|

Published by OREP, E&O Insurance Experts | February 2013 |

Click to Read Current Issue |

|

"While there is no

clear accounting of how much debt Evaluation Solutions left behind, the

current evidence suggests that the unpaid invoices to real estate

professionals total in the millions."

Editor’s Note:

Fast becoming one the valuation industry’s most pressing problems, another

AMCs has failed; this time leaving appraisers and agents/brokers owed

thousands or tens of thousands of dollars. How the lender and regulators

respond may create an important precedent for the industry.

AMC

Fails: Appraisers and Real Estate Agents Stiffed Again

By Isaac Peck

Evaluation Services/ES Appraisal Services is the latest national appraisal

management company (AMC) to declare bankruptcy and leave hundreds of real

estate appraisers and agents/brokers with unpaid invoices.

While there is no clear accounting of how much debt Evaluation

Solutions left behind, the current evidence suggests that the unpaid

invoices to real estate professionals total in the millions.

Shelley Smith (not her real name) is a real

estate agent/broker who says that she is owed over $46,000 by Evaluation

Solutions for over 900 BPOs that she completed over a six-month period. "I

worked for them for three years and they were always slow to pay. They

typically took 90 days to pay me,” Smith says.

Smith experienced the same issues as others with

regards to being lied to about when payment was being mailed out. “This

latest time, they actually sent me an email in October of last year that my

payment had gone out, so I kept working for them, but the check never came,”

says Smith.

Upon hearing the news that Evaluation Solutions

was filing for bankruptcy, Smith created a Facebook profile,

Evalonline Complaint,

as a gathering place for appraisers and agents/brokers to come together and

discuss their options.

At the time of this writing, the profile had 69

friends.

Since Evaluation Solutions went under, Smith has

been in direct contact with Chase, the lender and “client” who ordered all

of the BPOs through Evaluation Solutions. Chase initially instructed her to

fax her invoices over to their research team, but less than a week later

Chase sent notice to Smith saying that since they are not the direct vendor

they declined to pay the invoices or to further research the issue.

Through her Facebook profile,

Evalonline Complaint,

Smith says she is gathering support for a class action lawsuit against Chase

bank, if it comes to that.

According to Smith, a class-action lawsuit

against Chase will be used as a last resort if filing complaints with the

OCC and CFPB fail.

To Smith, this is also a case of fraud on

Evaluation Solutions’ part and she has also filed a

Fraud Tip Form

with the FBI. “It is fraudulent behavior for them to accept money for work

from Chase, and then not pay us for doing that work. But also, the repeated

instances of emailing us that payment had been posted, when no payment was

coming, was intentionally fraudulent. I believe they intentionally lied and

engaged in fraudulent and criminal behavior,” says Smith.

(story continues below)

(story continues)

Collecting

Those agents/brokers and appraisers who have been affected have been

actively sharing their stories online and putting pressure on the lender who

hired Evaluation Solutions, JP-Morgan Chase, to cover the AMC’s bad debts.

Last year under similar circumstances, appraisers cited numerous

regulations, including the statutes of FIRREA and the OCC (Collecting

AMC Debt from Lender), arguing that when an AMC fails to pay the

appraiser, the lender becomes responsible, since the AMC is an “agent” of

the lender (AMC

Bad Debt – Lenders Responsible?).

In fact, there is precedence for lenders stepping forward and paying the bad

debts of their AMCs—last year MetLife Bank paid on AppraiserLoft bad debts (Lender

Paying Appraisers Stiffed by AppraiserLoft) and Wells Fargo paid

the unpaid invoices for their agent, JVI (Wells

Fargo Paying JVI Bad Debt).

So far, Chase, the lender who hired Evaluation Solutions, is refusing to

take responsibility.

Appraisers Left Unpaid

Nicholas Conteduca, an appraiser from Chicago, says he is owed well over

$30,000 for appraisals he did for Evaluation Solutions.

After hearing they were ceasing operations, he created a website,

www.ESAppraisalScam.com, that allows appraisers and

agents/brokers to share information, collaborate, and post how much they are

owed. The website is littered with comments from appraisers and

agents/brokers who are owed tens of thousands of dollars.

At the time of this writing, the running total reported to the

website is over $1,000,000.

Conteduca’s story has similarities with others. He says he worked for

Evaluation Solutions for two years and that slow payment was the norm.

“It would typically take 60 days or more to receive payment, and

sometimes up to four or five months. But I always understood that they took

a long time to pay,” says Conteduca. The fact that Evaluation Solutions

consistently let invoices build up into the thousands, and tens of thousands

of dollars before paying, made it less alarming when the total invoice

amount would begin to build back up.

Like others in his situation, one of the reasons Conteduca kept working for

Evaluation Solutions was because they paid him higher fees than any other

AMC. “On orders where the standard fee was

$250-$300, they would pay $600 or $700 an appraisal,” Conteduca says.

The staff at Evaluation Solutions often lied about when payment was going

out too, according to Conteduca. “There were times when they said they sent

out a check but they didn’t. The only way

to get paid was to constantly email and call them,” says Conteduca.

Conteduca says he has been in contact with Chase, who

had told him they would contact him on January 10 with a response, but so

far he has heard nothing from them.

