|

Published by OREP, E&O Insurance Experts | March 2013 |

Click to Read Current Issue |

|

"If one of my

appraisers didn't meet value, they were blacklisted. Our own company would

turn them in to the state and call them a bad appraiser,"

Interview: Appraiser Who Brought Down Countrywide

By Isaac Peck, Associate Editor

The U.S. housing bubble and the corresponding real

estate market crash of 2007-2008 brought about one of the most severe

economic downturns in America since the Great Depression. The fallout was

extensive: banks failed, established companies declared bankruptcy, the net

worth of American households plunged, and millions of Americans lost their

homes and jobs in a great recession that quickly spread globally, submerging

the economies of Europe, Asia, and the developing world.

Among the many firms and individuals who acted

irresponsibly, and maybe criminally, perhaps none did so with such flair and

recklessness as Countrywide Financial. Before its rescue-sale to Bank

of America (BOA), Countrywide was the largest mortgage lender in the United

States.

Countrywide became a

“leader” of sorts in the lending industry, according to numerous lawsuits

filed by the Department of Justice, by adopting reckless lending practices,

encouraging fudged loan applications, and violating appraiser independence

in order to gain market share. A move that, some say, led to other lenders

lowering their standards to compete.

A little-known fact is that the original

whistleblower at Countrywide Financial, the man whose suit sparked an

investigation that culminated in a one billion dollar settlement between BOA

and the Department of Justice, is a real estate appraiser named Kyle Lagow.

(story continues below)

(story continues)

Kyle

Lagow

Lagow was an appraisal manager and assistant vice president at Landsafe,

Inc., the appraisal subsidiary of Countrywide, a position which gave him an

inside look at the practices which caused the downfall of the largest

mortgage lender in America. For his part, Lagow sees Countrywide as being at

the heart of both the housing bubble and the real estate crash. In his

words, Countrywide, “Started a train and laid the tracks that ran the

industry off the edge of a cliff.”

This is his story.

How It Began

Kyle

Lagow of Plano, Texas says he was an appraiser running his own firm for 14

years when he was contacted in 2004 by Landsafe and offered a position as an

appraisal manager, responsible for building an appraisal division to span

several states.

“The

third time they called they made the opportunity attractive enough and told

me that I would be able to build a staff of quality appraisers. So I told

them that as long as we do it right, I’ll run it,” Lagow says.

At Landsafe, Lagow was tasked with hiring and training a division of staff

appraisers spanning multiple states whose primary purpose was to appraise a

growing volume of Countrywide loans. Ultimately, Lagow helped open new

markets for the company, expanding Landsafe’s appraiser panel into Utah,

Colorado, Arizona, Louisiana, Texas and Oklahoma.

Fraudulent Appraisals

Lagow

says it didn’t take long for him to realize that Landsafe’s executives

weren’t interested in quality appraisals. The original suit filed by

the DOJ alleges that in early 2005, a Landsafe executive called a meeting of

appraisal managers and made it clear that (1) they needed to quit thinking

of an appraisal as a separate unit, (2) that Landsafe appraisers were there

only to “help facilitate closing,” and (3) that they needed to change their

“thought process.” (You can find the suit at WorkingRE.com; Sidebar

Information (left column); Lagow vs. Countrywide Original Complaint.)

“An appraiser would turn in his or her appraisal. If it was low or didn’t

meet value, it went to a reviewer. If the appraiser didn’t meet value, the

reviewers were instructed to go and look at the market to see if they used

the best comps and to try to discredit the appraiser. The kicker is that I

have an appraiser who I trusted, hired and put on my fee panel because I

believed they would do a good job. But at Landsafe, the entire review

process was designed to ensure the appraisal came in at value. If one of my

appraisers didn’t meet value, they were blacklisted. Our own company would

turn them in to the state and call them a bad appraiser,” says Lagow.

Unfortunately, extreme internal pressure to meet value and the blacklisting

of quality appraisers was just the tip of the iceberg. In 2005, Lagow

learned of a joint venture between KB Home and Countrywide, wherein

Countrywide would provide the loans for new construction developments of KB

Home. Lagow was tasked with hiring appraisers to complete that appraisal

work. However, Lagow says that when his staff appraisers showed up at

KB’s developments to appraise properties, they were turned away and told

that KB had an agreement with Countrywide where it alone would decide who

did the appraisals.

Lagow soon learned that a separate appraisal manager at Landsafe was

handling all of KB appraisal assignments; the work went to a small number of

hand-picked appraisers. The DOJ suit alleges that in Houston, the appraiser

chosen by KB Home completed over 400 appraisals in a single month by

himself, all at a price of $450 per appraisal.

Shortly after Lagow realized what was happening, he began sending

notifications to upper management, even though he had been warned against

putting his concerns in writing. On September 7, 2005, Lagow wrote the

following:

“In summary: We have a clear attempt to control the market- utilization

of one appraiser, a refusal to supply data with outside appraisers, and the

appraiser of choice is being paid a fee abnormally higher than what we pay

everyone else for the same work. Add in the fact that recent appraisals from

outside appraisals have come in low, and I could make a fairly strong case

for market manipulation and appraisal fraud. Even if it is not intentional,

it looks bad.”

