| > E&O/GL Insurance for Home Inspectors Competitive Rates, Broad Coverage, Free Risk Management, online inspection support for tough questions, discounts on education and more… Professional Coverage, Competitive Pricing Shop OREP today! |

Inspecting in a Slowing Market

by Isaac Peck, Senior Broker at OREP.org

It’s no secret that the real estate market has slowed down. Rapidly rising interest rates, uncertainty in the economy, and the looming threat of a recession have taken their toll.

The latest data from the National Association of Realtors (NAR) shows that existing home sales in July declined by 20 percent. Existing home sales in August 2021 were 576,000. But in August 2022, only 451,000 homes were sold—a decline of 125,000 home sales.

If we assume an average home inspection fee of $400, a decline of 125,000 home sales represents $50 million in lost revenue for home inspectors nationwide just in the month of August this year. (*125,000 Homes X $400 Inspection Fee = $50,000,000—Assuming all homes would’ve been inspected.) If you take into account additional services inspectors provide, such as sewer scoping, radon testing, and mold testing, the impact is likely even worse.

This is no small decline in business in just a single month.

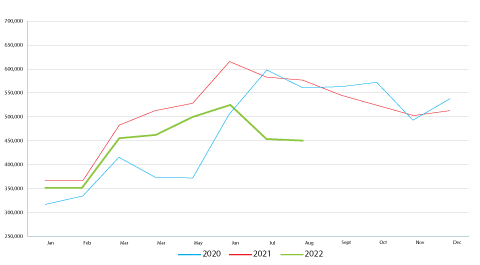

In fact, these are the lowest sales numbers for the month of August that we’ve seen in the last decade—making it the slowest August since 2011. But compared to 2020 and 2021, an even sharper contrast is notable. Figure 1 shows the Existing Home Sales in 2022 compared to the last two years.

Figure 1: Existing Home Sales in 2022, Compared to 2020 and 2021

Click To Enlarge Image

Of course, one bright side for home inspectors is that the slowing of the market has done away with the risky practice of waiving the home inspection that became so popularized during the height of the “craze” in 2020 and 2021.

Nevertheless, home inspectors are feeling the slowdown. In the face of declining real estate transactions and declining revenue—what is a home inspector to do?

Slowing

Ian Robertson, a veteran home inspector in New York and co-founder of Inspector Toolbelt, a fast-growing inspector reporting and scheduling software, says that while his inspection firm is not doing bad, they are still feeling the sting of the slowdown. “We are seeing a fair number of our competitors go out of business because of the slowing market. I’m not talking about an official ‘Hey everybody, I’m out of business,’ but we’re seeing home inspectors shut down their websites, pull down their Facebook page, and going out and doing contracting work full-time until the market turns around,” says Robertson.

This is a unique time for home inspectors, according to Robertson, because the market is still transitioning between a seller’s market to a buyer’s market. “The transition period is generally the worst for home inspectors because not a lot of transactions are taking place. It takes time for sellers to adjust to the new market reality. I see a lot of home inspectors hurting but not talking about it. I try to be super transparent about my business on my Inspector Toolbelt podcast, and I’ve been upfront that this year (2022) is the first year since the great recession that my firm has seen a downward turn in our numbers. I expect that by late spring next year (2023), we should see some things pick up. As the spring season goes along, more and more listings are going to come to market and we should see a full-blown buyer’s market take hold,” reports Robertson.

In the meantime, Robertson encourages inspectors who are struggling not to give up. “We are seeing inspectors giving up because the market is getting hard. It’s been a really easy market for the last six or seven years. If you started as a home inspector in the last few years, the market was booming and it was easy for new inspectors to find business and thrive. In contrast, now is the time when you have to stick with it. The guys who hang on and ramp up their marketing now are going to get paid later,” Robertson argues.

Of course, the bright side of some home inspectors shutting down their businesses is that once the market picks back up there will be much less competition in the market. “Once the market turns we’ll have a lot less competition,” Robertson says.

(story continues below)

(story continues)

Stepping Up Marketing

Of course, surviving a slowdown involves more than just hanging on and waiting for conditions to change. Now is the time to step up your marketing, argues Robertson. “When the market is transitioning like this, now is the perfect time for inspectors to go back to grassroots marketing. With a slow market, if our real estate agent base is having 500 agents who refer their clients to us for the home inspection, we’re now going to need 800 agents to refer us—just to maintain the same level of business,” Robertson reports.

With transactions slowing down, both home inspectors and real estate agents have more time. This gives inspectors an opportunity to focus on building relationships with agents. “This is the time where visiting real estate offices, giving presentations to agents, and taking agents out to lunch is much more effective. The best part is that marketing to real estate agents is practically free. You don’t need to buy extravagant lunches or drop off fancy candy and flowers to their offices. It costs you gas and your time to drive around and visit real estate offices and invite the broker out to lunch. It can be time consuming, but it’s not expensive,” says Robertson.

In terms of low-cost, grassroots marketing, Robertson encourages inspectors not to default to the “easy” tasks. “Many inspectors want to sit at home in their pajamas and post on Facebook or send out mass email blasts or mass text messages. The problem is that everyone is doing that. It is easy to send email blasts and mass text messages, post on Facebook, and follow agents on TikTok. But for those home inspectors who are willing to do the real hard work, those are the ones who are going to do a lot better. Our firm doesn’t rely on agent referrals as the primary source of business, but given the extra time that we have, we are now very focused on developing our agent relationships during this downtime,” Robertson advises.

