|

Published by OREP, E&O Insurance Experts | October 10, 2013 |

Print: Click to read current issue Am I a Working RE Paid Subscriber? |

>

Click to Print

|

There are actually two reasons why you see appraisers these days going from

being very generous in their values to being ultra conservative.

Why Appraisals Are Coming In Low

by Phillip Spool, ASA

Here’s why it is not unusual to sell a house for more

than what the appraiser values it at.

For many years appraisers complained that mortgage

brokers were interfering with their conclusion of value, pushing the appraiser

to come up with a higher number. On May 1, 2009, appraisers got their wish

with the creation of the Home Valuation Code of Conduct (HVCC), requiring all

lending institutions to go through an intermediary to order appraisals.

This means that mortgage brokers are no longer allowed to order an appraisal and

banks have to have someone within the bank, not associated with the lending

department, order the appraisal or go through an intermediary.

Most banks decided it was easier to go through an

intermediary and thus the rise of appraisal management companies (AMCs).

Ironically, what the appraiser believed would be total appraisal independence

turned into a total nightmare. Almost immediately, appraiser fees were cut

in half. The AMCs were charging the banks around $500 and pocketing around

$225 to $250 for their fee. Many of the good appraisers were unhappy with

this fee reduction and either left the appraisal industry or no longer did

appraisals for lending institutions.

This resulted in AMCs maintaining appraisers who were happy with $250 to $275 and willing to complete an appraisal report within a 48 hour turnaround time. With the reduction of good appraisers, AMCs were contracting appraisers who were either not properly trained or were located in areas far away from their assignment. But this is not the main reason why appraisals began coming in low, low enough in many cases, to either cause a sale to fall apart or force the buyer to come up with additional funds to close.

There are actually two reasons why you see appraisers

these days going from being very generous in their values to being ultra

conservative.

Reason # 1: Those appraisers who are still in business are very concerned about either being sued by the lender for a loan that went into default or worried that the lender, buyer or seller will file a complaint with the Division of Real Estate, saying that the appraisal is not supported- even though lenders were giving 100% loans, NINJA loans (no income, no job, no assets) and participating in other reckless lending practices.

(story continues below)

(story continues)

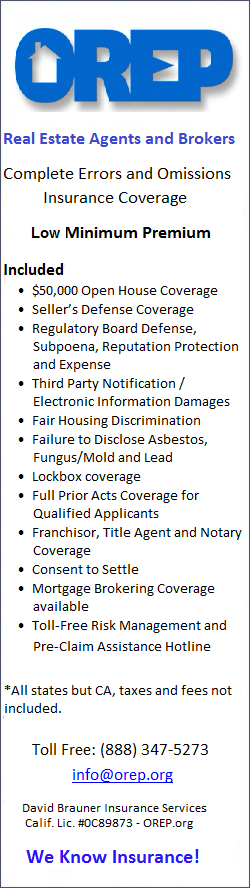

Lenders require appraisers to have errors and omissions

insurance, so suing has become an easy way for lenders to recoup money lost in a

default. Ironically, virtually none of the mortgage brokers were sued. A

complaint against the mortgage broker had to be filed with the Division of

Financial Services and not the Division of Real Estate. Besides, most

mortgage brokers did not have E&O insurance. Appraisers are now very

concerned with the possibility of a loan going into default. In addition,

the new Dodd Frank Bill passed by Congress makes

it mandatory for lenders and AMCs to turn an appraiser in to the state

regulatory agency if they believe the appraiser prepared a faulty appraisal

report, for whatever reason. In Florida, in 2009 and 2010, there were

approximately 2,000 complaints filed against appraisers. In 2011, there

were approximately 1,000 complaints filed. It is unknown how many

appraisers were sued during this time as statistics are not kept on lawsuits and

most settle before they go to trial.

Reason # 2: The AMCs and/or banks have

their own set of guidelines, besides those set forth for appraisers in the

Uniform Standards of Professional Appraisal Practice (USPAP). And if the

loan is going to be sold through FannieMae, then the appraiser has another set

of guidelines to abide by. But it is the AMC and bank guidelines that are

most troublesome to appraisers.

Some guidelines restrict the appraiser into using only sales within the past

three months and either within the neighborhood or within a one-mile radius.

This is fine when there are an abundance of qualified sales. “Qualified”

sales are those that are not foreclosures or short sales, not to say these

should be ignored. They should be considered but if there are enough sales

of “qualified” transactions, then those are the ones to use. In some

instances, like areas with a majority of foreclosures, like Homestead, Florida,

the appraiser has no choice but to use sales of a foreclosed property or short

sale. But the appraiser must consider the property’s physical condition

when using a foreclosed property as a comparable.

Going back to the guidelines from AMCs or banks, the

appraiser must follow their requirements but by doing so, they might be

excluding sales that occurred within the past six to twelve months and therefore

might be overlooking a property that is very similar to the subject. The

appraiser also might be overlooking a sale that is just outside one mile in a

similar, substitute neighborhood that is very similar to the subject.

Being very restrictive in choosing sales based on guidelines that are too narrow

can result in a value that does not support the contract price of a property.

By the way, Fannie Mae or FHA do not have a "one mile" guideline, only

some lending institutions or AMCs.

Appraisers should also be aware that if the area they

are appraising has a shortage of supply and a pent-up demand, such as Pinecrest

and Coral Gables (Florida), people are willing to pay more to buy that house or

condominium unit, as choices are limited.

Banks want to make loans and what is interesting now is

that when AMC appraisers come in lower than the contract price, the banks are

pressuring the AMCs to get their appraisers to make the loans go through.

Now appraisers are being pressured by the AMCs, when in the past they were

pressured by mortgage brokers. What appraisers were complaining about in

the past has now come around to a full circle.

So when you get upset at an appraiser for coming in

with a value lower than the contract price, consider their restrictions.

Even with a cash deal, the appraiser might be so accustomed to using the

restrictive guidelines set by the AMC, that they fail to realize that perhaps

there are sales that can legitimately support the contract price.

If you are working for a buyer, don’t necessarily assume the appraiser is

correct in his/her value. One has to look at the comparables the appraiser

used. Go by those houses, check the MLS sheets on those houses and see for

yourself if they are inferior, superior or comparable. I always encourage

agents to supply a list of comparable sales to me to support the purchase price.

In some cases, the agents know there is no support and should state that to the

buyer and seller.

About

the Author

Phil Spool, ASA, has been appraising in Miami-Dade County Florida since 1973. He

is a State-Certified General Appraiser, Vice-President of the Greater Miami

Chapter of the American Society of Appraisers and has published numerous

articles in Working RE Magazine, a national appraisal journal. He can be

reached at pgspool@bellsouth.net.

>

Click to Print

this Article

ATTENTION: You are receiving WRE Online News because you opted in at WorkingRE.com or purchased E&O insurance from OREP. WRE Online News Edition provides news-oriented content twice a month. The content for WRE Special Offer Editions is provided by paid sponsors. If you no longer wish to receive these emails from Working RE, please use the link found at the bottom of this newsletter to be removed from our mailing list.