki/Highest_and_best_use) This invalidates much of this article’s assumptions.

-