Buyer’s Market?

While the market has clearly turned in favor of buyers, Robertson says that it will take some further adjustments for it to fully transition into a healthy buyer’s market. “When you have a transition from a seller’s market to a buyer’s market, it’s a weird time for transactions and for home inspectors generally. If you look at Google trends, search volumes for the number of home inspections is way down. There are some areas in the country where the volume of searches is so low there’s basically no data! These are some of the lowest search volumes I’ve seen in the entire year,” Robertson reports.

Nevertheless, Robertson says if you can still afford your online marketing, don’t stop. “If you are hurting for work, why take away one of the few channels you have to get business? I’ve even talked to home inspectors who have taken down their websites, saying they’ll put them back up next year when business picks up. What agent is going to refer you if you don’t have a website? If you’re not on social media, you don’t exist. If you pull back now, you’re not going to be able to recover quickly when the market comes back,” says Robertson.

While now is the time to step up on building relationships with agents, home inspectors should also be prepared to ramp up their direct-to-buyer marketing in 2023. “Once we transition to a full-on buyer’s market in late spring of next year, buyers will be looking for home inspectors directly. In a buyer’s market, the buyers call around to find the most qualified home inspector. They will call and interview you. Once that starts, that’s when direct-to-buyer marketing becomes super important and inspectors will want to ramp up that part of their business,” Robertson says.

No Waived Inspections

Dave Klima, co-founder of InspectedHouses.com and President of Aardvark Home Inspectors Inc., says that the upside to all this is that buyers are no longer waiving home inspections. “We’re seeing prices go down, the number of days a house is on the market go up, and the total number of homes on the market generally is going up. The number of inspections we’re doing hasn’t really dropped dramatically though and the reason is because the market is turning into a buyer’s market. Buyers used to be skipping home inspections and our industry really took a hit because so many people were skipping inspections. That’s not happening now. Even though the number of inspections has gone down, the number of homes getting inspected has not declined too much in my market,” reports Klima.

Pre-Listing Inspections

As a longtime advocate for pre-listing inspections, Klima sees the coming buyer’s market as creating the perfect opportunity for home inspectors to increase their business with pre-listing inspections. This is because during a buyer’s market, buyers typically have control of the negotiations and are much more likely to scrutinize the home. “Buyers will get a home inspection and then demand that X, Y, or Z be fixed or they’re not buying the house. Sellers are often forced to make those repairs, usually on very short notice, because they don’t want the house to go back on the market and sit for another three or four months,” reports Klima.

Pre-listing inspections give sellers a lot more control over the sale of their home, make the sale more certain, reduce surprises, and make the transaction more profitable, according to Klima. This is because it gives sellers advance notice of any issues a buyer’s inspector might find and gives them the opportunity to address it before the home goes on the market. “Often if a seller gets a pre-listing inspection, they can make many of the repairs themselves—put in a GFCI outlet, and so on. Whereas if the house is already in escrow, these contractors charge rush, premium pricing. Buyers and their agents typically demand that the work be done by a licensed electrician or a licensed contractor and trying to make those repairs on short notice doesn’t give the seller much time to shop around. So it saves money for sellers on both fronts: they have the opportunity to fix some things themselves and they can shop around and get better repair pricing and higher quality work,” Klima says.

Whereas only five percent of Aardvark’s (Klima’s firm) revenue comes from pre-listing inspections currently, Klima is hopeful he can increase that figure up to 20 percent of his revenue as the buyer’s market picks up. He is actively visiting Realtors’ offices and giving presentations to agents on the topic where he explains to real estate agents the many benefits of pre-listing inspections.

If pre-listing inspections are positioned correctly, they can also translate into a LOT more revenue for both the home inspector and the Realtor. Klima built InspectedHouses.com, which is a platform that home inspectors and Realtors can use to showcase homes that come with pre-listing inspections. Part of Klima’s approach is to put a sign in the front yard of a listing promoting that the home has been pre-inspected. Potential buyers then visit the website (or just scan the QR code on the sign) and can view (or purchase) the pre-listing inspection depending on the seller’s preference. This gives both the Realtor and the home inspector a list of potential buyer leads they can follow up with and try to close. Klima reports his best performing pre-listing inspection translated into four additional inspections. “We got 13 leads off the InspectedHouses system and we ended up doing inspections for three of those buyers, plus an inspection for the seller who was buying another home as well. And it works the same way for Realtors—we’ve had Realtors we work with that have turned one transaction into four. Think of what that can do for a Realtor—and if you are the one helping them grow their business, who do you think they are going to want to work with?” Klima says.

With interest rates expected to continue rising into 2023, home inspectors (and all real estate related professions) will be watching home sales activity with a careful eye—and doing everything they can to drum up business. Make sure you stay informed with the latest news and information by subscribing to Working RE’s digital newsletter at Working RE.com.

About the Author

Isaac Peck is the Editor of Working RE magazine and the President of OREP, a leading provider of E&O insurance for appraisers, inspectors, and other real estate professionals in 50 states. He received his master’s degree in accounting at San Diego State University. Reach Isaac at isaac@orep.org or ( or (888) 347-5273. Calif. Lic. #4116465.

OREP Insurance Services, LLC. Calif. License #0K99465

by Jay Hensleigh

You may want to re-visit the “take a realtor to lunch” idea. In Oregon (and I presume other states) it is a conflict of interest and not legal to buy anything for realtors. You might be suggesting something that could get home inspectors in hot water with their regulating body.

-