At the end of his email, Lagow warned that the problem would spread if

nothing was done to fix it: “I also want to caution anyone who cares to

listen, that if we allow this in Houston it will spread through the KB Home

markets.”

Lagow says that he personally inspected many of the

appraisal reports completed by the Houston appraiser. “I looked at appraisal

orders. I could tell you when the inspection appointments were scheduled.

One day, one was set for noon and the next one at 12:01 P.M. It was a total

fraud,” says Lagow.

Lagow’s words of warning fell on deaf ears as Landsafe executives proceeded

to institute a “production-based” pay system where staff appraisers were

forced to radically increase their appraisal volume in order to earn the

same income, according to the complaint filed by the DOJ. Lagow also says

that Landsafe also facilitated a channel whereby Countrywide’s own loan

officers could request target “audits” of Landsafe appraisers who were not

meeting value.

The original suit filed against Countrywide by the DOJ lists over half a

dozen appraisers who were “audited” at the direction of loan officers who

were upset that appraisers were not meeting value. According to the suit,

one of the appraisers that Lagow hired to add integrity to the appraisal

process was told point blank by a KB Home sales manager that KB would no

longer require his services if his appraisals came in below contract price.

When he refused to go along with the fraud, the appraiser was blacklisted

from completing appraisals on any Countrywide loans.

Frustrated at the apparent fraud he was witnessing, Lagow sent this chilling

email to his supervisors at Countrywide Governance in February 2006:

“At the risk of losing my job I am forwarding this email to you and want

to relay my deepest concern for the situation addressed. I report directly

to you but I am also forwarding this to (a superior) because she and I have

talked about general concerns in the past.

I have spent considerable time looking over the KB Home situation in

Houston, Texas and took some time to drive a couple of subdivisions this

weekend and look around. As you are aware, one appraiser controls the

orders and the values…I believe that (name redacted) and KB Home are engaged

in a fraud to manipulate the local market.

In looking at the appraiser’s reports, when he needs to, for value, he goes

outside the market to access superior sales to bump up the market and then

uses the same sales in future sales, thus establishing and manipulating the

market. The appraisal reports I have examined have a continual

characteristic of selective manipulations of the market data in an effort to

pump up the market. It is my opinion that, based on very limited data,

we could be making 115% loans in the markets and if you examine some KB Home

subdivisions you see significant foreclosure rates. I believe that by

allowing the situation to continue we are condoning the activity and placing

at risk the jobs of our employees at Landsafe and Countrywide. I am even

more concerned, and I do not have any supporting data other than the logic

that an order has to come from us, that the individuals who mandated that

only one appraiser be utilized may be a Countrywide employee and could be

implicated in a conspiracy to defraud both the homeowners and the

stockholders.

We are charged with the responsibility of protecting our client’s assets. If

I am correct on any of this, and if it blows up, the blame will rightly fall

on us for failing in our task. This has the potential to be a lightning rod

for the demise of Landsafe and we will need to act to make sure every effort

has been made to safeguard against this…”

Nothing changed as a result of the letter, Lagow says. Finally, in 2008,

Lagow says he sent an email directly to Angelo Mozilo, CEO of Countrywide,

urging him to stop the fraudulent practices and warning him that his

executives were not reporting the facts to him.

“I really wanted Mozilo to have not been aware of this. I wanted to

believe that a guy who spent 40 years building this company wouldn’t want

its legacy to be that we ran an industry off a cliff and that we gave our

industry a bad name. I couldn’t believe that he could have known about it, I

went to everyone else before I went to Mozilo,” says Lagow.

Lagow explains that Mozilo sent someone down to, in his words, “put on a

show.” He was even contacted by several of Countrywide’s top

executives who seemed concerned, but the “conclusion” of management was that

Lagow’s concerns were unfounded.

Fighting from the Corner

By late

2008, Lagow learned that he needed treatment to combat cancer and he was

subsequently fired from Landsafe. “I fought inside the company for a

long time to stop what was going on. When I left I told them, look, I’m

going to fight to fix this either inside the company or outside the

company,” says Lagow.

Leaving Landsafe wasn’t easy for Lagow. “At the time, I was pretty defeated.

I built their market for them. They took my model and applied it to the east

and the west coast. They didn’t have a clue how to hire and manage a staff

appraiser division,” says Lagow.

Lagow says he wasn’t even planning to file suit. “I had cancer when they

fired me. I just wanted to make it through that fight. I honestly

didn’t want to go this route- I was on the list to do work for Bank of

America. But then I received a letter from a BOA’s attorney saying

that they were not going to put me on their fee panel list,” says Lagow. At

that point, Lagow said he had no choice. “I had to fight, there was nothing

left. I was broke. I couldn’t do work for them, I didn’t have

any money. After all that they put me through, I was ultimately deprived of

this little bit of dignity of being able to do appraisal work. I got mad. I

picked up the phone and called up some lawyers who were filing a class action

lawsuit. I said how can I help?”