William Furney, an appraiser from Rhode Island,

says his firm is owed $73,960 for work done over six months. “Five of my

appraisers and myself were doing work for Evaluation Solutions. I’ve already

paid out around $40,000 to my appraisers, so now I’m out the money that they

owe me,” says Furney.

Furney, who had been working for Evaluation

Solutions for three years, confirms Conteduca’s experience that Evaluation

Solutions was consistently slow to pay, but that they also paid a little bit

more than other AMCs.

“They had owed me money before this. They paid

me here and there and sometimes a few months would go by,” says Furney.

Furney says he only did a few appraisals for

them in the beginning because of their slow payment, but then they would

pay.

“One time it went for five months, so I started putting a lot of pressure on

them and they sent me a large sum,” Furney says.

Furney ended up doing so much work

for them that he made a few friends at their office. “The girls from the

office would text me, asking me if I needed work,” says Furney.

“This time around, the amount they owed me was

getting larger and larger and I started freaking out. They would tell me,

‘I’m really sorry, I’m going to Fed-Ex you a check so you’ll have it by this

day,' but the check would never come,” says Furney.

On the day Evaluation Solutions shutdown, Furney

was still trying to get paid. “I started getting really fed up so I called

one of the girls there who I knew.

She said that she was putting

pressure on the head of accounting, and that my check should’ve gone out

already.

She told me that the head accountant was in a

meeting and that she’d call me right back.

I got a text message an hour later and

she said ‘I just lost my job, they just kicked everybody out,’” says Furney.

After hearing that Evaluation Solutions was

going under, he called the WAMU-Chase Department in Florida. “The manager

there told me he was being bombarded with calls from appraisers, then gave

me the cell-phone number of the regional manager of the mortgage department

at Chase,” says Furney. “When I originally called the regional manager, he

told me to send him a list of my invoices and that he would get to the

bottom of it, but he never called me back.

When I finally got him back on the

phone, he told me he ‘got wind’ that Chase isn’t really responsible for this

and that he couldn’t help me,” says Furney.

“This regional manager had the manager at

WAMU-Chase in Florida call me back and he immediately started reading a

script.

It was pretty clear that Chase had their legal

department send around a script to read to all appraisers calling in about

this issue. I managed to get him off the script and he ended up telling me

he was the one who hired Evaluation Solutions and he offered to refer me to

his other clients!

I said no thanks, that’s my kid’s college fund!”

says Furney.

Moving Forward

It has been less than a month since Evaluation

Solutions closed its doors, so it remains to be seen how Chase will handle

this issue. From what appraisers and agents/brokers on the ground are

saying, it is likely that within the coming weeks numerous complaints will

be filed against JP Morgan Chase with the OCC, CFPB, and with the Florida

State Banking Commission.

If Chase continues to deny responsibility for

Evaluation Solutions’ bad debts, the response by regulators might set a new

precedent for the industry- whether it holds Chase responsible or not.

The bankruptcy of Evaluation Solutions is a

glaring reminder that the proper regulation and vetting of AMCs continues to

remain a problem for the industry.

Working RE has covered this issue in depth and

appraisers and agents/brokers are encouraged to read the stories of others

who have been successful in getting lenders to pay for the bad debts of the

AMCs they hired:

·

Success Collecting AMC Debt from Lender

·

AMC Bad Debt – Lender Responsible?

·

Lender Paying Appraisers Stiff by AppraiserLoft

·

Wells Fargo Paying JVI Bad Debt

Working RE also has an

AMC Rater blog, where appraisers

can share their experiences with AMCs and pick up on AMCs who are having

payment problems. On the AMC Rater blog, appraisers were warning that

Evaluation Solutions was slow/no pay as early as April 2012.

About the Author

Isaac Peck is the Associate Editor of Working RE

Magazine and Marketing Coordinator at

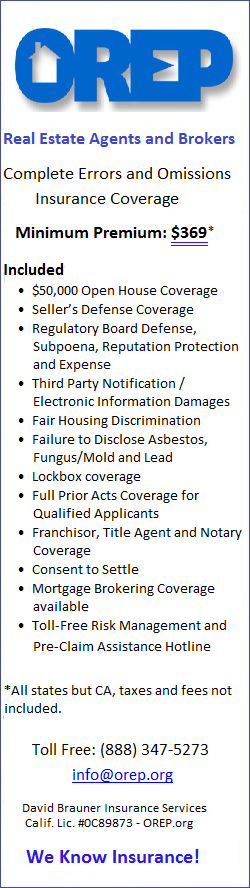

OREP.org, a leading provider of

E&O Insurance for appraisers, inspectors, and other real estate

professionals in 49 states. He received his Bachelors in Business Management

at San Diego State University. He can be contacted at

Isaac@orep.org or 888-347-5273.

ATTENTION: You are receiving WRE Online News because you opted in at WorkingRE.com or purchased E&O insurance from OREP. WRE Online News Edition provides news-oriented content twice a month. The content for WRE Special Offer Editions is provided by paid sponsors. If you no longer wish to receive these emails from Working RE, please use the link found at the bottom of this newsletter to be removed from our mailing list.