The rest is history. In late 2009, Lagow filed a whistle-blower complaint

under seal, charging that Countrywide had committed fraud and violated the

U.S. False Claims Act.

But things got worse for Lagow before they got better. “Once the lawsuit was

filed I couldn’t talk to anybody, not even my family. You go out there to

try to help an industry, and no one even knows you’re fighting the fight.

Your kids look at you like a failure, you can’t get any work. You’re

fighting cancer. I lost everything, I had repo people knocking on my door,”

Lagow says.

Lagow’s complaint was among at least five other whistle-blower complaints

that were rolled into the $25 Billion settlement between regulators and the

nation’s largest banks in 2012. Lagow’s complaint was also critical to a $1

billion settlement between the Federal Housing Administration (FHA) and Bank

of America in 2012.

For Lagow, his eventual victory is bittersweet. “As far as being a

whistleblower, I wouldn’t wish it on anyone. I got lucky. Without my

lawyers, Tom Loeser, Shane Stevenson, and Stevie Berman, who were courageous

enough to take the case, I’d be sitting in a house in default.”

For his share of the settlement, Lagow will receive $14.5 million for his

role as whistleblower. Lagow is thankful but says that it isn’t as much as

people might think. “By the time the government takes its share, and

the attorneys take theirs, it’s not as much of a windfall as everybody

thinks. If I were working for the rest of my life, I would earn more

than that,” says Lagow.

Present and the Future

Appraisers may not be surprised to learn that Lagow doesn’t think much has

changed in the industry, even after all he has struggled for. “I don’t think

I made much of a difference. Everybody likes to say that there have been big

changes. The only change right now is that there aren’t as many loans being

done. If you had stolen $1 billion at gun-point, would you still be typing

on your computer? I don’t think so. Yet the same people who were in charge

when this fraud took place are still here. My supervisor at Landsafe, the

area manager, is still there. The appraiser who was completing 400

appraisals a month in Texas still has his license. So you tell me, what’s

changed?”

“You still have staff appraisers who know that if they don’t meet values,

their name is going to show up on somebody’s do not use list,” Lagow

continues. “Volume corrupts because the biggest problem that we had

back then was that loan officers who did the biggest volume would say, ‘If

you don’t get rid of so and so, I’m going to go somewhere else.’ So

loan officers had tremendous weight and influence and they still do. You

have the same infrastructure in place so once loan officers start doing

millions of dollars of loans again, the same thing will happen.”

“What these criminals did, committing fraud and inflating values, was a

felony before and it is a felony now, yet we haven’t put any of the big

players in jail- so nobody’s afraid,” Lagow says. “Go out there and look and

see how many people have been indicted from small private mortgage

companies. Look and see how many have been indicted and tried and put

in jail from the largest mortgage companies. You will find that there are

numerous individuals in the private sector but when it comes to the big

companies, the regulators don’t go after them. Let’s start putting some

people in jail and see how quickly the rules start getting followed. Unless

there is a profound movement in the industry as a whole, they’re going to do

it again. And they’ll put the burden, and the blame, on the appraiser.”

Lagow’s message to other appraisers is simple: do good, honest work. “My

message is to do the numbers, do the best appraisal reports you can.

If somebody doesn’t like your work, if your values aren’t there, walk away.

Have the dignity and self-respect to walk away and go find another client,

everything else will take care of itself.”

About the Author

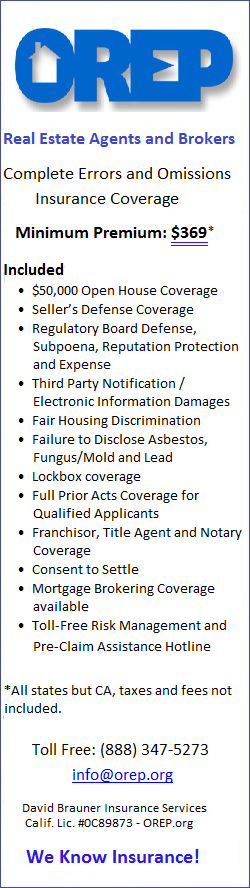

Isaac Peck is the Associate Editor of Working RE Magazine and Marketing

Coordinator at

OREP.org, a

leading provider of E&O Insurance for appraisers, inspectors, and other real

estate professionals in 49 states. He received his Bachelors in Business

Management at San Diego State University. He can be contacted at

Isaac@orep.org or 888-347-5273.

ATTENTION: You are receiving WRE Online News because you opted in at WorkingRE.com or purchased E&O insurance from OREP. WRE Online News Edition provides news-oriented content twice a month. The content for WRE Special Offer Editions is provided by paid sponsors. If you no longer wish to receive these emails from Working RE, please use the link found at the bottom of this newsletter to be removed from our mailing list.